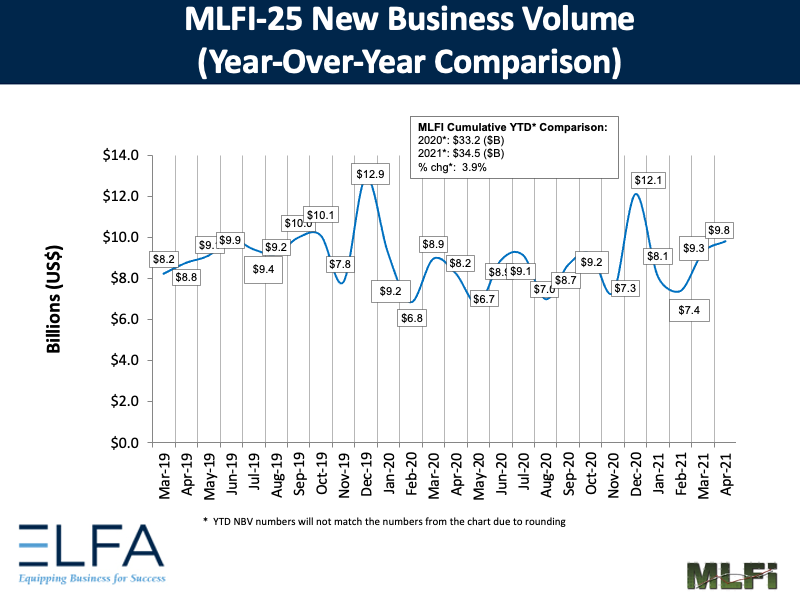

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross-section of the $900 billion equipment finance sector, showed their overall new business volume for April was $9.8 billion, up 19 percent year-over-year from new business volume in April 2020. Volume was up 5 percent month-to-month from $9.3 billion in March. Year-to-date, cumulative new business volume was up 4 percent compared to 2020.

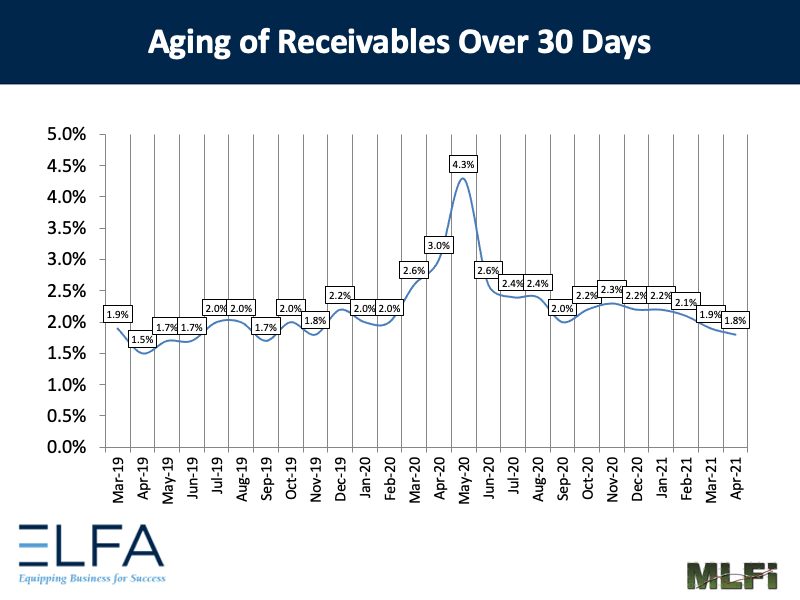

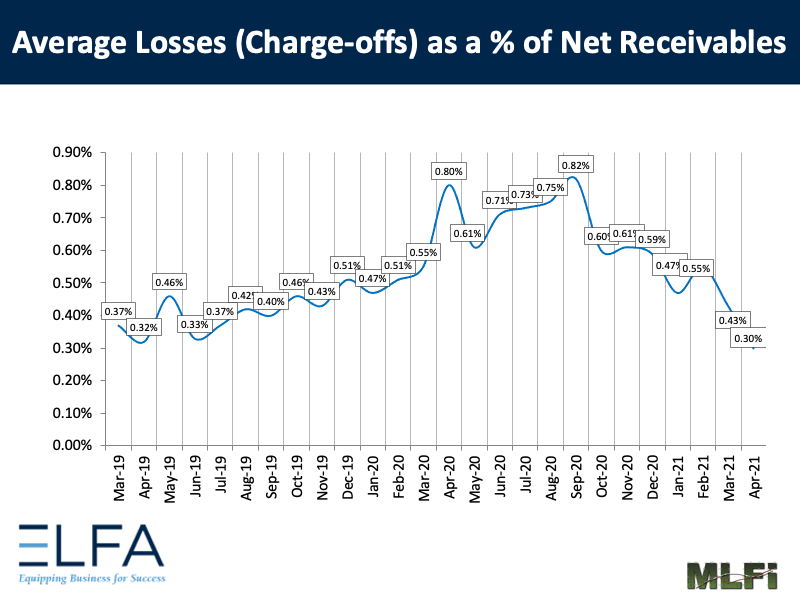

Receivables over 30 days were 1.8 percent, down from 1.9 percent the previous month and down from 3.0 percent in the same period in 2020. Charge-offs were 0.30 percent, down from 0.43 percent the previous month and down from 0.80 percent in the year-earlier period.

