Duravant acquires packaging equipment manufacturer T-TEK

Automation equipment leader Duravant expands packaging solutions portfolio with the acquisition of end-of-line equipment provider T-TEK Duravant LLC (“Duravant”), a global engineered equipment and automation solutions provider to the food processing, packaging, and material handling sectors, announced that it had acquired T-TEK Material Handling LLC (“T-TEK”), a manufacturer of high-speed packaging machinery and systems solutions headquartered in Montgomery, Alabama. T-TEK designs, builds, and services innovative end-of-line equipment, including palletizers, depalletizers, conveyors, and custom automated lines for blue chip producers of packaged food, beverage, and consumer products. Recognized for their extensive technical knowledge of palletizing applications, T-TEK is a leader in delivering turnkey systems as well as equipment rebuilds and upgrades for any existing machinery brand. “We’re excited to welcome T-TEK to Duravant,” said Mike Kachmer, Chairman and CEO of Duravant. “T-TEK has an impressive history of fostering strong customer relationships through a differentiated service delivery model. Their technical sales and consultation process is key to their longstanding partnerships with brand owners, facility operators, engineering firms, and integrators.” T-TEK’s approach begins with understanding customers’ production goals and tailoring a line plan that blends current assets and processes with new technologies to deliver maximum investment output. T-TEK has a proven reputation for delivering innovation and quality for high-speed production environments. With deep experience in high-volume beverage production, T-TEK also excels at customized solutions that tackle small, non-standard packages that are fragile and difficult to palletize. T-TEK is a strategic acquisition for Duravant as the company expands its reach in the growing packaged food and beverage sector. T-TEK’s portfolio is highly complementary to Duravant’s product offering across its nVenia, Mespack, and Wulftec brands, which are all members of Duravant’s packaging segment. “T-TEK’s technology and equipment offering aligns perfectly with palletizing solutions offered by nVenia,” said David Malinas, Chief Operating Officer, Duravant. “We now have a complete, comprehensive solution set for all palletizing applications. And with adjacent load containment solutions offered through Wulftec’s premier stretch wrapping and strapping technologies, customers have a trusted source for all their end-of-line packaging needs.” “We are excited to join forces with Duravant and to collaborate across their family of Operating Companies,” said Michael Traff, President of T-TEK. “Duravant’s established infrastructure and extensive aftermarket network through Duravant Lifecycle Services will help us accelerate our growth with new customers and invest in resources and new technologies that will enable us to serve our existing customer base better.”

What Fed Chair Powell’s address means for manufacturing

Today, Federal Reserve Chair Jerome Powell gave the most concrete signal yet that interest rate cuts are on the horizon at his Jackson Hole press conference. The outlook is promising for manufacturers and those in the industry closely watching the developments and anticipating IMTS 2024 – The International Manufacturing Technology Show. “The increased likelihood of a September rate cut after Fed Chair Jerome Powell’s Jackson Hole address will likely boost manufacturing technology orders through the remainder of 2024, further amplifying the residual effects of an IMTS show year,” says Christopher Chidzik, principal economist at AMT – The Association For Manufacturing Technology. “With capacity utilization rates remaining at historically elevated levels in industrial sectors, additional investment in capital equipment will be necessary for manufacturers to address any sudden spikes in demand without a return of supply-side inflationary pressures.”

