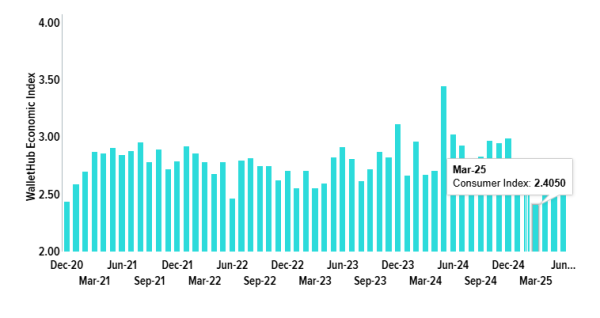

The WalletHub Economic Index decreased by 13% between June 2024 and June 2025. This means consumers are less confident about their financial outlook this month than they were at the same time last year.

The WalletHub Economic Index is based on a monthly survey that evaluates economic prospects based on 10 components of consumer sentiment. These components revolve around how people feel about their finances, purchasing plans, and employment opportunities.

Chip Lupo, WalletHub Analyst

Main Findings

Change in WalletHub Economic Index: June 2025 vs. June 2024

| Economic Index | Change |

|---|---|

| Likelihood of buying a home in the next six months | -22.7% |

| Likelihood of buying a car in the next six months | -20.6% |

| Likelihood of making a big purchase in the next six months | -12.9% |

| Positive outlook on finances six months from now | -7.3% |

| Stress level about money now | -6.5% |

| Positive sentiment about current employment opportunities | -4.7% |

| Confidence in having a job in six months | -3.7% |

| Positive sentiment about credit score in the next six months | -1.9% |

| Positive sentiment about debt levels in the next six months | -1.5% |

| Positive sentiment about finances now | -1.3% |

| Overall WalletHub Economic Index | -13.3% |

Detailed Findings

- Year-over-year, consumers felt less confident about their financial outlook in June 2025, with the value of the overall index registered being 13% lower than in June 2024.

Overall

| Month | Consumer Index |

|---|---|

| Dec-20 | 2.4367 |

| Jan-21 | 2.5875 |

| Feb-21 | 2.6973 |

| Mar-21 | 2.8747 |

| Apr-21 | 2.8602 |

| May-21 | 2.9083 |

| Jun-21 | 2.8467 |

| Jul-21 | 2.8809 |

| Aug-21 | 2.9561 |

| Sep-21 | 2.7818 |

| Oct-21 | 2.8905 |

| Nov-21 | 2.7205 |

| Dec-21 | 2.7919 |

| Jan-22 | 2.9204 |

| Feb-22 | 2.8592 |

| Mar-22 | 2.7848 |

| Apr-22 | 2.6812 |

| May-22 | 2.7833 |

| Jun-22 | 2.4610 |

| Jul-22 | 2.7971 |

| Aug-22 | 2.8198 |

| Sep-22 | 2.7463 |

| Oct-22 | 2.7448 |

| Nov-22 | 2.6210 |

| Dec-22 | 2.7067 |

| Jan-23 | 2.5536 |

| Feb-23 | 2.7050 |

| Mar-23 | 2.5559 |

| Apr-23 | 2.5974 |

| May-23 | 2.8207 |

| Jun-23 | 2.9142 |

| Jul-23 | 2.8124 |

| Aug-23 | 2.6164 |

| Sep-23 | 2.7196 |

| Oct-23 | 2.8747 |

| Nov-23 | 2.8245 |

| Dec-23 | 3.1176 |

| Jan-24 | 2.6672 |

| Feb-24 | 2.9604 |

| Mar-24 | 2.6705 |

| Apr-24 | 2.7031 |

| May-24 | 3.4450 |

| Jun-24 | 3.0243 |

| Jul-24 | 2.9285 |

| Aug-24 | 2.7318 |

| Sep-24 | 2.8328 |

| Oct-24 | 2.9703 |

| Nov-24 | 2.9471 |

| Dec-24 | 2.9900 |

| Jan-25 | 2.6064 |

| Feb-25 | 2.5645 |

| Mar-25 | 2.4050 |

| Apr-25 | 2.4889 |

| May-25 | 2.5228 |

| Jun-25 | 2.6218 |

- Decreasing financial optimism: In June 2025, consumers’ optimism about their finances recorded a slight increase (+1.6%) from the previous month. On the flip side, the level of optimism decreased by 1.3% over the past year.

