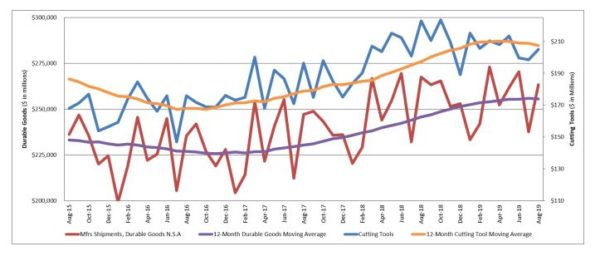

August 2019 U.S. cutting tool consumption totaled $205.1 million according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 3.3 percent from July’s $198.5 million and down 8 percent when compared with the $222.8 million reported for August 2018. With a year-to-date total of $1.7 billion, 2019 is up 1.2 percent when compared with 2018.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools. According to Phil Kurtz, President of USCTI, “August numbers reflected an increase from July but an 8% decrease from August 2018. While 2019 year-to-date market remains positive, the gain is deteriorating and may turn negative before year end as there are a number of reports now showing an overall manufacturing slow down.”

“Cutting tool consumption continues to decelerate in-line with the slowing U.S. industrial sector. Robust U.S. manufacturing activity of 2018 has slowed, impacted by uncertain economic growth both here and abroad as well as ongoing trade issues. The weakening economic outlook drives softening industrial production, manufacturing output and business spending. This means that the U.S. benefit from rising inventories is over and inventory liquidation has begun. With industrial production likely to continue to be sluggish for the foreseeable future, most manufacturing has begun an inventory liquidation of short-cycle components.

The cutting tool sector is not immune. Cutting tool demand M/M has been volatile for the eight months of 2019; but 2019 YTD gains peaked in January and have continued to soften as the year progressed. August YTD data shows down 8% and we expect cutting tool activity to continue to decelerate – if not contract – for the remainder of 2019 and likely into next year,” said Eli Lustgarten, President of ESL Consultants.

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.