TVH Parts Co. leads the way in sustainable business practices

TVH Parts Co. has called the greater Kansas City area home for almost 20 years as the company’s Americas Headquarters is located in Olathe, KS. TVH is committed to being the one-stop shop for parts & accessories in the material handling, industrial, and light construction industries. Originally founded in Belgium, TVH has a global presence with over 90 branches worldwide and continues expanding into new markets. During TVH’s time in Olathe, they have been an active community member and continue pushing sustainability within the industry. TVH promotes internal and external sustainability by creating programs to help the environment while striving to be a good corporate citizen. With many domestic and international locations, TVH actively promotes a sustainable environment in all its facilities. Switching to biodegradable cups and utensils has been a great start in reducing waste on everyday items. LED lights have helped reduce energy consumption within offices and are continually being added to facilities to help reduce TVH’s carbon footprint. The Olathe office has been working towards adding car chargers to the parking lot to promote the use of electric vehicles and decrease carbon emissions. TVH has demonstrated a solid commitment to environmental stewardship through these sustainable practices, inspiring employees to adopt greener habits. TVH encourages employees to prioritize sustainability through the internal program Think Green. Think Green promotes the conservation of natural resources and strives to support environmental improvements that foster a clean, safe, and sustainable place to live and work. The program is dedicated to reducing TVH’s environmental impact and acts as an advocate within the company. TVH supports the local community through the Adopt-A-Street program, holding street cleanups to minimize pollution. Along with events, the program also sends informational emails to employees about recycling, energy conservation tips, and other environmental events going on in the community. Through these emails, employees can learn to promote sustainability at the office and in their daily lives outside of work. Another building block of TVH’s sustainability is the remanufactured parts program. This program involves restoring used parts to like-new condition, which reduces waste and provides customers with sustainable shopping options. Various parts, from engines to electronics, can be remanufactured, offering customers multiple alternatives for the parts they need. By encouraging customers to send in their used parts, TVH helps reduce parts waste nationwide and promotes the importance of sustainability to the customer base. TVH is continually promoting sustainability to its employees and customers by implementing eco-friendly practices, reducing carbon emissions, and encouraging the use of renewable energy sources. Additionally, they foster a culture of environmental responsibility through internal programs and awareness. TVH is proud to call Olathe, KS, home and is excited to be a part of the community by actively participating in local events, supporting community initiatives, and contributing to the well-being of the greater Kansas City area.

Motion enters agreement to purchase Industrial Products Distributor

Motion’s Market Expanding in Canada Motion Industries, Inc. signed a definitive purchase agreement to acquire the operating assets of Canadian-based LSI Supply Inc. and its sister company 273 Ontario (which trades as LSI). The transaction is expected to close later this month, subject to customary closing conditions. Headquartered in Windsor, Ontario, LSI Supply has five area locations and distributes bearings, seals, power transmission and fluid power components, and industrial supplies. Industries served include agriculture, automotive, food & beverage, marine, plastic injection, renewable energy and tool & die. LSI also provides maintenance supplies for the military and wastewater services. Jordan Sharpe, President of LSI said, “We are thrilled to join the Motion team and look forward to contributing to the company’s growth. With Motion, our offerings will be broader and deeper than ever, raising our customer service to new heights.” “This acquisition will broaden our leadership position in eastern Canada,” said James Howe, President of Motion. “LSI’s talent, offerings and markets complement Motion’s perfectly. The business culture is an especially good fit, which is critically important when joining forces and providing premier customer service. We look forward to welcoming LSI’s 30+ employees and creating significant opportunities for our teammates and supplier partners, which will increase value for our customers.”

CL&D opens new South Carolina Facility

CL&D’s new South Carolina facility, its second in the state, positions the company to increase its flexographic production capabilities to better serve customers. CL&D has announced the opening of its new facility located at 2020 Williams Industrial Blvd, Rock Hill, S.C. This new plant allows CL&D to increase its flexographic production capabilities, particularly thanks to the inclusion of its brand new 52” wide web press. “We are excited to add this new capacity and capability to CL&D’s portfolio,” said Mike Hokanson, General Manager, CL&D. “The additional capacity will serve our growing existing customers, as well as fuel our growth. The new wide-web capabilities opens up new markets and allows us to service our customers from small digital runs all the way to large quantities/sizes.” Notable capabilities offered from its new plant include: 52” high speed 10 color CI flexographic press with state-of-the-art print registration Turreted continuous solventless lamination Turreted high-speed slitting with automated unloading and loading High speed seaming with turreted unwind and rewind Notable products produced from its new plant include: Shrink sleeves Bundling film Cold seal and heat seal bar wrappers Pre-made Gusseted and Spouted pouches HFFS and VFFS pouches Stick packs This is CL&D’s second facility in Rock Hill, and fifth in total. CL&D has been converting film for nearly 50 years, handling a wide array of sizes and package styles of flexographic and digital print solutions. CL&D offers not only film converting, but also has a fulfillment service department for short-run products such as samples or trade show products. CL&D also boasts a comprehensive design and support team, to help customers develop their creative visions into a packaging reality. The opening of this fifth facility marks a milestone in CL&D’s journey of innovation and growth. CL&D’s dedication to providing its customers with high-quality film has led to its successes in the marketplace. This expansion reflects CL&D’s commitment to meeting the needs of its customers now and in the future.

