For Germany’s Kion Group AG, the prospect of a no-deal Brexit has a welcome upside.

Companies operating in the U.K. fear that if Britain crashes out of the European Union without an agreement it could create shortages and they are stockpiling goods, feeding demand for Kion’s forklift trucks, according to CEO Gordon Riske.

With global demand for industrial trucks cooling, that’s an unexpected boon and has underpinned the Frankfurt-based company’s financial targets for this year, even as rivals like Jungheinrich AG blame downward forecast revisions on a “gloomier macroeconomic environment.”

“The U.K. is one of the hottest markets for us at the moment” and the best performing in Europe, Riske said in an interview. “Companies in literally all industries are increasing their safety inventories of spare parts and other goods to prepare for Brexit, and to do that they need more of our products.”

Fears of product shortages and supply chain disruptions were reinforced last week when U.K. Prime Minister Boris Johnson was forced to publish the government’s worst-case scenario for a disorderly Brexit. The paper, codenamed Yellowhammer, undermined Johnson’s assertion that the U.K. can cope with a no-deal departure and stoked fears in Britain and beyond about the potential impact.

Full Steam

Riske said that contrary to the trend across the rest of Europe, the British forklift market — which makes up about 7% of Kion’s sales — has seen solid growth this year, with orders expanding at a double-digit rate. That compares to a tepid gain of 1.7% for the segment as a whole in the first half.

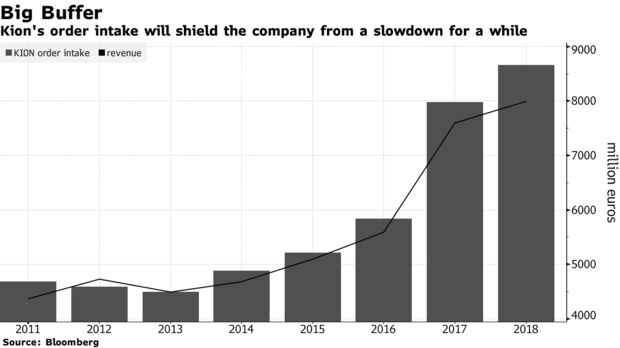

Beyond U.K. companies making contingency plans for a no-deal Brexit, Kion is also benefiting from five years of consecutive growth that pushed its order backlog to a record, Riske said. That allowed the manufacturer to let its factories run at full steam, including Saturday shifts at all its plants.

Kion shares were up 2.9% at 14:20 CEST, while Germany’s MDAX index rose only 0.2%. Jungheinrich shares fell 1.2%.

“Riske’s bullish statements on capacity utilization are clearly a positive surprise,” Jasko Terzic, an analyst at Bankhaus Metzler, said by phone. “While early indicators are rather pointing downwards and Jungheinrich has cut its guidance, Kion doesn’t see a reason to reduce production.”

Automotive suppliers across Germany, by contrast, are already cutting jobs and working shorter hours as the country teeters on the brink of recession.

While Kion is not immune to slowing global growth, it has confirmed its targets for sales and profit for this year. Its goal to lift sales by about one quarter to 10 billion euros ($11 billion) by 2022 is “well in reach and feasible,” Riske said.

The Asia-Pacific region contributed just 11% to sales last year, but China will be among the company’s most important markets by 2025, he said. Kion has strong ties with Chinese engine maker Weichai Power, which owns 45% of the company’s shares.

“Weichai Power is playing a very constructive role in our effort to grow in China, and we are already cooperating on many projects,” Riske said.

Kion’s warehouse automation business, created in 2016 when the company spent $3.25 billion to buy Dematic Corp, is performing well, according to the CEO.

While order intake fluctuates, the segment is benefiting from the trend toward ordering more goods on the internet, and companies from Amazon.com to grocery chains are trying to automate much of the logistics.

Buying Dematic briefly handed Kion the global No. 1 spot, but Toyota Industries Corp. retook the lead a year later by acquiring Vanderlande and Bastian Solutions, as the rivals move toward selling logistics equipment more complex than forklift trucks.

Future solutions for autonomous sites will include robots that can pick and pack goods as well as micro-warehouses for grocers. They will handle incoming merchandise as well as prepare click and collect orders.