How do you feel about your finances right now?

| Month | Level of Optimism |

|---|---|

| Dec-20 | 2.9497 |

| Jan-21 | 3.0791 |

| Feb-21 | 3.0472 |

| Mar-21 | 3.3062 |

| Apr-21 | 3.1255 |

| May-21 | 3.0776 |

| Jun-21 | 3.0613 |

| Jul-21 | 2.9432 |

| Aug-21 | 3.2342 |

| Sep-21 | 3.0000 |

| Oct-21 | 3.1024 |

| Nov-21 | 2.9913 |

| Dec-21 | 3.0455 |

| Jan-22 | 3.1653 |

| Feb-22 | 3.0861 |

| Mar-22 | 3.0513 |

| Apr-22 | 2.9349 |

| May-22 | 2.9333 |

| Jun-22 | 2.7747 |

| Jul-22 | 3.0080 |

| Aug-22 | 2.9870 |

| Sep-22 | 2.9156 |

| Oct-22 | 2.8744 |

| Nov-22 | 2.8978 |

| Dec-22 | 3.0377 |

| Jan-23 | 2.7324 |

| Feb-23 | 2.8962 |

| Mar-23 | 2.7254 |

| Apr-23 | 2.9643 |

| May-23 | 2.9484 |

| Jun-23 | 3.0866 |

| Jul-23 | 2.9640 |

| Aug-23 | 2.7975 |

| Sep-23 | 2.8349 |

| Oct-23 | 2.9874 |

| Nov-23 | 2.8900 |

| Dec-23 | 3.0796 |

| Jan-24 | 2.7957 |

| Feb-24 | 2.8565 |

| Mar-24 | 2.7557 |

| Apr-24 | 2.7468 |

| May-24 | 3.1952 |

| Jun-24 | 2.9745 |

| Jul-24 | 3.0348 |

| Aug-24 | 2.9568 |

| Sep-24 | 3.0134 |

| Oct-24 | 2.8884 |

| Nov-24 | 2.9773 |

| Dec-24 | 3.1100 |

| Jan-25 | 2.8650 |

| Feb-25 | 2.9100 |

| Mar-25 | 2.8069 |

| Apr-25 | 2.7711 |

| May-25 | 2.8878 |

| Jun-25 | 2.9350 |

- Decreasing stress: Consumers’ stress levels regarding money are lower (-6.5%) in June 2025 compared to the same period last year.

How do you feel about money?