H&E Opens New Branch in Frederick, MD

H&E Rentals announced the opening of its Frederick branch, the company’s third location in the state of Maryland. H&E has opened 27 new general rental branches across the country and acquired nine others since the second quarter of last year, and it operates in 32 states. The facility is located at 4820 Winchester Boulevard, Frederick, MD 21703-7444, phone 240-739-7800. It includes a fully fenced yard area, offices, and a repair shop and carries a variety of construction and general industrial equipment. “The location of our new Frederick branch gives H&E expanded coverage northwest of the Baltimore and Washington, D.C., metropolitan areas. We serve all of Western Maryland, along the Pennsylvania and Virginia state lines, as well as the northeast corner of West Virginia,” says Branch Manager David Roles. “H&E’s fleet is one of the youngest in the industry, and by having our Warrenton, Baltimore and Forestville branches within reach, we can source the reliable equipment customers need from an expanded line. Whether for a day, a week, a month, or a year, we will quickly deliver the right equipment for the job straight to the project site. We’re eager to show everyone how easy renting equipment can be and provide our signature higher standard of service.” The Frederick branch specializes in the rental of aerial lifts, earthmoving equipment, telescopic forklifts, compaction equipment, generators, light towers, compressors, and more and represents the following manufacturers: Allmand, Atlas Copco, Bomag, Case, Club Car, Cushman, Doosan, Gehl, Generac Mobile, Genie, Hamm, Hilti, Husqvarna, JCB, JLG, John Deere, Kobelco, Kubota, LayMor, Ledwell, Lincoln Electric, Link-Belt Excavators, MEC, Miller, Multiquip, Polaris, Sany, Skyjack, SkyTrak, Sullair, Sullivan-Palatek, Tag, Towmaster, Unicarriers, Wacker Neuson, Yanmar, and others. Founded in 1961, H&E is one of the largest equipment rental companies in the nation, providing a higher standard in equipment rentals. Branches are located throughout the Pacific Northwest, West Coast, Intermountain, Southwest, Gulf Coast, Southeast, Midwest, and Mid-Atlantic regions.

