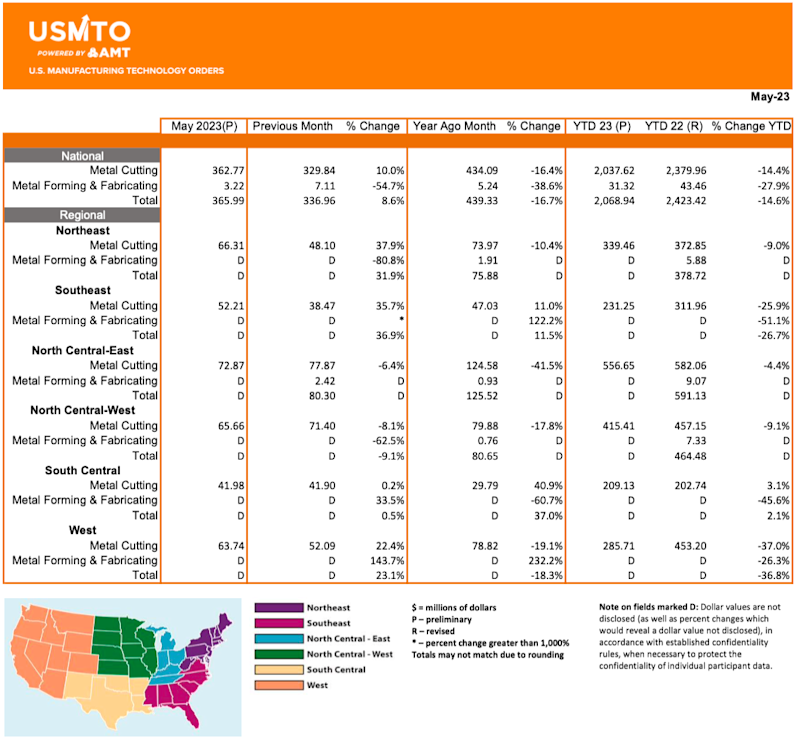

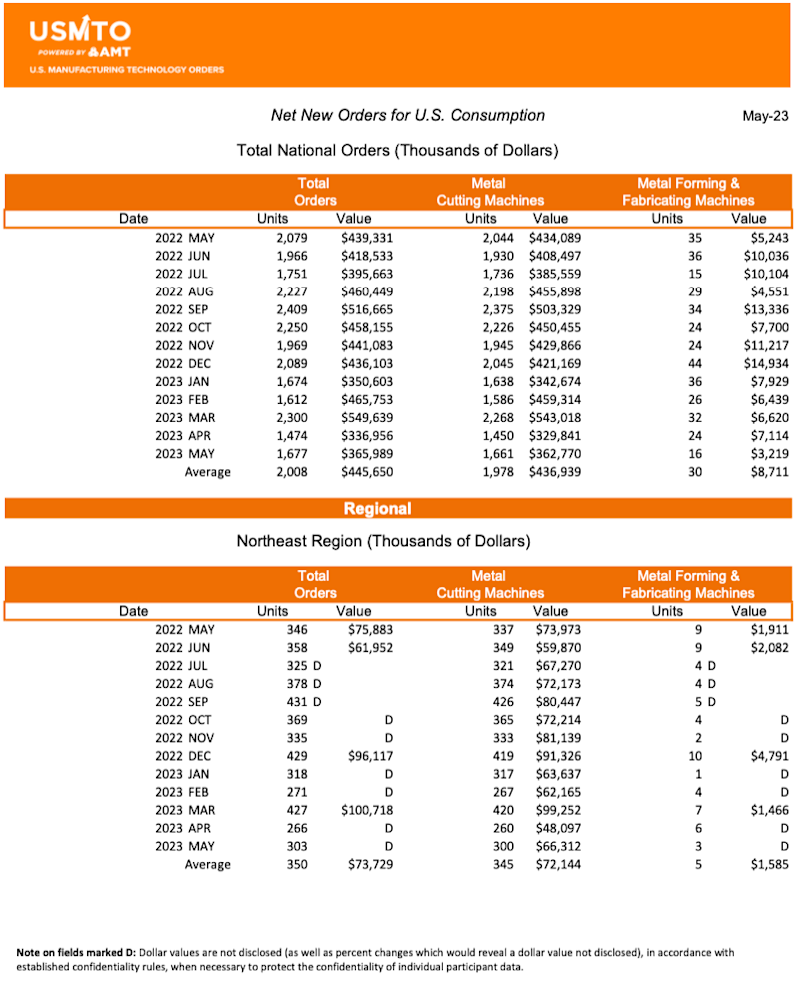

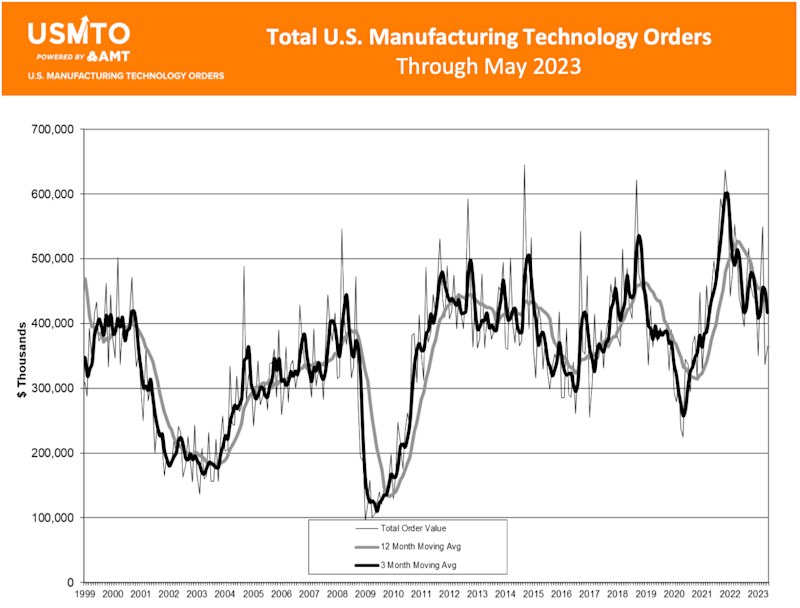

New orders of manufacturing technology totaled $365.9 million in May 2023, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. May orders increased 8.6% over April 2023 but fell short of May 2022 orders by 16.7%. Annual orders for 2023 increased to $2.1 billion, nearly 15% behind orders for the same period in 2022.

“May orders increased but not enough to make up for the record decline we saw in April,” said Douglas K. Woods, president of AMT. “Job shops increased orders at a slightly faster pace than the general market, but many large consumers of manufacturing technology decreased orders for the second month in a row. Significant growth from typically smaller consumers of manufacturing technology highlights some interesting changes in how and where goods are manufactured, particularly in anticipation of government spending programs.”

For instance, orders from manufacturers of electrical equipment are at the highest monthly level of 2023. This puts the industry on pace to make the second-largest investment in manufacturing technology since 2018. Much of the current investment stems from efforts to mitigate strains on the grid caused by unusual weather patterns. However, more investment from this sector may be on the horizon. The Grid Resilience and Innovation Partnership (GRIP) program, part of the 2021 Bipartisan Infrastructure Act, is expected to send notification of approved projects by the summer of 2023, which may spur more investment in manufacturing technology from this industry.

The construction industry has also shown growth in manufacturing technology investment. Construction machinery manufacturers doubled their order volume over April 2023, putting them on pace for the highest order volume since 2012, and hardware, screw, nut, and bolt manufacturers significantly increased orders in May. The increasing need for capacity is likely coming from the increase in residential construction, with new housing starts increasing dramatically in May and new permits on an upward trend since the beginning of the year. In addition to the recent uptick in residential construction, real construction spending on new manufacturing facilities has doubled since the end of 2021.

“Despite the positive news for the general economy, such as the upward revision to Q1 GDP two weeks ago and continued employment strength, the manufacturing technology industry is showing signs of a slowdown,” said Woods. “In his June 14 press conference, Federal Reserve Chair Jerome Powell mentioned that manufacturers of durable goods – the consumers of manufacturing technology – would likely feel the effects of elevated interest rates before the broader economy. Our experience in 2016 shows that it is possible for there to be a downturn in the manufacturing technology industry while avoiding a broader recession. Only time and more data will tell if we are in an economic situation more like 2016 than the situation in 2001, as many economists have predicted.”