| Month | Stress Level |

|---|---|

| Dec-20 | 2.4444 |

| Jan-21 | 2.3439 |

| Feb-21 | 2.2406 |

| Mar-21 | 1.9904 |

| Apr-21 | 2.2941 |

| May-21 | 2.3147 |

| Jun-21 | 2.1992 |

| Jul-21 | 2.3974 |

| Aug-21 | 2.1599 |

| Sep-21 | 2.2596 |

| Oct-21 | 2.3071 |

| Nov-21 | 2.3537 |

| Dec-21 | 2.3182 |

| Jan-22 | 2.1488 |

| Feb-22 | 2.2582 |

| Mar-22 | 2.3333 |

| Apr-22 | 2.4326 |

| May-22 | 2.3333 |

| Jun-22 | 2.6087 |

| Jul-22 | 2.5080 |

| Aug-22 | 2.3766 |

| Sep-22 | 2.3867 |

| Oct-22 | 2.4619 |

| Nov-22 | 2.4178 |

| Dec-22 | 2.3302 |

| Jan-23 | 2.4648 |

| Feb-23 | 2.5425 |

| Mar-23 | 2.5410 |

| Apr-23 | 2.4286 |

| May-23 | 2.4085 |

| Jun-23 | 2.3333 |

| Jul-23 | 2.4279 |

| Aug-23 | 2.5443 |

| Sep-23 | 2.4009 |

| Oct-23 | 2.3655 |

| Nov-23 | 2.6100 |

| Dec-23 | 2.3333 |

| Jan-24 | 2.4609 |

| Feb-24 | 2.5185 |

| Mar-24 | 2.6250 |

| Apr-24 | 2.5759 |

| May-24 | 2.3905 |

| Jun-24 | 2.6943 |

| Jul-24 | 2.3781 |

| Aug-24 | 2.6173 |

| Sep-24 | 2.5089 |

| Oct-24 | 2.4622 |

| Nov-24 | 2.6136 |

| Dec-24 | 2.2300 |

| Jan-25 | 2.5000 |

| Feb-25 | 2.4000 |

| Mar-25 | 2.5545 |

| Apr-25 | 2.6219 |

| May-25 | 2.4341 |

| Jun-25 | 2.5200 |

Note: The lower the value, the less stress people feel about money.

- Decrease in optimism: In June 2025, consumers’ optimism about whether their finances will improve in the next six months is lower (-7.3%) than it was last year.

How will your finances look six months from now?

| Month | Level of Improvement |

|---|---|

| Dec-20 | 3.0952 |

| Jan-21 | 3.1818 |

| Feb-21 | 3.2500 |

| Mar-21 | 3.3014 |

| Apr-21 | 3.3020 |

| May-21 | 3.3233 |

| Jun-21 | 3.3678 |

| Jul-21 | 3.3057 |

| Aug-21 | 3.3086 |

| Sep-21 | 3.2723 |

| Oct-21 | 3.3425 |

| Nov-21 | 3.2358 |

| Dec-21 | 3.3017 |

| Jan-22 | 3.3058 |

| Feb-22 | 3.2951 |

| Mar-22 | 3.2265 |

| Apr-22 | 3.1488 |

| May-22 | 3.2333 |

| Jun-22 | 2.8933 |

| Jul-22 | 3.2080 |

| Aug-22 | 3.2424 |

| Sep-22 | 3.1022 |

| Oct-22 | 3.2152 |

| Nov-22 | 3.2044 |

| Dec-22 | 3.1698 |

| Jan-23 | 3.1455 |

| Feb-23 | 3.2358 |

| Mar-23 | 3.2090 |

| Apr-23 | 3.1607 |

| May-23 | 3.2582 |

| Jun-23 | 3.2424 |

| Jul-23 | 3.1802 |

| Aug-23 | 3.1350 |

| Sep-23 | 3.2500 |

| Oct-23 | 3.1218 |

| Nov-23 | 3.2850 |

| Dec-23 | 3.5522 |

| Jan-24 | 3.3304 |

| Feb-24 | 3.3981 |

| Mar-24 | 3.3011 |

| Apr-24 | 3.2468 |

| May-24 | 3.5810 |

| Jun-24 | 3.3885 |

| Jul-24 | 3.2488 |

| Aug-24 | 3.2160 |

| Sep-24 | 3.4063 |

| Oct-24 | 3.0717 |

| Nov-24 | 3.4318 |

| Dec-24 | 3.2600 |

| Jan-25 | 3.2800 |

| Feb-25 | 3.1050 |

| Mar-25 | 3.1485 |

| Apr-25 | 3.0995 |

| May-25 | 3.0878 |

| Jun-25 | 3.1400 |

- Less new employment opportunities: The share of consumers who feel new employment opportunities are “abundant” is lower (-4.7%) in June 2025 compared to last year.