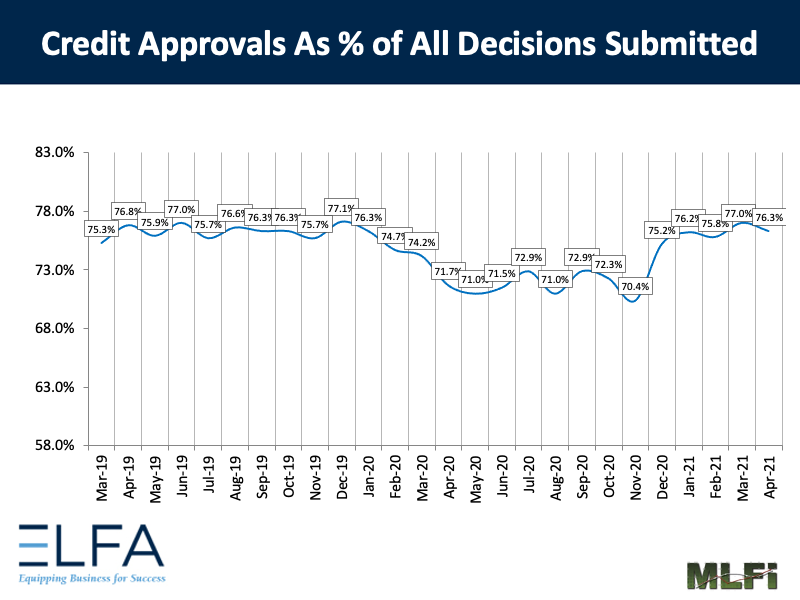

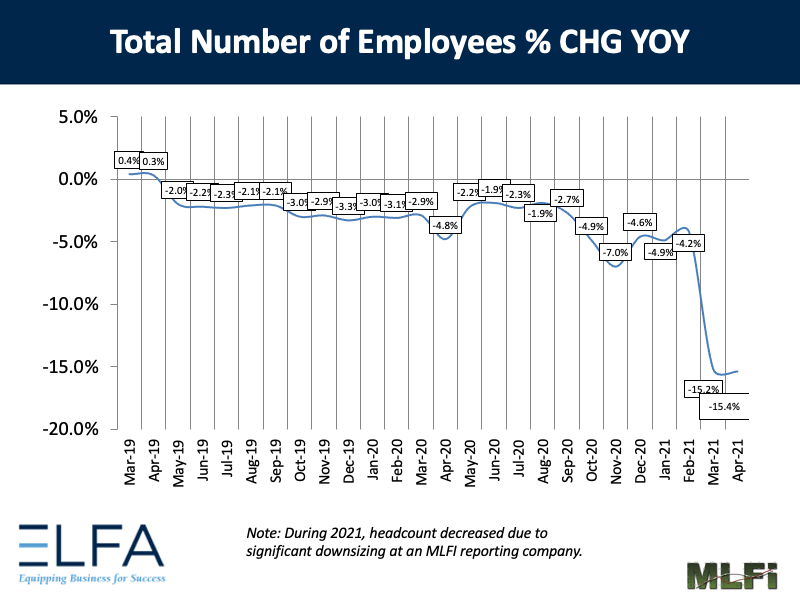

Credit approvals totaled 76.3 percent, down from 77.0 percent in March. Total headcount for equipment finance companies was down 15.4 percent year-over-year, a decrease due to significant downsizing at an MLFI reporting company.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in May is 72.1, easing from April’s all-time high of 76.1, but still at historic high levels.

ELFA President and CEO Ralph Petta said, “Respondents showed robust April business activity, attesting to a strengthening economy. Despite soft labor market data for the month, an increasing number of businesses are opening up, as more Americans are receiving a vaccination, traveling, and otherwise trying to return to some semblance of normalcy. Portfolio quality also shows resilience as lease and loan contract modifications requested by many customers appear to be in the rear-view mirror. The economy and business activity still have a ways to go to return to pre-pandemic levels, but what we see so far in terms of capital equipment investment is indeed encouraging as we head into the summer months.”

Ricardo Rios, president and CEO, Commercial Equipment Finance, Inc., said, “2021 is trending to be a banner year for CEFI. The April MLFI results and those at CEFI demonstrate major similarities; the only outlier being YOY headcount (where CEFI is 20 percent above). While we are actively seeking to hire additional team resources, the recruiting market is proving to be challenging.”