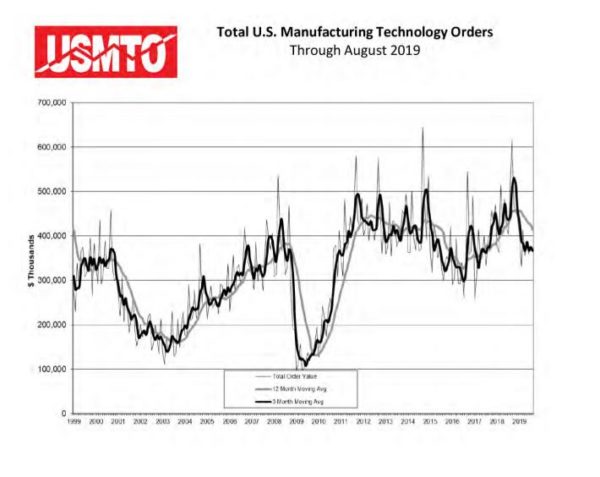

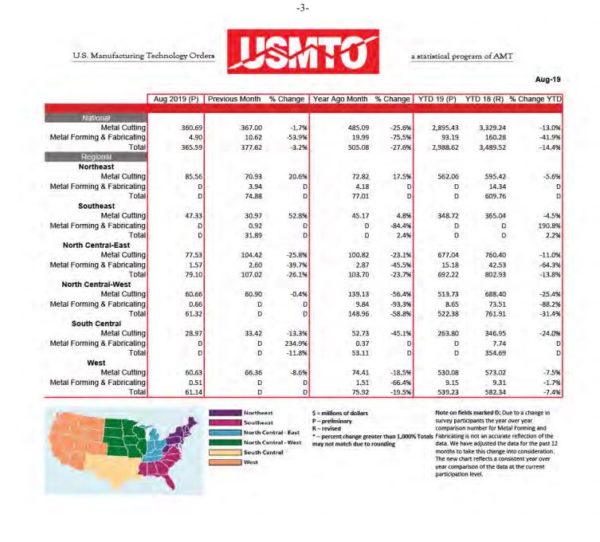

U.S. manufacturing technology orders fell 3.2 percent from the previous month to a total of $365.6 million in August 2019, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. Orders decreased 27.6 percent from August 2018, which was the best August on record at $505 million.

Orders for 2019 totaled just under $3 billion, a decline of 14.4 percent from the 2018 total to date. Despite the decline over 2018, the total value of manufacturing technology orders in 2019 are the second highest annual total through August since 2014.

The Southeast region experienced robust growth driven primarily by orders in the metal cutting category. The Northeast was the only other region to have positive order growth from July to August. The North Central – East had the largest month over month decline, decreasing orders by over a quarter from July. The West and South-Central posted losses while the North-Central-West region was near-flat from over the previous month.

“The consensus of analysts at MTForecast is that markets should pick up in the U.S. as early as next summer, and will pick up in Europe several months earlier, taking the pressure off the U.S.,” said Douglas K. Woods, president of The Association For Manufacturing Technology.

“The consensus of analysts at MTForecast is that markets should pick up in the U.S. as early as next summer, and will pick up in Europe several months earlier, taking the pressure off the U.S.,” said Douglas K. Woods, president of The Association For Manufacturing Technology.

“This was reflected at EMO Hannover where we saw a great deal of interest on the floor, particularly in the Industry 4.0/IIoT pavilion, but not a high level of capital commitment, reflecting uncertainty and challenges

in the European market.”

“Looking at Asia, it is likely the Free Trade Agreement with Japan will substantially reduce tariffs on U.S. machine tools imports from Japan, which will require some adjustments. Overall, it should have a positive impact on trade and improve the profitability and opportunities of U.S. agricultural, automotive and aerospace sectors, which could well offset any negative effects of tariffs falling on manufacturing technology imports.”

Orders from machine shops were near-flat, yet showed a slight increase over July. Construction machinery manufacturing vastly expanded orders over July. Aerospace orders increased by nearly a third. The automotive

sector decreased orders overall despite modest increases from the transmission and powertrain manufacturing sector.