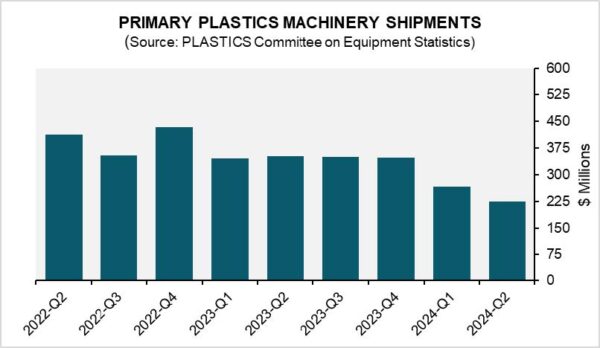

The Plastics Industry Association’s Committee on Equipment Statistics (CES) released Q2 2024 shipment data for primary plastics machinery in North America, covering injection molding and extrusion. The shipment value is estimated at $224.8 million, marking a 15.4% decrease from the previous quarter and a 36.2% year-over-year (Y/Y) decline.

In the primary plastics machinery sector, single-screw extrusion saw a 3.4% quarter-over-quarter (Q/Q) increase but a 28.6% Y/Y decrease. Twin-screw extrusion experienced a 23.5% Q/Q decrease and a 25.3% Y/Y decline. Injection molding shipments fell by 16.3% Q/Q and faced a 37.7% Y/Y decline.

“The second consecutive quarter of decline in shipments is not due to a pullback in plastics demand. In fact, based on monthly Plastics Demand Estimate,∗ there has been growth in demand recently. There is no indication that the baseline demand for plastic products has deteriorated,” commented PLASTICS’ Chief Economist, Perc Pineda, PhD. Manufacturers’ finished goods inventories of plastics and rubber products were estimated at $15.0 billion in June this year, compared to $15.2 billion in June last year, indicating slow inventory adjustments.

Results from the latest CES quarterly survey showed that a high percentage (79.9%) of respondents anticipate steady or improved market conditions over the next twelve months. However, 40.0% reported an increase in quoting activity, which was lower than the 48.9% in the previous quarter’s survey citing an increase in quoting activity.

In Q2 2024, U.S. total exports of plastics equipment declined by 14.7% to $341.0 million compared to the previous quarter, while imports decreased by 3.8% to $856.8 million during the same period. Slightly more than half (53.4%) of exports went to Mexico and Canada, jointly accounting for $182.3 million of U.S. plastics machinery exports globally.

Pineda remarked, “While the rate of decline in the second quarter was significantly less than in the first quarter, the industry continues to deal with higher interest rates, and that’s weighing on capital expenditure plans.” The economy is currently not operating at maximum capacity in plastics processing; capacity utilization is below potential, leaving room for growth.