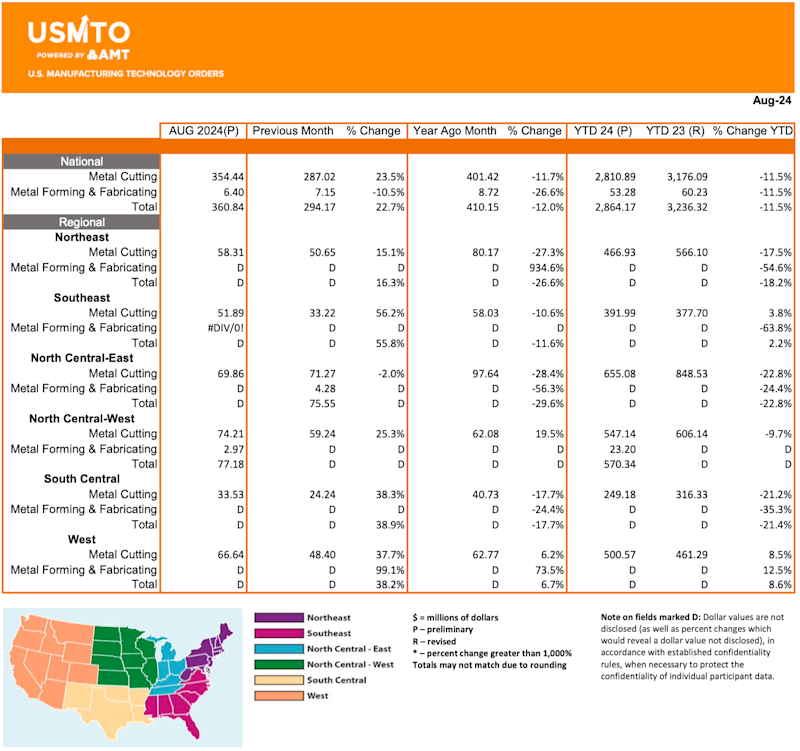

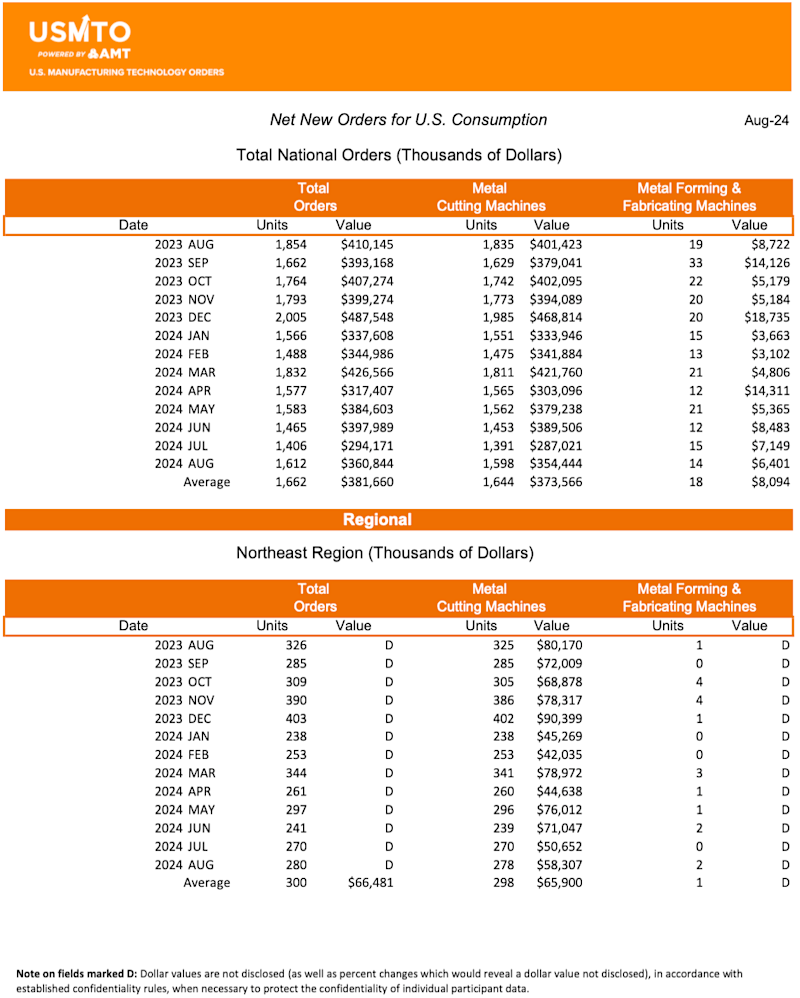

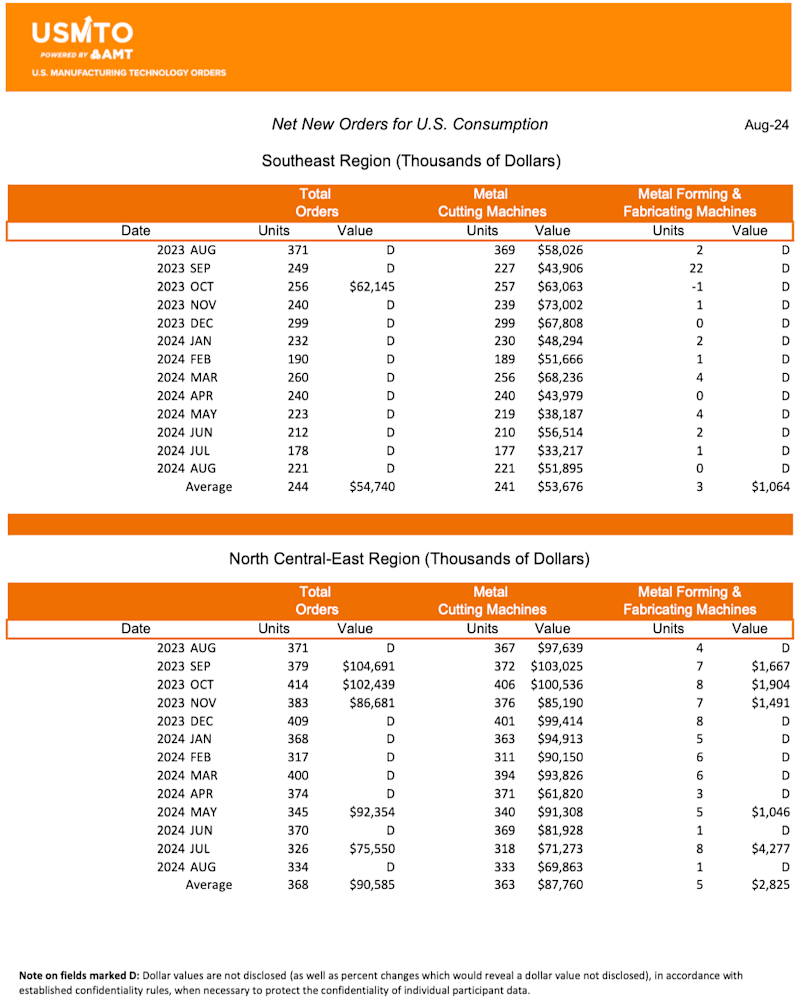

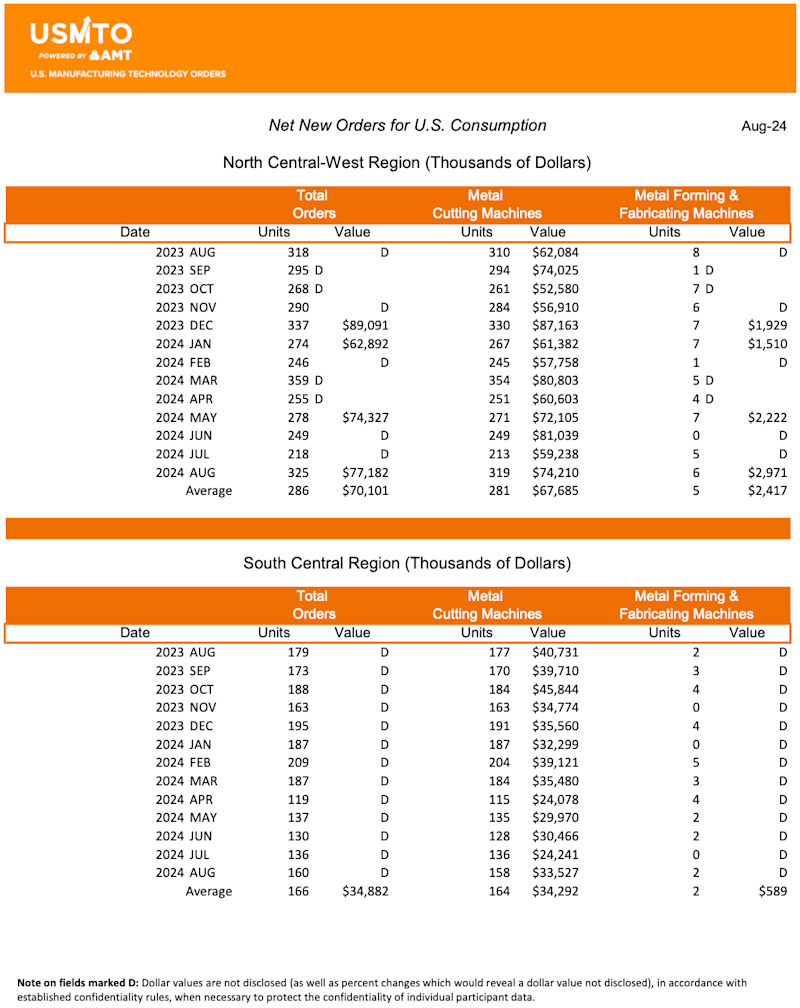

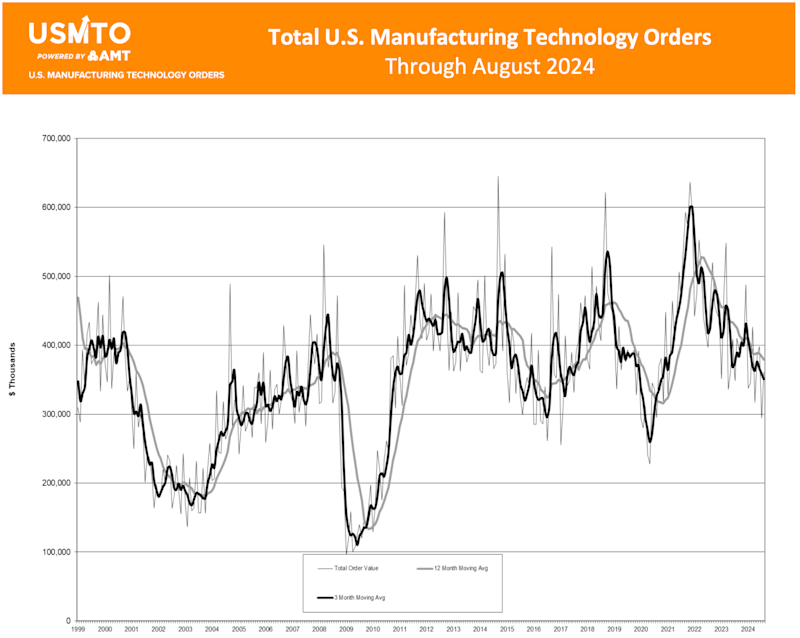

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For Manufacturing Technology, totaled $360.8 million in August 2024. These orders for metalworking machinery increased 22.7% from July 2024 but fell 12% short of August 2023 orders. Year-to-date orders reached $2.81 billion, a decline of 11.5% compared to the first eight months of 2023.

While orders continue to lag behind those placed in 2023, the level of order activity remains above historical levels. August 2024 orders are 3.8% above those placed in a typical August. This trend indicates the industry is still undergoing a period of normalization following the COVID disruptions rather than an actual decline. Historically elevated capacity utilization rates across durable goods manufacturers indicate a genuine need for additional investment in manufacturing technology.

- Contract machine shops, the largest manufacturing technology customers, increased the number of units ordered and the value of their orders for the first time since March 2024. This growth in a key customer segment is a welcome sign after a sluggish July, which saw the lowest value of orders since May 2020 and the fewest units ordered since July 2010. Since job shops typically absorb elevated capacity needs from OEMs, this buying trend indicates that production could continue to grow.