U.S. Rail Traffic Report for the week ending August 17, 2024

The Association of American Railroads (AAR) reported U.S. rail traffic for the week ending August 17, 2024. This week’s total U.S. weekly rail traffic was 516,819 carloads and intermodal units, up 8.0 percent compared with the same week last year. Total carloads for the week ending August 17 were 231,081 carloads, up 1.0 percent compared with the same week in 2023, while U.S. weekly intermodal volume was 285,738 containers and trailers, up 14.3 percent compared to 2023. Eight of the 10 carload commodity groups posted an increase compared with the same week in 2023. They included grain, up 5,861 carloads, to 21,651; chemicals, up 2,008 carloads, to 33,599; and petroleum and petroleum products, up 1,849 carloads, to 11,267. Commodity groups that posted decreases compared with the same week in 2023 were coal, down 7,409 carloads, to 62,194; and nonmetallic minerals, down 2,110 carloads, to 31,897. For the first 33 weeks of 2024, U.S. railroads reported a cumulative volume of 7,095,685 carloads, down 3.9 percent from the same point last year; and 8,523,136 intermodal units, up 8.9 percent from last year. Total combined U.S. traffic for the first 33 weeks of 2024 was 15,618,821 carloads and intermodal units, an increase of 2.7 percent compared to last year. North American rail volume for the week ending August 17, 2024, on 10 reporting U.S., Canadian, and Mexican railroads totaled 333,194 carloads, down 0.2 percent compared with the same week last year, and 367,264 intermodal units, up 11.6 percent compared with last year. Total combined weekly rail traffic in North America was 700,458 carloads and intermodal units, up 5.6 percent. North American rail volume for the first 33 weeks of 2024 was 21,843,479 carloads and intermodal units, up 2.4 percent compared with 2023. Canadian railroads reported 86,349 carloads for the week, down 4.6 percent, and 69,111 intermodal units, down 2.6 percent compared with the same week in 2023. For the first 33 weeks of 2024, Canadian railroads reported a cumulative rail traffic volume of 5,270,427 carloads, containers, and trailers, up 1.2 percent. Mexican railroads reported 15,764 carloads for the week, up 7.4 percent compared with the same week last year, and 12,415 intermodal units, up 49.1 percent. Cumulative volume on Mexican railroads for the first 33 weeks of 2024 was 954,231 carloads and intermodal containers and trailers, up 3.7 percent from the same point last year.

AutoScheduler.AI finalist in CSCMP 3Vs Business Innovation Award

Second Consecutive Year Being Named One of Three Finalists for 3V Awards AutoScheduler.AI has announced the company has been named a top 3 finalist in the 3Vs Business Innovation Awards. As a finalist, AutoScheduler.AI is one of the top three companies in the business innovation category, and it will present its case at the upcoming CSCMP Conference. “AutoScheduler.AI is honored to be named to this prestigious list for the second consecutive year,” says Keith Moore, CEO of AutoScheduler.AI. “This year we introduced AutoPilot Central, which provides a birds-eye view of multi-site data for centralized command and control of an entire distributed warehouse network, helping to mitigate the risk of not meeting customers’ fulfillment times, thus improving customer service and satisfaction.” According to an AGILE Business Media and Events announcement, “Due to the overwhelming number of exceptional entries, there was a delay in this announcement, and we apologize for the wait. After thorough deliberation, our panel has made their selections. We extend our heartfelt gratitude to everyone who submitted entries; each was truly innovative and impressive. With great excitement, AGILE now reveals the judges’ top finalists for both the 3 Vs Business Innovation Award and the Best Overall Startup Award contests. These companies captivated the judges and earned their positions through outstanding efforts.” AutoPilot Central gathers information from each WMS running AutoPilot and provides centralized warehouse orchestration where executives gain visibility across all sites. The AutoScheduler platform visualizes all operations at the distribution center, takes into account all warehouse constraints, applies advanced technology such as artificial intelligence and machine learning, and then optimizes labor, robotics, touches, and inventory to drive efficiencies. AutoScheduler.AI will present its pitch live in the Innovation Theater at EDGE 2024 in Nashville, on Monday, September 30, 2024, and winners will be announced for each contest.

