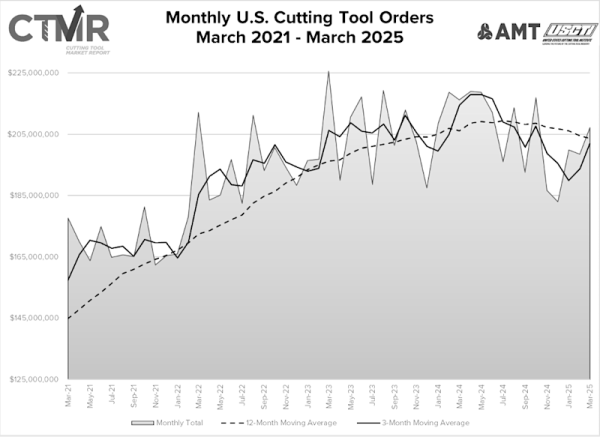

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), totaled $207.1 million in March 2025. Orders increased 4.3% from February 2025 but dropped 4.2% from March 2024. Year-to-date shipments totaled $605.6 million, a drop of 5.9% from the same period in 2024.

“Despite the uncertainty from Washington, it was still business as usual for most companies,” said Jack Burley, chairman of AMT’s Cutting Tool Product Group. “However, most tooling manufacturers are either dealing with increased tariffs for products sourced abroad or increased costs for raw materials like tungsten carbide, or both. These increased costs for perishable tools are already getting passed on, resulting in a hit to the operating margins for manufacturers.”

Bret Tayne, president of Everede Tool Co., said, “March cutting tool sales improved over February and were at the highest level we have seen since October 2024. Despite the improvement, year-over-year sales remained below 2024 levels for the third consecutive month. Although this data precedes the ‘Liberation Day’ tariff announcements, I’ve anecdotally heard optimism that the current volatility will be short-lived, and modest growth will return in the second half of the year.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.