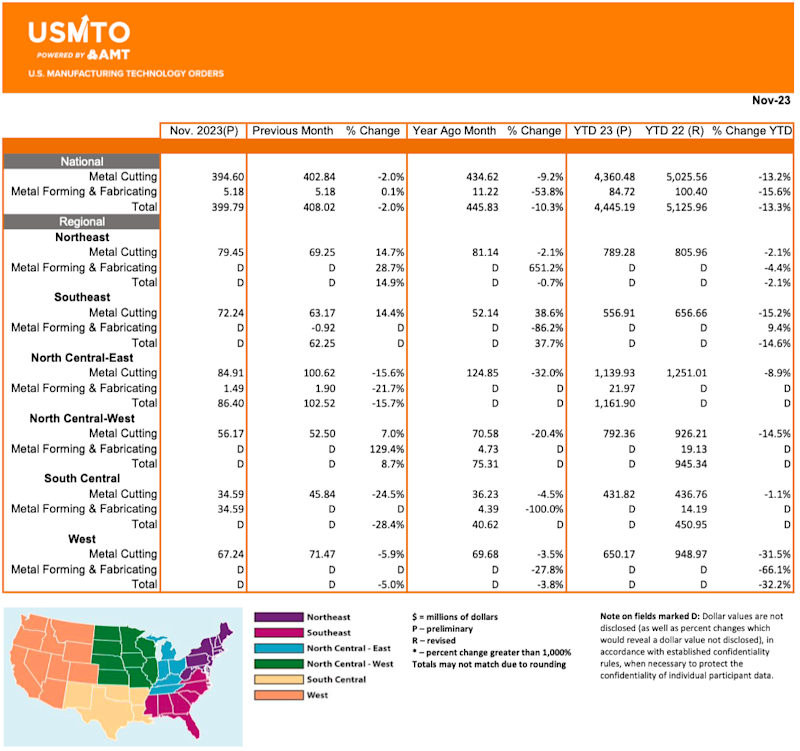

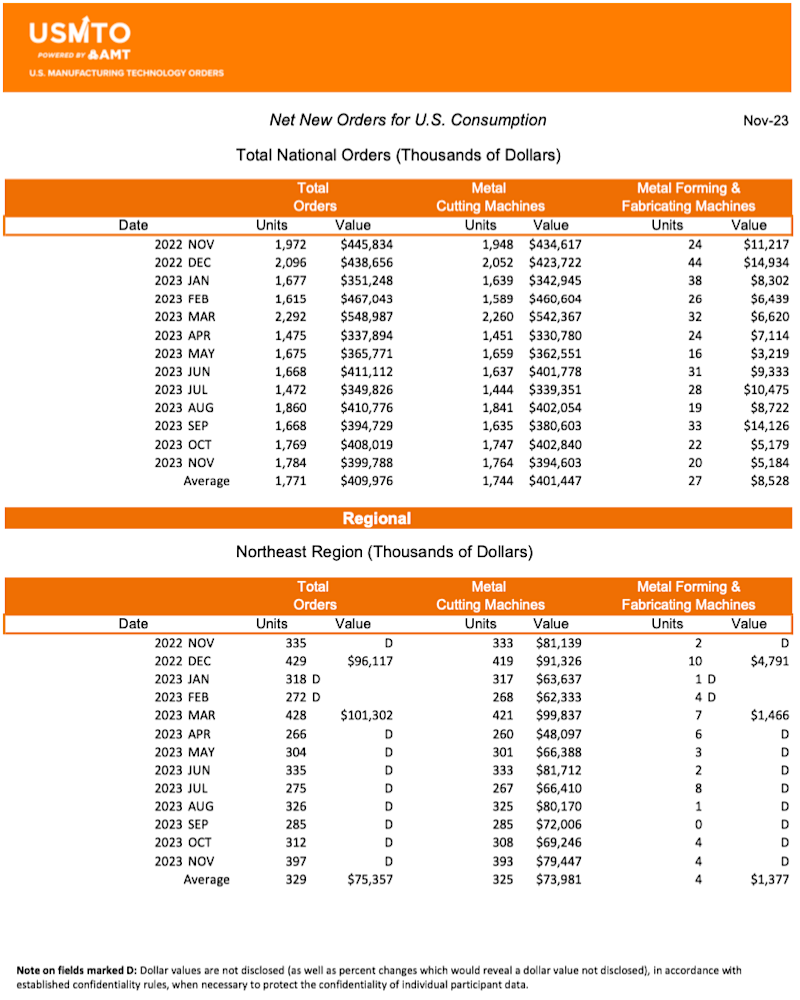

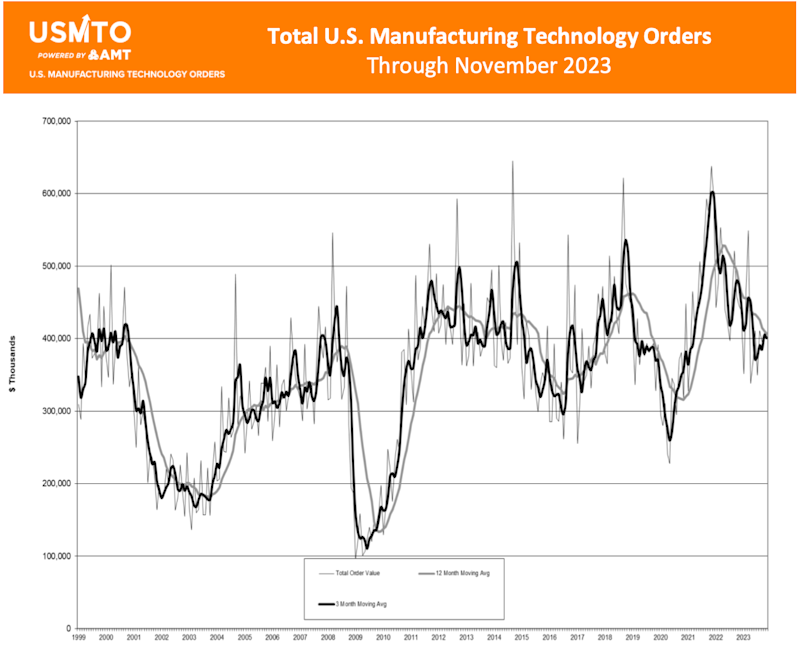

The soft landing the U.S. economy generally experienced through 2023 did not affect all sectors of the economy evenly. Even in the face of improving economic health, orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, consistently fell short of orders placed in 2022. November 2023 was no different, with orders falling to $399.8 million, 10.3% lower than those placed in November 2022 and 2% behind orders placed in October 2023. Year-to-date orders reached $4.45 billion in 2023, 13.3% below the same period in 2022.

Contract machine shops, the largest consumer of manufacturing technology, decreased their November 2023 orders by nearly 16% from October 2023. The decline was nearly balanced by increases from other manufacturing sectors. Of those sectors that increased orders in November, aerospace manufacturers peaked at 60% above the monthly average compared to the rest of 2023. Electrical equipment manufacturers also increased orders. Tight conditions in the labor market persisting through the holiday travel and shopping seasons necessitated additional investment in automation to help manufacturers meet consumer demand.