How would you describe current employment opportunities?

| Month | Job Availability |

|---|---|

| Dec-20 | 2.4947 |

| Jan-21 | 2.4901 |

| Feb-21 | 2.6179 |

| Mar-21 | 2.5646 |

| Apr-21 | 2.8078 |

| May-21 | 2.9009 |

| Jun-21 | 3.0728 |

| Jul-21 | 3.0611 |

| Aug-21 | 3.1450 |

| Sep-21 | 3.0979 |

| Oct-21 | 3.1181 |

| Nov-21 | 3.0961 |

| Dec-21 | 3.1570 |

| Jan-22 | 3.1736 |

| Feb-22 | 3.0943 |

| Mar-22 | 2.9103 |

| Apr-22 | 2.9814 |

| May-22 | 3.1167 |

| Jun-22 | 2.8300 |

| Jul-22 | 3.0480 |

| Aug-22 | 3.0736 |

| Sep-22 | 3.0533 |

| Oct-22 | 3.0090 |

| Nov-22 | 2.8933 |

| Dec-22 | 2.9528 |

| Jan-23 | 2.9437 |

| Feb-23 | 2.9764 |

| Mar-23 | 2.8607 |

| Apr-23 | 2.8571 |

| May-23 | 2.8967 |

| Jun-23 | 3.1126 |

| Jul-23 | 3.0045 |

| Aug-23 | 3.0380 |

| Sep-23 | 2.8915 |

| Oct-23 | 2.9454 |

| Nov-23 | 2.8250 |

| Dec-23 | 3.0249 |

| Jan-24 | 2.7435 |

| Feb-24 | 2.7917 |

| Mar-24 | 2.6648 |

| Apr-24 | 2.5190 |

| May-24 | 3.0000 |

| Jun-24 | 2.8535 |

| Jul-24 | 2.7512 |

| Aug-24 | 2.6543 |

| Sep-24 | 2.8348 |

| Oct-24 | 2.8725 |

| Nov-24 | 2.8409 |

| Dec-24 | 2.8900 |

| Jan-25 | 2.7200 |

| Feb-25 | 2.7550 |

| Mar-25 | 2.5891 |

| Apr-25 | 2.6119 |

| May-25 | 2.7024 |

| Jun-25 | 2.7200 |

- Weaker sense of job security: People’s confidence in having a job in the next six months is lower (-3.7%) in June 2025 compared to last year.

How confident are you that you will have a job in six months?

| Month | Confidence Level |

|---|---|

| Dec-20 | 3.2804 |

| Jan-21 | 3.3123 |

| Feb-21 | 3.4481 |

| Mar-21 | 3.3876 |

| Apr-21 | 3.4196 |

| May-21 | 3.5086 |

| Jun-21 | 3.5364 |

| Jul-21 | 3.4236 |

| Aug-21 | 3.5242 |

| Sep-21 | 3.3702 |

| Oct-21 | 3.4921 |

| Nov-21 | 3.4847 |

| Dec-21 | 3.4256 |

| Jan-22 | 3.6281 |

| Feb-22 | 3.4139 |

| Mar-22 | 3.4316 |

| Apr-22 | 3.4512 |

| May-22 | 3.6375 |

| Jun-22 | 3.3794 |

| Jul-22 | 3.5440 |

| Aug-22 | 3.5411 |

| Sep-22 | 3.5467 |

| Oct-22 | 3.6368 |

| Nov-22 | 3.5022 |

| Dec-22 | 3.4292 |

| Jan-23 | 3.3709 |

| Feb-23 | 3.4387 |

| Mar-23 | 3.4303 |

| Apr-23 | 3.3080 |

| May-23 | 3.5962 |

| Jun-23 | 3.4632 |

| Jul-23 | 3.5045 |

| Aug-23 | 3.3586 |

| Sep-23 | 3.5613 |

| Oct-23 | 3.3739 |

| Nov-23 | 3.5950 |

| Dec-23 | 3.6716 |

| Jan-24 | 3.5087 |

| Feb-24 | 3.6111 |

| Mar-24 | 3.4034 |

| Apr-24 | 3.3101 |

| May-24 | 3.7905 |

| Jun-24 | 3.4522 |

| Jul-24 | 3.4925 |

| Aug-24 | 3.3272 |

| Sep-24 | 3.6607 |

| Oct-24 | 3.7769 |

| Nov-24 | 3.6273 |

| Dec-24 | 3.8050 |

| Jan-25 | 3.4650 |

| Feb-25 | 3.4600 |

| Mar-25 | 3.3218 |

| Apr-25 | 3.3333 |

| May-25 | 3.1805 |

| Jun-25 | 3.3250 |

- Real estate popularity drop: Home-buying interest among consumers decreased by nearly 23% in June 2025 compared to last year, marking the second-largest decrease recorded since December 2020.

