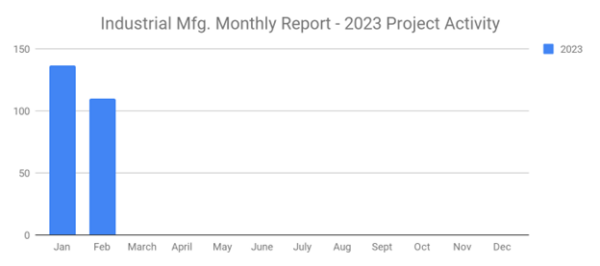

IMI SalesLeads has announced the February 2023 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction, and significant equipment modernization projects. Research confirms 110 new projects in February as compared to 130 in January in the Industrial Manufacturing sector.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing – By Project Type

- Manufacturing/Production Facilities – 98 New Projects

- Distribution and Industrial Warehouse – 71 New Projects

Industrial Manufacturing – By Project Scope/Activity

- New Construction – 34 New Projects

- Expansion – 38 New Projects

- Renovations/Equipment Upgrades – 41 New Projects

- Plant Closings – 14 New Projects

Industrial Manufacturing – By Project Location (Top 10 States)

- California – 10

- Ohio – 8

- Indiana – 8

- Michigan – 7

- Texas – 7

- Georgia – 6

- North Carolina – 5

- Tennessee – 5

- Alabama – 4

- New York – 4

Largest Planned Project

During the month of February, our research team identified 12 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Texas Instruments Inc., which is planning to invest $11 billion in the construction of a manufacturing facility in LEHI, UT. They are currently seeking approval for the project. Construction is expected to begin in Fall 2023, with completion slated for early 2026.

Top 10 Tracked Industrial Manufacturing Projects

KANSAS:

A defense contractor is planning to invest $2 billion for the construction of a 235,000 S.F. computer chip manufacturing facility in BURLINGTON, KS. They are currently seeking approval for the project.

COLORADO:

Semiconductor mfr. is planning to invest $880 million for the expansion of its manufacturing facility in COLORADO SPRINGS, CO. They have recently received approval for the project.

NEW YORK:

Wind turbine mfr. is planning to invest $500 million in the construction of a manufacturing facility in COEYMANS, NY. They are currently seeking approval for the project.

SOUTH CAROLINA:

Semiconductor mfr. is planning to invest $443 million for the renovation and equipment upgrades on a 300,000 S.F. manufacturing and office facility at 1800 Overview Dr. in ROCK HILL, SC. They have recently received approval for the project. They will relocate their headquarter operations upon completion in Fall 2023.

UTAH:

Consumer goods mfr. is planning to invest $400 million for the expansion of its paper product manufacturing facility in CORINNE, UT. They have recently received approval for the project.

GEORGIA:

Auto body parts mfr. is planning to invest $300 million in the construction of a manufacturing facility in RINCON, GA. They are currently seeking approval for the project. Completion is slated for 2025.

IOWA:

Industrial valve mfr. is planning to invest $75 million for a 36,000 S.F. expansion and equipment upgrades on their manufacturing facility in OSKALOOSA, IA. They have recently received approval for the project.

MINNESOTA:

Fluid control equipment mfr. is planning to invest $43 million for a 176,000 S.F. expansion of their manufacturing facility in ANOKA, MN. They are currently seeking approval for the project. Construction is expected to start in the Summer of 2023, with completion slated for late 2024.

NORTH CAROLINA:

EV charging station mfr. is planning to invest $41 million for the construction of a manufacturing facility in DURHAM, NC. They have recently received approval for the project.

TENNESSEE:

Water heater mfr. is planning to invest $30 million for the expansion of its manufacturing facility in LEBANON, TN. They are currently seeking approval for the project.

About IMI SalesLeads, Inc.

Since 1959, IMI SalesLeads, based in Jacksonville, FL is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.