Episode 513: Dock Doors and more with The Miner Corporation

On today’s episode of The New Warehouse Podcast, we discuss dock doors and more with Dennis Sanacore, Senior Vice President of Sales at The Miner Corporation. We cover the aspects of warehouse operations, focusing on dock doors and the innovative approaches to managing them. The Miner Corporation, a leader in industrial services, offers a unique perspective on enhancing operational efficiency through advanced dock solutions and proactive maintenance strategies. Innovative Dock Door Designs and Their Impact Modern warehouses face numerous challenges, but few components are as crucial as the dock door. Dennis Sanacore explains, “People think a door is a door, but in the business, there’s a uniqueness to every single application which causes challenges for customers.” The selection of dock doors varies greatly depending on the operational needs—whether it’s insulation requirements for climate control or durability for high-traffic docks. Introducing impactable doors and protective designs minimizes maintenance needs and boosts operational continuity. “Impactable doors are probably 2-3 times the cost of a regular sectional door, but they come with less maintenance and less downtime,” which Sanacore highlights as essential for maintaining flow and safety at the docks. How Dock Doors Impact Energy Efficiency A significant innovation in dock management is the focus on energy conservation and efficiency. Dennis notes the importance of adequately sealing dock areas to prevent energy waste, “We’ve come up with a couple of different programs… it’s going to save them 5 million a year. It will reduce emissions by 21,000 metric tons and save them $75,000 at that facility.” These programs promote sustainability and offer substantial cost savings, proving crucial for businesses looking to optimize their operational expenditure while enhancing their environmental impact. Dock Technology and Proactive Maintenance Looking ahead, Dennis discusses integrating data-driven solutions and proactive maintenance programs that are becoming more prevalent. “We’re trying to take maintenance to the next level by digitizing it,” he says, emphasizing their SafeCHECK app to streamline maintenance processes and prevent downtime. Such advancements are crucial for enhancing the reliability and efficiency of warehouse operations. Key Takeaways Impactable doors reduce maintenance costs and improve operational durability. Advanced sealing solutions can significantly cut energy costs and reduce environmental impact. Proactive, data-driven maintenance programs are essential for minimizing downtime and optimizing dock operations. The New Warehouse Podcast Episode 513: Dock Doors and More with The Miner Corporation

EDC announced recertifications in UL508 Panel Shop

EDC announces the ongoing certification achievements of its engineers in UL, Rockwell Automation, Siemens, Ignition, and other critical areas, highlighting their commitment to safety, security, and technical proficiency. Electronic Drives and Controls, Inc. has announced the UL508A recertification of Anthony Fasolo. The UL508A certification is an accreditation for industrial control panels which ensures that the panels meet comprehensive safety and performance standards set by Underwriters Laboratories (UL), a global safety science leader. UL508A-certified companies can mark a panel as UL-certified, a guarantee for clients that the panels used in their operations comply with the stringent requirements in safety, reliability, and quality. This reduces the risk of electrical hazards and enhances overall operational safety and reliability. Chuck Dillard, Vice President of EDC, emphasized the significance of the UL certification. “The UL508A recertification is a testament to our rigorous standards and commitment to delivering safe and reliable control panel solutions. This certification not only assures our clients of our technical proficiency but also demonstrates our adherence to the highest safety standards in the industry.” In addition to the recent UL508 recertification, EDC engineers have achieved and maintained certifications in Rockwell Automation, Siemens, Ignition, and CSIA, among others. Further information on these certifications can be found here. Ed Sefcik, Engineering Manager at EDC, elaborated on the importance of Rockwell certification. “Maintaining the Rockwell Automation certification keeps us current on any changes and ensures we maintain a high level of knowledge of those products.” He further added of the CSIA certification, “The CSIA certification process challenges our organization to deeply evaluate our processes, instilling discipline and promoting continuous improvement.” Among other things, CSIA certification ensures that clients receive full documentation and have access to system backups, providing peace of mind and reliability in their operations. Regarding safety and security certifications, Paul Rosato, EDC’s Safety Coordinator, stated, “There’s no mission greater than safety. We want our team to return home safely every day. This commitment to safety and conscientiousness is the foundation of everything we do.”