How likely are you to buy a home in the next six months?

| Month | Likelihood |

|---|---|

| Dec-20 | 1.6772 |

| Jan-21 | 1.7984 |

| Feb-21 | 1.7783 |

| Mar-21 | 1.7225 |

| Apr-21 | 1.8392 |

| May-21 | 1.8491 |

| Jun-21 | 1.6245 |

| Jul-21 | 1.9389 |

| Aug-21 | 1.8290 |

| Sep-21 | 1.7745 |

| Oct-21 | 1.8504 |

| Nov-21 | 1.6812 |

| Dec-21 | 1.7438 |

| Jan-22 | 1.7314 |

| Feb-22 | 1.8770 |

| Mar-22 | 1.8419 |

| Apr-22 | 1.7860 |

| May-22 | 1.8000 |

| Jun-22 | 1.8419 |

| Jul-22 | 1.9120 |

| Aug-22 | 1.7792 |

| Sep-22 | 2.0089 |

| Oct-22 | 1.8655 |

| Nov-22 | 1.7467 |

| Dec-22 | 1.7453 |

| Jan-23 | 1.6995 |

| Feb-23 | 1.6981 |

| Mar-23 | 1.7418 |

| Apr-23 | 1.7991 |

| May-23 | 2.0000 |

| Jun-23 | 1.9610 |

| Jul-23 | 2.0180 |

| Aug-23 | 1.8523 |

| Sep-23 | 1.8066 |

| Oct-23 | 2.2395 |

| Nov-23 | 2.0000 |

| Dec-23 | 2.0000 |

| Jan-24 | 1.8043 |

| Feb-24 | 2.1620 |

| Mar-24 | 1.8409 |

| Apr-24 | 2.1835 |

| May-24 | 2.6190 |

| Jun-24 | 2.4777 |

| Jul-24 | 2.1542 |

| Aug-24 | 2.1420 |

| Sep-24 | 1.7768 |

| Oct-24 | 2.5060 |

| Nov-24 | 2.2364 |

| Dec-24 | 1.8200 |

| Jan-25 | 1.6700 |

| Feb-25 | 1.7000 |

| Mar-25 | 1.7723 |

| Apr-25 | 1.9602 |

| May-25 | 1.8390 |

| Jun-25 | 1.9150 |

- Decreasing interest in auto purchases: The share of consumers who expect to buy a car in the next six months is roughly 21% lower in June 2025 compared to last year. This is the third-highest drop in auto purchase interest on record since December 2020.

How likely are you to buy a new car in the next six months?