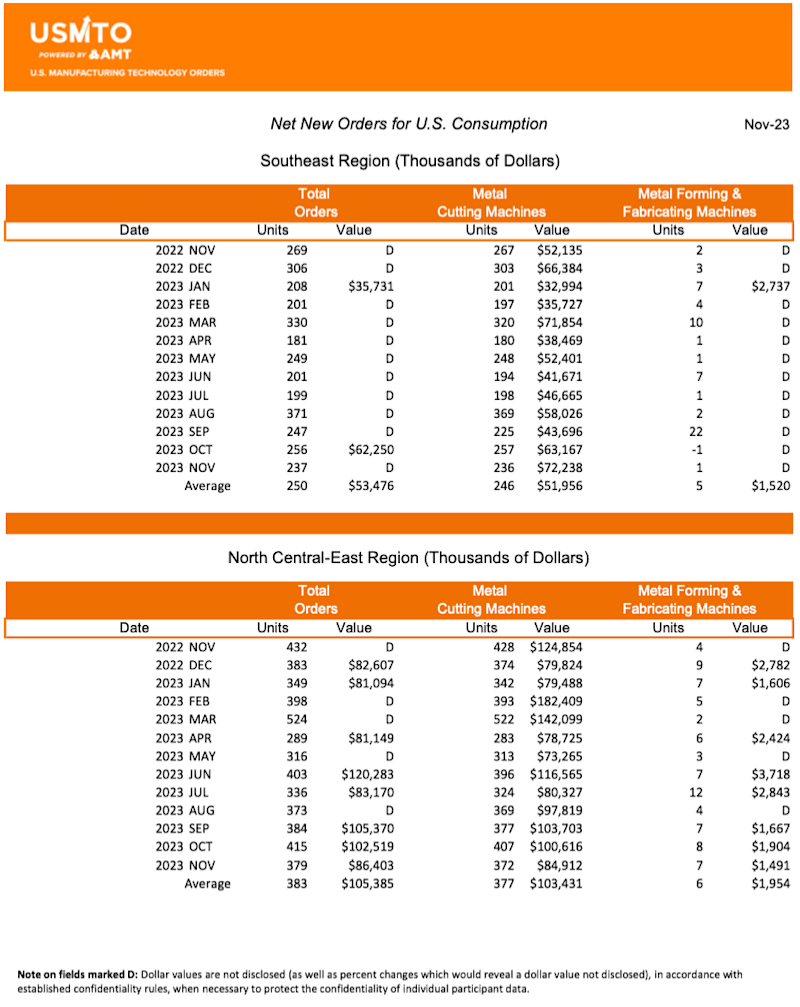

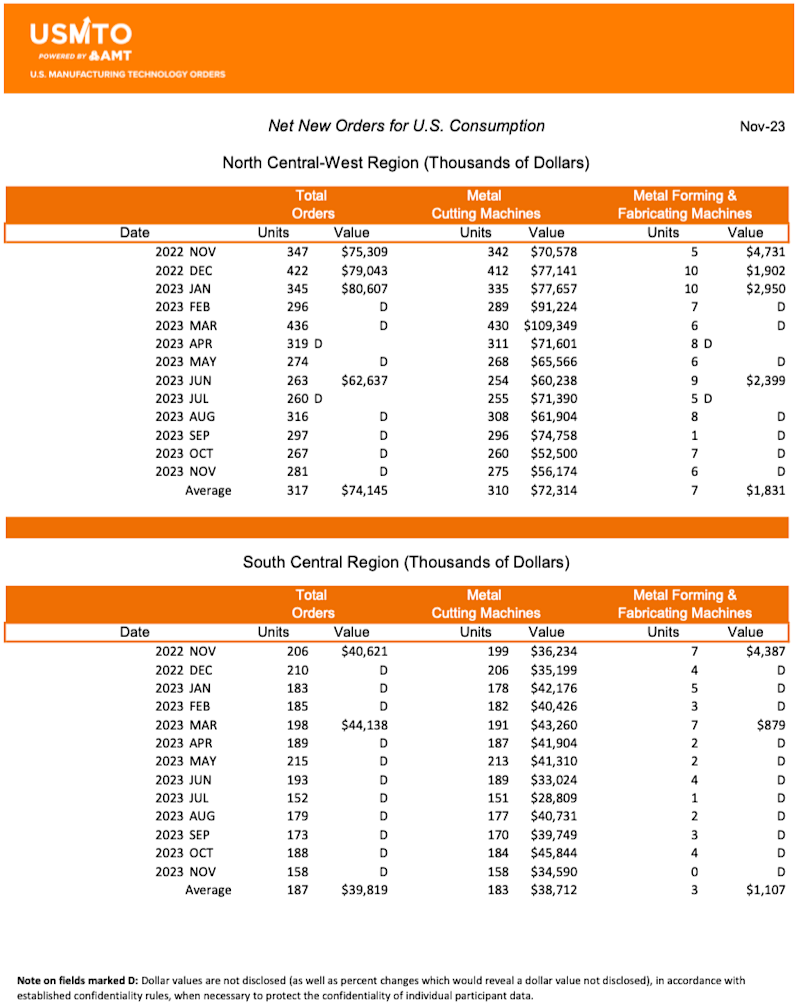

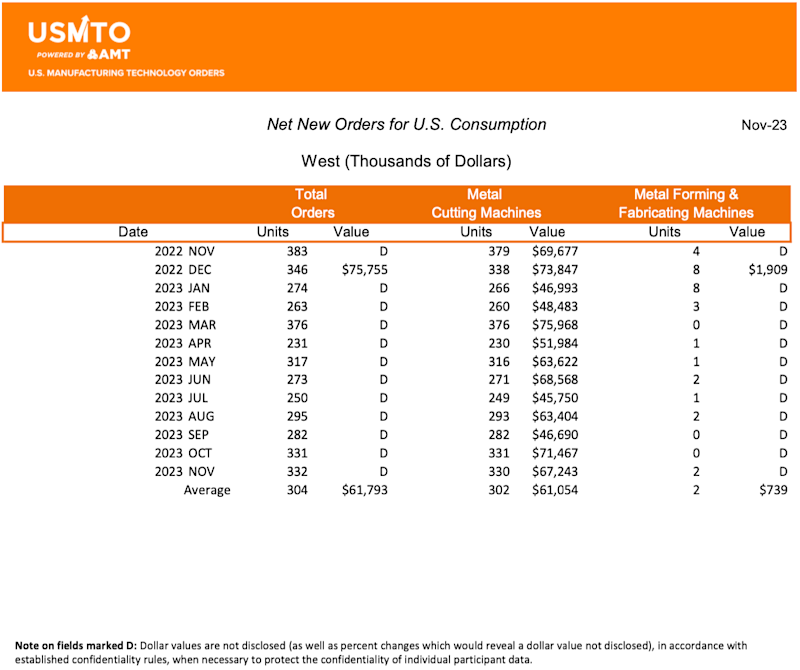

While overall orders for the year were down compared to their near-record levels in 2022, several regions and industries saw a late-year rally, showing strong order activity through November 2023. The Northeast and South-Central regions only declined by around 2% from their 2022 totals – virtually flat compared to the steeper declines seen in other regions. The minimal comparative losses in these regions were driven by significant year-over-year growth in orders from aerospace manufacturers. The South-Central region also benefited from significant growth in orders from the automotive sector. The release of December 2023 USMTO data will determine if the November bright spots were outliers or the beginning of a rebound that could drive manufacturing technology investment into 2024.