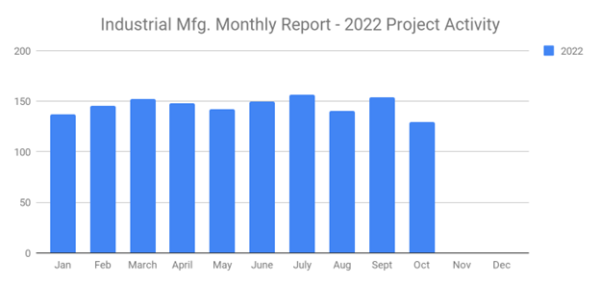

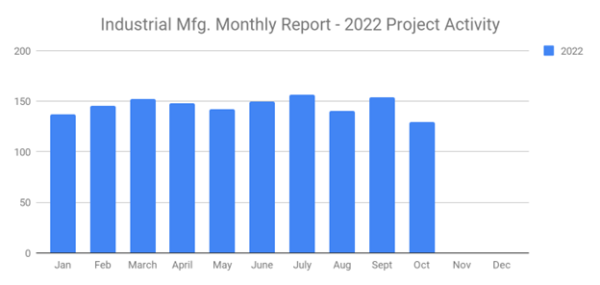

SalesLeads announced today the October 2022 results for the newly planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity; including facility expansions, new plant construction, and significant equipment modernization projects. Research confirms 129 new projects in the Industrial Manufacturing sector.

The following are selected highlights on new Industrial Manufacturing industry construction news.

Industrial Manufacturing – By Project Type

Manufacturing/Production Facilities – 117 New Projects

Distribution and Industrial Warehouse – 77 New Projects

Industrial Manufacturing – By Project Scope/Activity

New Construction – 40 New Projects

Expansion – 48 New Projects

Renovations/Equipment Upgrades – 42 New Projects

Plant Closings – 10 New Projects

Industrial Manufacturing – By Project Location (Top 10 States)

- Michigan – 11

- California – 8

- Ontario – 8

- Indiana – 7

- New York – 7

- Ohio – 7

- South Carolina – 6

- Texas – 6

- North Carolina – 5

- Tennessee – 5

Largest Planned Project

During the month of October, our research team identified 15 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more.

The largest project is owned by Micron Technology, Inc., which is planning to invest $100 billion in the construction of a manufacturing facility in CLAY, NY. They are currently seeking approval for the project. Construction will occur in multiple phases and is expected to begin in 2023.

Top 10 Tracked Industrial Manufacturing Projects

MICHIGAN:

Battery mfr. is planning to invest $1.6 billion for the renovation and equipment upgrades on a recently leased 660,000 SF manufacturing facility at 42060 Ecorse Rd. in VAN BUREN TOWNSHIP, MI. Completion is slated for 2024.

SOUTH CAROLINA:

Automotive mfr. is planning to invest $700 million for the construction of a 1 million SF EV battery manufacturing facility in WOODRUFF, SC. They are currently seeking approval for the project.

TENNESSEE:

EV battery mfr. is planning to invest $500 million for the construction of a manufacturing facility in CLARKSVILLE, TN. They are currently seeking approval for the project.

ALABAMA:

Automotive component mfr. is planning to invest $205 million for the construction of a 450,000 SF EV battery manufacturing facility in MONTGOMERY, AL. Construction is expected to start in late 2022.

GEORGIA:

Building materials mfr. is planning to invest $150 million for a 500,000 SF expansion of their manufacturing and warehouse facility in MACON, GA. They are currently seeking approval for the project.

KANSAS:

Tire mfr. is planning to invest $125 million for the expansion of its manufacturing facility in TOPEKA, KS. They have recently received approval for the project.

TENNESSEE:

Battery material and technology company is planning for the expansion of their warehouse and manufacturing facility at 1029 W 19th St. in CHATTANOOGA, TN. Completion is slated for 2024.

MICHIGAN:

Automotive component mfr. is planning to invest $100 million for the renovation and equipment upgrades on two recently leased manufacturing facilities totaling 314,000 SF at 12240 Oakland Blvd. in HIGHLAND PARK, MI, and in SHELBY TOWNSHIP, MI. They have recently received approval for the projects.

ALABAMA:

An Aerospace company is planning to invest $45 million for the expansion, renovation, and equipment upgrades on their manufacturing facility in COURTLAND, AL. Completion is slated for late 2026.

TEXAS:

Residential glass products mfr. is planning to invest $30 million for a 195,000 SF expansion of their manufacturing and warehouse facility in WAXAHACHIE, TX. They are currently seeking approval for the project. Completion is slated for late 2023.

About the Author:

Since 1959, SalesLeads, based out of Jacksonville, FL has been providing Industrial Project Reports on companies that are planning significant capital investments in their industrial facilities throughout North America. Our professional research team identifies new construction, expansion, relocation, major renovation, equipment upgrades, and plant closing project opportunities so that our clients can focus sales and marketing resources on the target accounts that have an impending need for their products, services, and indirect materials.