| Month | Likelihood |

|---|---|

| Dec-20 | 1.8757 |

| Jan-21 | 1.9960 |

| Feb-21 | 2.0613 |

| Mar-21 | 2.0766 |

| Apr-21 | 2.1333 |

| May-21 | 2.2500 |

| Jun-21 | 1.9272 |

| Jul-21 | 2.1834 |

| Aug-21 | 2.1041 |

| Sep-21 | 2.0043 |

| Oct-21 | 2.0827 |

| Nov-21 | 1.9127 |

| Dec-21 | 2.0248 |

| Jan-22 | 1.9463 |

| Feb-22 | 2.0656 |

| Mar-22 | 2.1068 |

| Apr-22 | 1.9349 |

| May-22 | 2.0583 |

| Jun-22 | 2.1186 |

| Jul-22 | 2.1400 |

| Aug-22 | 2.1342 |

| Sep-22 | 2.2400 |

| Oct-22 | 1.9776 |

| Nov-22 | 2.0044 |

| Dec-22 | 2.0425 |

| Jan-23 | 1.9343 |

| Feb-23 | 2.0802 |

| Mar-23 | 1.9057 |

| Apr-23 | 1.9911 |

| May-23 | 2.2019 |

| Jun-23 | 2.3030 |

| Jul-23 | 2.1757 |

| Aug-23 | 2.0084 |

| Sep-23 | 2.1557 |

| Oct-23 | 2.4832 |

| Nov-23 | 2.2000 |

| Dec-23 | 2.3632 |

| Jan-24 | 2.0304 |

| Feb-24 | 2.4074 |

| Mar-24 | 2.1648 |

| Apr-24 | 2.3544 |

| May-24 | 2.8667 |

| Jun-24 | 2.6688 |

| Jul-24 | 2.3980 |

| Aug-24 | 2.3272 |

| Sep-24 | 2.1027 |

| Oct-24 | 2.6813 |

| Nov-24 | 2.4091 |

| Dec-24 | 2.4450 |

| Jan-25 | 1.8750 |

| Feb-25 | 1.8600 |

| Mar-25 | 1.9109 |

| Apr-25 | 2.0398 |

| May-25 | 1.9366 |

| Jun-25 | 2.1200 |

- Large purchases are not a priority: In June 2025, consumers’ likelihood of making a large purchase in the next six months is almost 13% lower than it was last year, the third-sharpest drop in consumers’ interest in large purchases since December 2020.

How likely are you to make a large purchase within the next six months?

| Month | Likelihood |

|---|---|

| Dec-20 | 2.4365 |

| Jan-21 | 2.4506 |

| Feb-21 | 2.5613 |

| Mar-21 | 2.6842 |

| Apr-21 | 2.6588 |

| May-21 | 2.6897 |

| Jun-21 | 2.4559 |

| Jul-21 | 2.8166 |

| Aug-21 | 2.6654 |

| Sep-21 | 2.5319 |

| Oct-21 | 2.5512 |

| Nov-21 | 2.5328 |

| Dec-21 | 2.6322 |

| Jan-22 | 2.5909 |

| Feb-22 | 2.6516 |

| Mar-22 | 2.7479 |

| Apr-22 | 2.5163 |

| May-22 | 2.4375 |

| Jun-22 | 2.5652 |

| Jul-22 | 2.6000 |

| Aug-22 | 2.6190 |

| Sep-22 | 2.5422 |

| Oct-22 | 2.5561 |

| Nov-22 | 2.3733 |

| Dec-22 | 2.4623 |

| Jan-23 | 2.3521 |

| Feb-23 | 2.4906 |

| Mar-23 | 2.4385 |

| Apr-23 | 2.4420 |

| May-23 | 2.5822 |

| Jun-23 | 2.7056 |

| Jul-23 | 2.6622 |

| Aug-23 | 2.4473 |

| Sep-23 | 2.4764 |

| Oct-23 | 2.7059 |

| Nov-23 | 2.8050 |

| Dec-23 | 2.7512 |

| Jan-24 | 2.5739 |

| Feb-24 | 2.8704 |

| Mar-24 | 2.5625 |

| Apr-24 | 2.7785 |

| May-24 | 3.1429 |

| Jun-24 | 2.9490 |

| Jul-24 | 2.8408 |

| Aug-24 | 2.7469 |

| Sep-24 | 2.5268 |

| Oct-24 | 2.7291 |

| Nov-24 | 2.9773 |

| Dec-24 | 2.7000 |

| Jan-25 | 2.3200 |

| Feb-25 | 2.3900 |

| Mar-25 | 2.3465 |

| Apr-25 | 2.5124 |

| May-25 | 2.4537 |

| Jun-25 | 2.5700 |

- Decrease in debt-reduction confidence: The share of consumers who expect to have less debt after the next six months is lower (-1.5%) in June 2025 compared to last year.

Will you have more or less debt in six months?

