New orders of manufacturing technology totaled $436.5 million in November 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology

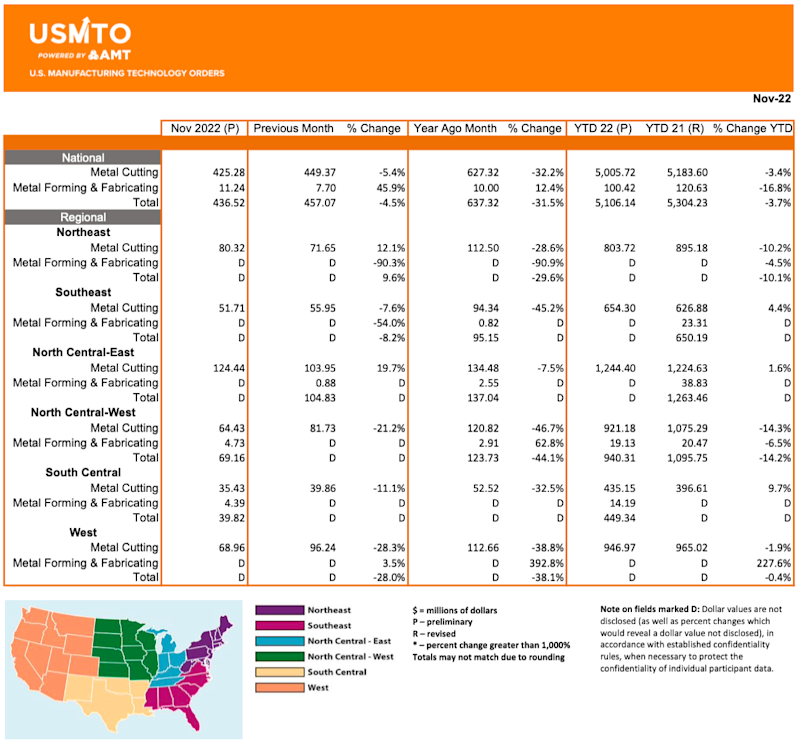

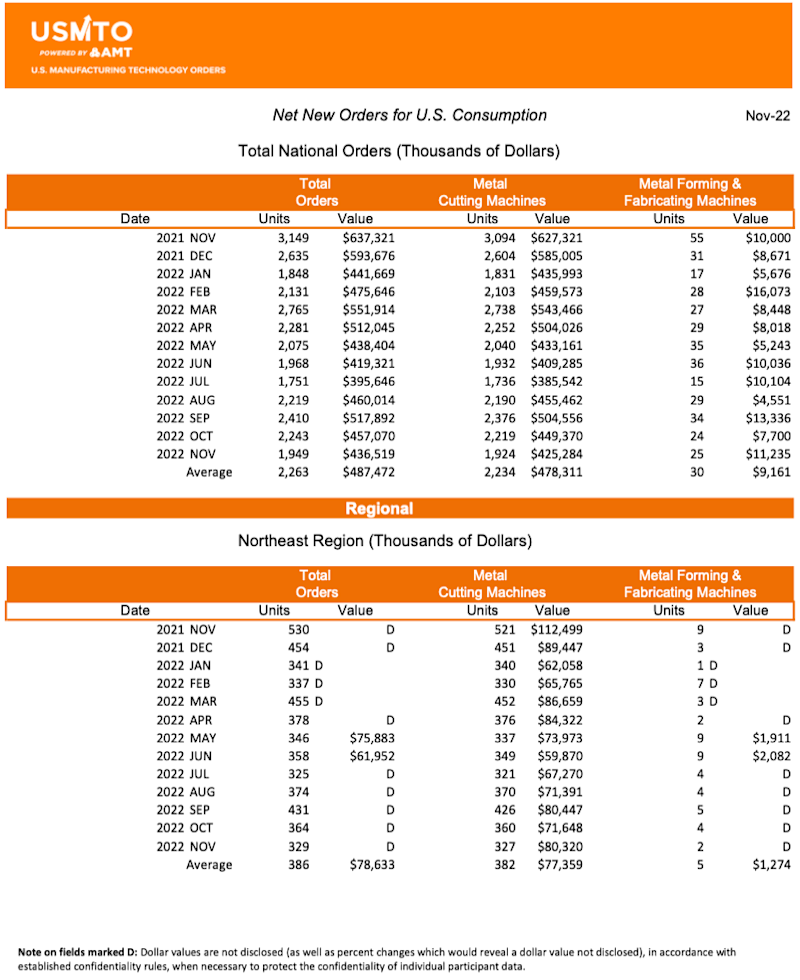

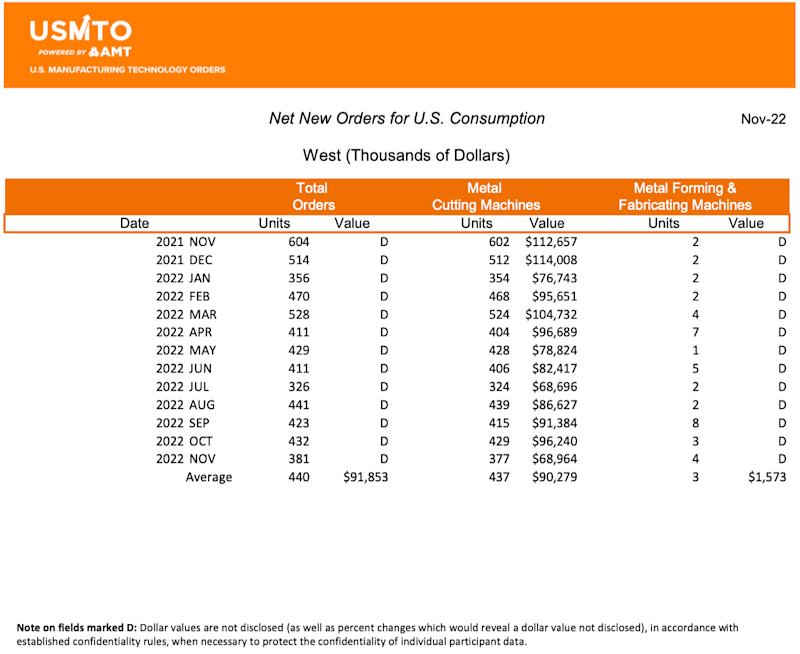

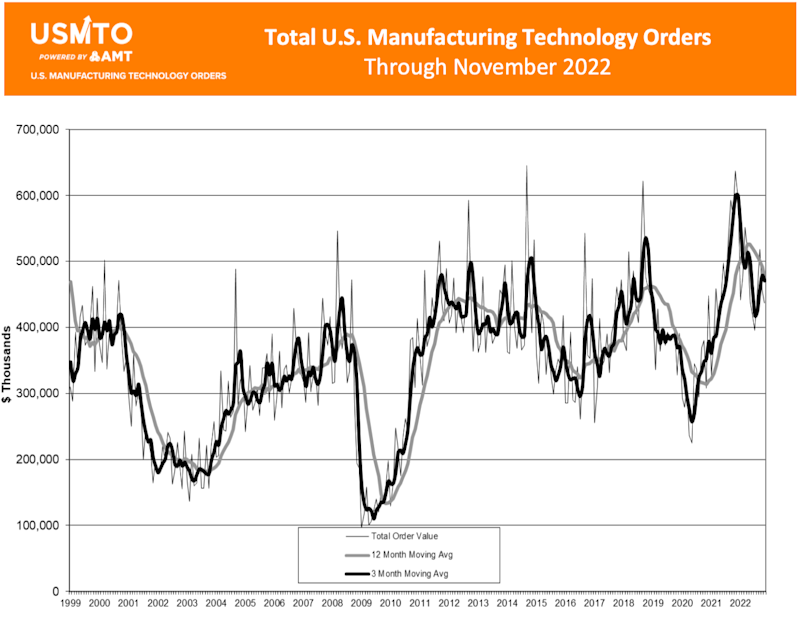

New orders of manufacturing technology totaled $436.5 million in November 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. November 2022 orders were down 4.5% from October 2022 and down nearly 32% from November 2021. Year-to-date orders dropped below 2021 for the first time in 2022, dipping 3.7% below the total through November 2021.

“After recording the highest level of orders in 2021, it was only a matter of time before 2022 fell slightly behind,” said Douglas K. Woods, president of AMT. “The fact that orders stayed above 2021 levels for 10 months really speaks to the continued strength in the demand for manufacturing technology. This demand has been spurred by the extraordinary economic challenges of the last few years, which has prompted expanded domestic manufacturing as well as foreign direct investment.”

Although domestic capacity has expanded greatly over the last two years, the current economic environment is starting to take a toll on demand for manufacturing technologies in some sectors. In an environment of rapidly rising interest rates, home construction and renovation has slowed, and manufacturers of household appliances have continued to reduce their orders through November 2022. Likewise, declining investments in capital goods by manufacturers of HVAC and commercial refrigeration reflect slowing demand from commercial construction. While job shops remain the largest customer segment, their orders have continued to decline since peaking in September 2022. Interestingly, the average value of orders from job shops has been increasing, indicating continued demand for the more-automated, higher-value machinery. Order activity in this sector appears driven by application-specific needs rather than expanding capacity.

“Despite some of the slowing orders, a number of our members remain confident in their 2023 projections because of the outstanding orders collected in 2022,” said Woods. “2023 will most likely be a balancing act. The manufacturing that has returned to the country will continue to spur economic activity, which may be tempered by rising interest rates and slowing demand.”