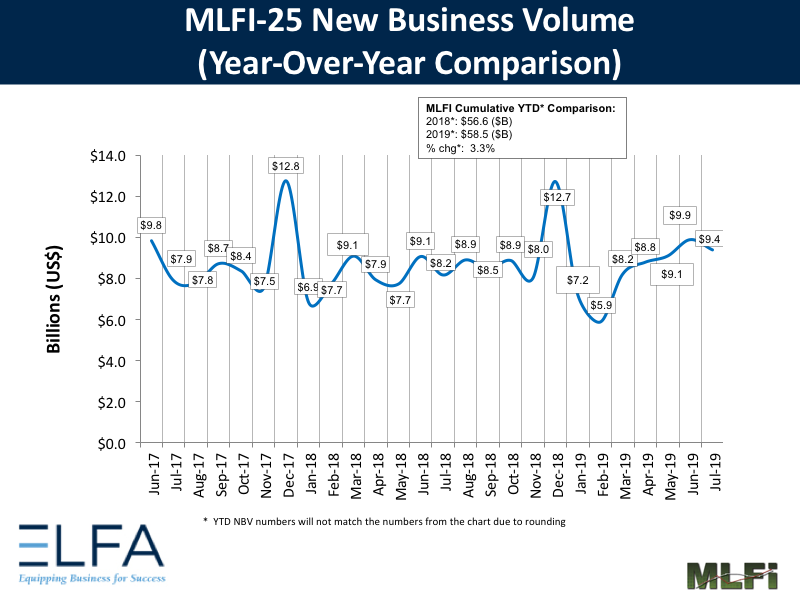

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for July was $9.4 billion, up 15 percent year-over-year from new business volume in July 2018. Volume was down 5 percent month-to-month from $9.9 billion in June. Year to date, cumulative new business volume was up 3 percent compared to 2018.

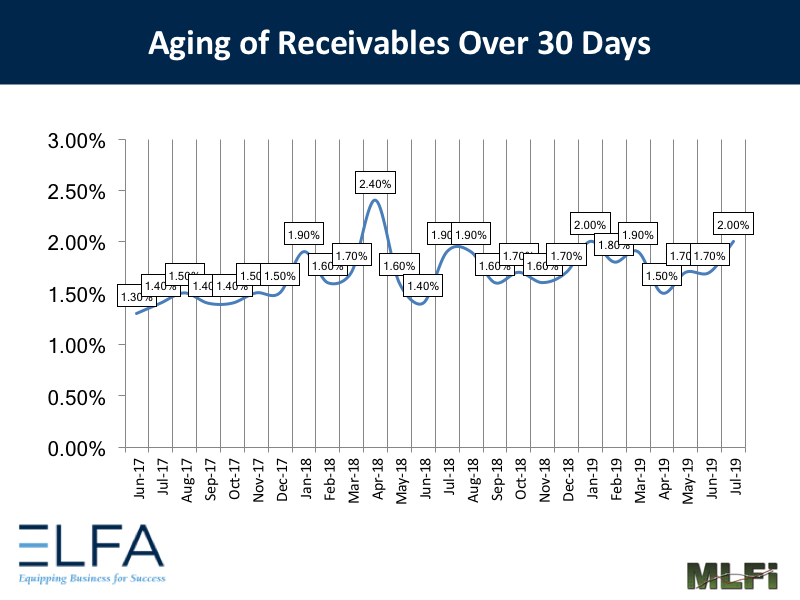

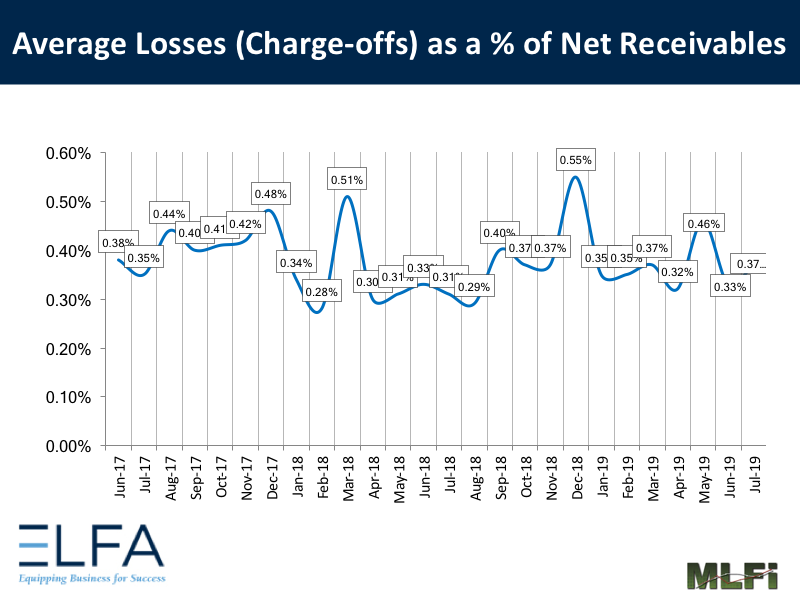

Receivables over 30 days were 2.0 percent, up from 1.70 percent the previous month and up from 1.90 percent the same period in 2018. Charge-offs were 0.37 percent, up from 0.33 percent the previous month, and up from 0.31 in the year-earlier period.