| Month | Debt Reduction Likelihood |

|---|---|

| Dec-20 | 3.1481 |

| Jan-21 | 3.2292 |

| Feb-21 | 3.3160 |

| Mar-21 | 3.4976 |

| Apr-21 | 3.4078 |

| May-21 | 3.4526 |

| Jun-21 | 3.5172 |

| Jul-21 | 3.3188 |

| Aug-21 | 3.3941 |

| Sep-21 | 3.3362 |

| Oct-21 | 3.3189 |

| Nov-21 | 3.3057 |

| Dec-21 | 3.3388 |

| Jan-22 | 3.3678 |

| Feb-22 | 3.3443 |

| Mar-22 | 3.3248 |

| Apr-22 | 3.4326 |

| May-22 | 3.4042 |

| Jun-22 | 3.0474 |

| Jul-22 | 3.3000 |

| Aug-22 | 3.3506 |

| Sep-22 | 3.1733 |

| Oct-22 | 3.3677 |

| Nov-22 | 3.2133 |

| Dec-22 | 3.3868 |

| Jan-23 | 3.3380 |

| Feb-23 | 3.3396 |

| Mar-23 | 3.2705 |

| Apr-23 | 3.2277 |

| May-23 | 3.3099 |

| Jun-23 | 3.3290 |

| Jul-23 | 3.2432 |

| Aug-23 | 3.2363 |

| Sep-23 | 3.1792 |

| Oct-23 | 3.1933 |

| Nov-23 | 3.3250 |

| Dec-23 | 3.5373 |

| Jan-24 | 3.2870 |

| Feb-24 | 3.3472 |

| Mar-24 | 3.3182 |

| Apr-24 | 3.2722 |

| May-24 | 3.3857 |

| Jun-24 | 3.1720 |

| Jul-24 | 3.3383 |

| Aug-24 | 3.1790 |

| Sep-24 | 3.1607 |

| Oct-24 | 3.1992 |

| Nov-24 | 3.1091 |

| Dec-24 | 3.4100 |

| Jan-25 | 3.5000 |

| Feb-25 | 3.3800 |

| Mar-25 | 3.1634 |

| Apr-25 | 3.1443 |

| May-25 | 3.2634 |

| Jun-25 | 3.1250 |

- Credit score insecurity: The share of consumers who expect their credit score to increase in the next six months is lower (-1.9%) in June 2025 compared to last year.

Will your credit score be better or worse in six months?

| Month | Score Increase Confidence |

|---|---|

| Dec-20 | 3.3492 |

| Jan-21 | 3.3676 |

| Feb-21 | 3.4009 |

| Mar-21 | 3.4737 |

| Apr-21 | 3.6000 |

| May-21 | 3.5474 |

| Jun-21 | 3.5441 |

| Jul-21 | 3.4847 |

| Aug-21 | 3.4981 |

| Sep-21 | 3.5149 |

| Oct-21 | 3.6024 |

| Nov-21 | 3.4192 |

| Dec-21 | 3.3430 |

| Jan-22 | 3.5702 |

| Feb-22 | 3.4098 |

| Mar-22 | 3.3547 |

| Apr-22 | 3.4512 |

| May-22 | 3.4000 |

| Jun-22 | 3.2846 |

| Jul-22 | 3.5000 |

| Aug-22 | 3.4719 |

| Sep-22 | 3.3289 |

| Oct-22 | 3.4036 |

| Nov-22 | 3.3867 |

| Dec-22 | 3.4340 |

| Jan-23 | 3.4272 |

| Feb-23 | 3.5236 |

| Mar-23 | 3.4016 |

| Apr-23 | 3.4509 |

| May-23 | 3.3662 |

| Jun-23 | 3.4242 |

| Jul-23 | 3.5135 |

| Aug-23 | 3.4599 |

| Sep-23 | 3.5000 |

| Oct-23 | 3.4034 |

| Nov-23 | 3.4650 |

| Dec-23 | 3.5473 |

| Jan-24 | 3.3826 |

| Feb-24 | 3.5463 |

| Mar-24 | 3.5284 |

| Apr-24 | 3.4177 |

| May-24 | 3.7048 |

| Jun-24 | 3.4904 |

| Jul-24 | 3.4876 |

| Aug-24 | 3.3704 |

| Sep-24 | 3.5893 |

| Oct-24 | 3.5219 |

| Nov-24 | 3.5000 |

| Dec-24 | 3.4700 |

| Jan-25 | 3.4050 |

| Feb-25 | 3.4000 |

| Mar-25 | 3.2129 |

| Apr-25 | 3.3234 |

| May-25 | 3.3268 |

| Jun-25 | 3.4250 |