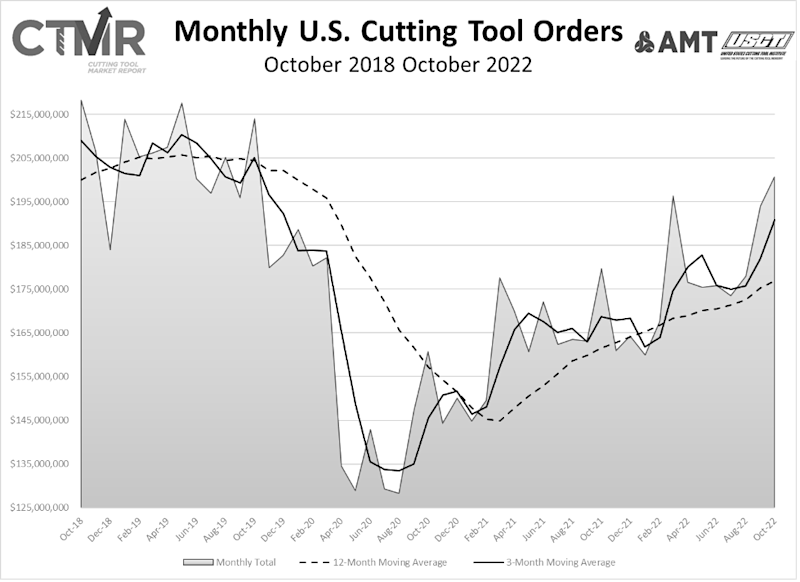

October 2022 U.S. cutting tool consumption totaled $200.6 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 3.4% from September’s $194.0 million and up 11.7% when compared with the $179.6 million reported for October 2021. This has been the highest monthly total since October 2019. With a year-to-date total of $1.8 billion, 2022 is up 9.4% when compared to the same time period in 2021.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“Market conditions for the cutting tool industry remain positive,” commented Jeff Major, president of USCTI. “Overall year-to-date sales versus 2021 are up 9.4%. Cutting tool sales for 2023 are expected to remain positive, led by the automotive and aerospace market segments. Shipping costs have stabilized somewhat, which helps our overall business, while there still remains some uncertainty with raw material costs.”

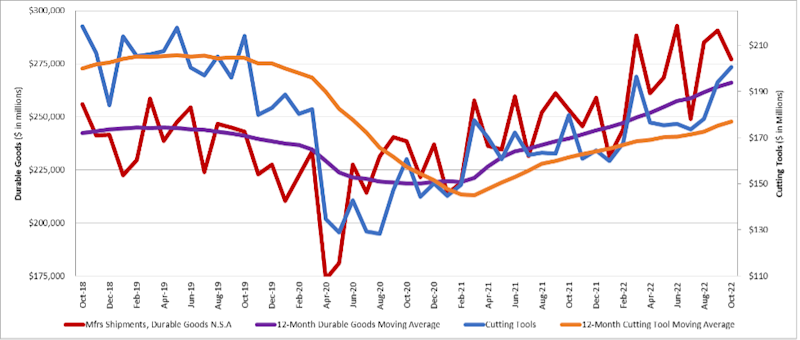

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, also had a positive attitude toward the direction of the cutting tool industry, stating, “Cutting tool orders continue to climb even through rocky waters. Certainly, we are all bracing for the impact of the interest rate increases by the Federal Reserve.” Stokey continued on, discussing how the durable goods industry influences the cutting tool industry. “The real key for our industry will be how durable goods perform in the months ahead. If durable goods production continues to grow, our industry may be able to stay in positive territory through an overall slowing economy.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.