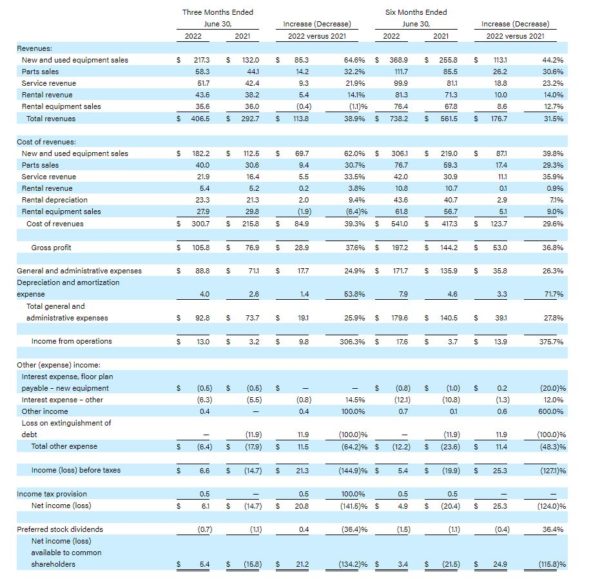

Second Quarter Financial Highlights: (comparisons are year over year)

- Total revenues increased 38.9% year over year to $406.5 million

- Construction and Material Handling revenue of $271.0 million and $135.5 million, respectively

- Product Support revenue increased by $23.5 million year over year to $110.0 million

- Record second quarter financial results primarily due to strong demand for equipment and product support growth

- Net income of $5.4 million available to common shareholders compared to a loss of $(15.8) million in 2021

- Adjusted basic and diluted net income per share* of $0.21 compared to a loss of $(0.06) in 2021

- Adjusted EBITDA* grew 45.3% to $41.4 million, compared to $28.5 million in 2021

Alta Equipment Group Inc., a provider of premium material handling and construction equipment and related services, today announced financial results for the second quarter ended June 30, 2022.

CEO Comment:

Ryan Greenawalt, Chief Executive Officer of Alta, said “As a result of the ongoing strong demand in our end-user markets, solid execution, flexible business model, and the positive contributions from our growth initiatives, we delivered record results for the second quarter. Total revenues increased38.9%, or $113.8million, to $406.5million, and Adjusted EBITDA also increased significantly from a year ago. We also achieved $5.4 million of GAAP net income for the quarter. We are seeing significant strength in our Construction segment and our material handling business is also performing well. As a result of our performance in the second quarter and our visibility going forward, we have raised our Adjusted EBITDA guidance for the year.”

In terms of our market outlook, Mr. Greenawalt noted “Despite the headline economic news, concerns about a recession, our business indicators remain robust for our end-user markets. Project activity across all our regions remains solid and our industry’s business cycle remains in growth mode. Our large level of new equipment sales for the quarter is indicative of pent-up demand for equipment that continues to manifest itself in historic levels of equipment sales backlogs. Our parts and service revenue lines are benefiting from an aging field population as we provide customers with best-in-class skilled technicians to keep their business operations up and running. We believe the finalization of the infrastructure bill will be an incremental benefit to our business in 2023 and beyond.”

In conclusion, Mr. Greenawalt commented, “We have effectively executed our growth strategy over the past two years and our second quarter results reflect that success. On a trailing twelve-month basis, our acquisitions since the IPO have added $376 million in revenue and $42.4 million in Adjusted EBITDA to the enterprise. After quarter end we entered into a definitive agreement to acquire Yale Industrial Trucks, Inc. (“YIT”), a privately held Yale lift truck dealer with five locations in southeastern Canada. The YIT deal is very consistent with our strategy to increase the scale of our business and will establish a presence for Alta in an international market for the first time. Our balance sheet is very solid and will support further acquisition activity as well as our new capital allocation policy, which includes paying a regular quarterly dividend and a share repurchase program.”

The full year 2022 Financial Guidance:

- The Company increased its guidance range and currently expects to report Adjusted EBITDA between $147 million and $152 million, net of new equipment floorplan interest, for the full year of 2022. This is an increase from between $137 million and $142 million, as previously expected.

Recent Business Highlights:

- On July 29th, the Company acquired the stock of YIT, a privately held Canadian equipment distributor with locations in Ontario and Quebec. YIT generated approximately $46.6 million in revenue and adjusted EBITDA of $9.4 million in the trailing twelve months through May 2022. The implied enterprise value of the acquisition is estimated to be approximately $33.5 million, subject to post-closing purchase price adjustments.

- The Company’s Board approved the initiation of a regular quarterly cash dividend for each of the Company’s issued and outstanding shares of common stock. The common stock dividend is $0.057 per share or approximately $0.23 per share on an annualized basis. The first common stock dividend will be payable on August 31st, 2022 to shareholders of record as of August 15th, 2022.

- The Company’s Board approved a share repurchase program authorizing Alta to repurchase shares of its common stock for an aggregate purchase price of not more than $12.5 million.