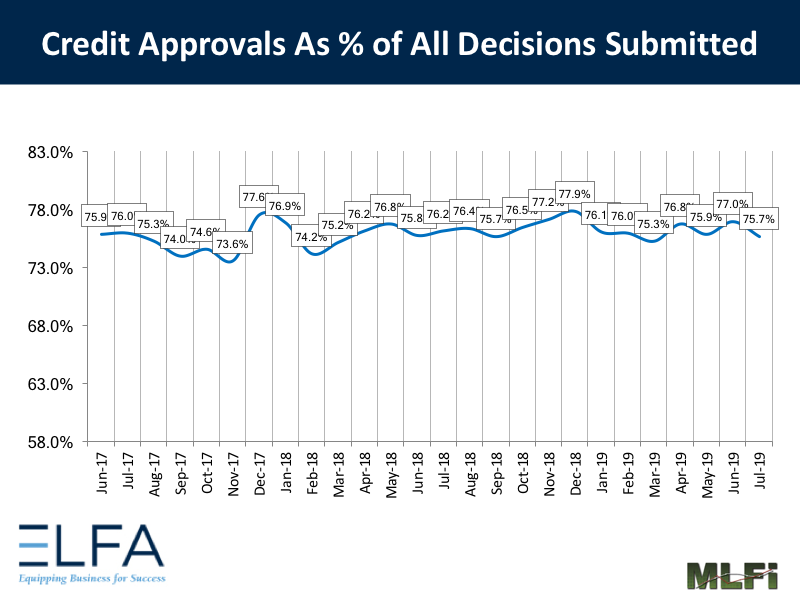

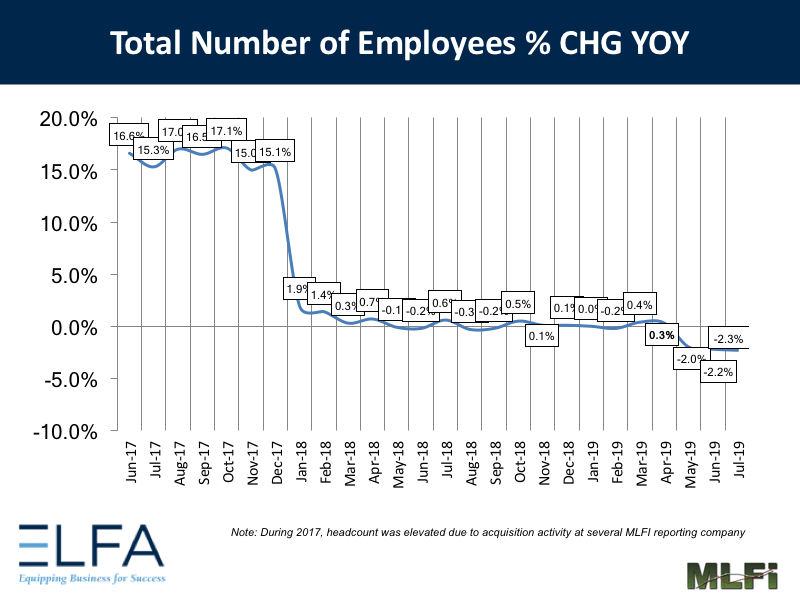

Credit approvals totaled 75.7 percent, down from 77.0 percent in June. Total headcount for equipment finance companies was down 2.3 percent year-over-year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in August is 58.9, up from the July index of 57.9.

ELFA President and CEO Ralph Petta said, “Despite early warning signs of a much-discussed economic downturn, a representative sample of companies in the equipment leasing and finance industry report strong mid-summer origination activity. While credit quality in these portfolios is something to monitor carefully, business owners continue to invest in productive assets to grow their businesses and increase operational efficiency.”

David Normandin, President and CEO, Wintrust Specialty Finance, said, “MLFI data illustrates that following a slow Q1, the market appears to have stabilized with a strong Q2 and July continued that result. While there was a slight seasonal volume decrease in July from June, it was significantly less than the last two years for the same period. At the same time, the market is experiencing a slight uptick in delinquency but charge-offs remain low. Credit quality is an increasing focus of risk professionals. In spite of relentless political rhetoric, stock market volatility and trade war concerns, the U.S. economy remains solid and demand for equipment finance is strong.”