- Manufacturers in the aerospace sector increased the value of their orders by 13% from July to August 2024, but the number of units increased by nearly 27% at that same time. This indicates their purchases are for additional capacity, which is confirmed by the sector’s persistently rising capacity utilization rates. While machinery orders from aerospace parts manufacturers have been strong in the past few months, the ongoing strike of Boeing machinists has the potential to dampen this demand. It would be tempting to compare this to the 2023 United Autoworkers strike, which almost had no impact on manufacturing technology orders from the automotive sector. However, the automotive industry had already been pulling back orders at that time after a historically elevated buying cycle over the summer of 2023.

- Additionally, capacity utilization rates were falling, and inventories were growing leading into the strike. The aerospace sector is in a decidedly different position, with increased orders, a buying cycle on an upswing, and capacity utilization rising for the past three years. Only time will tell how the Boeing strike could impact machinery orders.

Although August 2024 orders fell short of those placed in 2023, the outlook for the remainder of the year remains optimistic. The electric atmosphere at September’s IMTS, the largest manufacturing technology trade show in the Western Hemisphere, was a welcome sign that manufacturers need additional capacity as well as solutions to improve quality and efficiency. With the upcoming U.S. presidential election and the Federal Reserve beginning to reduce interest rates and signaling additional reductions, two of the major issues giving pause to further capital investment will be alleviated by year’s end. Given these factors and the coming expiration of bonus depreciation of capital equipment, the momentum of order activity in the last four months of 2024 will likely accelerate. It could carry over into 2025, as forecast by experts at AMT’s annual MTForecast conference.

# # #

The United States Manufacturing Technology Orders (USMTO) Report is based on the totals of actual data reported by companies participating in the USMTO program. This report, compiled by AMT – The Association For Manufacturing Technology, provides regional and national U.S. orders data of domestic and imported machine tools and related equipment. Analysis of manufacturing technology orders provides a reliable leading economic indicator as manufacturing industries invest in capital metalworking equipment to increase capacity and improve productivity. USMTO.com.