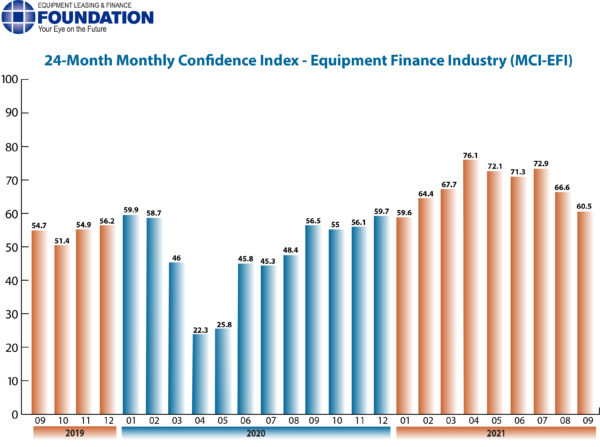

The Equipment Leasing & Finance Foundation (the Foundation) released the September 2021 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 60.5, a decrease from the August index of 66.6.

When asked about the outlook for the future, MCI-EFI survey respondent Bruce J. Winter, President, FSG Capital, Inc. said, “The delta variant is causing some slowdown in certain sectors which will delay, but not derail the recovery of these industries. Other sectors that have seen strong demand but were unable to fulfill all orders due to severe labor shortages are optimistic more workers will return now that the federal unemployment bonus has expired. We expect a robust fourth quarter and are optimistic the momentum will continue into early next year. Future inflation remains the great unknown, and the outcome of the proposed $3.5 trillion infrastructure bill will be a key determinate in whether we experience only short-term inflation or several years of inflation well above the Fed’s target rate.”

September 2021 Survey Results:

The overall MCI-EFI is 60.5, a decrease from the August index of 66.6.

- When asked to assess their business conditions over the next four months, 17.9% of executives responding said they believe business conditions will improve over the next four months, down from 35.7% in August. 71.4% believe business conditions will remain the same over the next four months, up from 64.3% the previous month. 10.7% believe business conditions will worsen, up from none in August.

- 21.4% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 32.1% in August. 75% believe demand will “remain the same” during the same four-month time period, an increase from 67.9% the previous month. 3.6% believe demand will decline, up from none in August.

- 32.1% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 28.6% in August. 67.9% of executives indicate they expect the “same” access to capital to fund business, a decrease from 71.4% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 28.6% of the executives report they expect to hire more employees over the next four months, down from 35.7% in August. 71.4% expect no change in headcount over the next four months, an increase from 64.3% last month. None expect to hire fewer employees, unchanged from August.

- 7.1% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 14.3% the previous month. 92.9% of the leadership evaluate the current U.S. economy as “fair,” up from 85.7% in August. None evaluate it as “poor,” unchanged from last month.

- 17.9% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 32.1% in August. 64.3% indicate they believe the U.S. economy will “stay the same” over the next six months, unchanged from last month. 17.9% believe economic conditions in the U.S. will worsen over the next six months, up from 3.6% the previous month.

- In September 42.9% of respondents indicate they believe their company will increase spending on business development activities during the next six months, down from 50% last month. 57.1% believe there will be “no change” in business development spending, an increase from 50% in August. None believe there will be a decrease in spending, unchanged from last month.

September 2021 MCI-EFI Survey Comments from Industry Executive Leadership:

Bank, Middle Ticket

“There is great interest in capital expansion in the industries we serve. Supply chain issues continue to delay equipment and the completion of projects. We will see this continue into next year and it will have an impact on when transactions end up on the books.” Michael Romanowski, President, Farm Credit Leasing

Independent, Large Ticket

“We always believe that secured equipment loans and leases will outperform all other asset classes; however, the last few months have created some concern among our customers. The shortage of labor, skilled or otherwise, has become problematic. Uncertainty with prospective policies coming out of Washington that could increase costs of doing business has slowed decision-making ahead of any conclusion. The persistence of COVID variants and potentially renewed mandates and restrictions create even more uncertainty. While we try our best not to worry about what we cannot control, this environment feels unprecedented. Until we have clarity on a number of these concerns, we think the rest of this year and into 2022 will be somewhat choppy.” Dave Fate, Chief Executive Officer, Stonebriar Commercial Finance.