Caldwell names Mueller Regional Sales Manager

The Caldwell Group Inc. has hired Steve Mueller as regional sales manager. It is the second time the below-the-hook and material handling equipment manufacturer has hired to the role this year, having recruited Teddy Berman as its first ever hire as a direct employee in a territory in January. Mueller brings a wealth of experience to the position, including over two decades at Fastenal, a fasteners and industrial supplies distributor. He will be responsible for offering the full range of Caldwell products, in addition to Renfroe lifting clamps and RUD lifting points, to the Upper Midwest area, covering North Dakota, South Dakota, Minnesota, Wisconsin, and Northern Illinois. Mueller said: “Having spent 22 years [at Fastenal], I have a deep-rooted enjoyment of technical sales and supporting distribution, developed in a similar role that covered the same geography. The synergies between old and new roles are great. However, my focus is now firmly switched to in-the-field Caldwell representation. I will be supporting our distributors with end-user visits and participation in customer events while delivering product expertise across our broad range of equipment.” Darrin Noe, director of sales and marketing, said: “We were looking for someone to reinforce our connectivity with our distributors in the Upper Midwest and Steve is the perfect guy to re-hoist the Caldwell flag in the region. He has outstanding personality traits and combines them with a solid work ethic. Steve is personable, well-rounded, grounded, and easy to talk to. Throw in his extensive industrial knowledge and it’s a great recipe for success.” Mueller’s work will dovetail with Berman’s efforts in the Carolinas, Georgia, and Tennessee regions, where he also represents the full brand trifecta. As widely reported, Caldwell continues to hire to sales-focused positions, making sure distributors and end users find it easier to do business with the company than any other lifting manufacturer. Assembling the right team is a critical part of that mission, Noe emphasized.

H&E opens new Branch in Lufkin, TX

H&E Rentals has announced the opening of its Lufkin branch, the company’s 31st location in the Lone Star State and its ninth Texas branch added in the past two years. H&E now operates in 32 states, and it has opened 26 new branches across the country and acquired nine others since the second quarter of last year. The facility is located at 4530 US Highway 69 N, Lufkin, TX 75904-8971, phone 936-299-5800. It includes a fully fenced yard area, offices, and a repair shop and carries a variety of construction and general industrial equipment. “H&E’s expansion in East Texas makes it even easier for us to reach customers north of the Houston metro area and beyond. Our new facility covers Lufkin and stretches south toward Woodville and Lake Livingston, north to Rusk and Mt. Enterprise, west beyond Crockett and Palestine, and east to the Louisiana state line ― as well as all points in between,” says Branch Manager Randy Crawford. “With our established Longview, Conroe, and Bryan branches within reach, we can work together to source equipment from an expanded local fleet and quickly get it on the job site. We’re in a great position to take care of customers wherever their projects are.” The Lufkin branch specializes in the rental of aerial lifts, earthmoving equipment, telescopic forklifts, compaction equipment, generators, light towers, compressors, and more and represents the following manufacturers: Allmand, Atlas Copco, Bomag, Case, Club Car, Cushman, Doosan, Gehl, Generac Mobile, Genie, Hamm, Hilti, Husqvarna, JCB, JLG, John Deere, Kobelco, Kubota, LayMor, Ledwell, Lincoln Electric, Link-Belt Excavators, MEC, Miller, Multiquip, Polaris, Sany, Skyjack, SkyTrak, Sullair, Sullivan-Palatek, Tag, Towmaster, Unicarriers, Wacker Neuson, Yanmar, and others. Founded in 1961, H&E is one of the largest equipment rental companies in the nation, providing a higher standard in equipment rentals. Branches are located throughout the Pacific Northwest, West Coast, Intermountain, Southwest, Gulf Coast, Southeast, Midwest, and Mid-Atlantic regions.

GRI Expands US Operations with New National Sales Managers

GRI has announced the appointment of Cara Junkins and Jeff Cole as National Sales Managers for the United States. These strategic hires underscore GRI’s commitment to strengthening its market position and delivering exceptional value to customers in the North American region. Cara Junkins joins GRI with a distinguished 30-year career in the tire industry, holding leadership roles in engineering, marketing, and sales at prominent companies such as Continental Tire, Titan/Goodyear, US Autoforce, and Yokohama-TWS. Most recently, she served as the US Regional Manager for Trelleborg AG, Forestry, and AG Tracks. Junkins has a proven track record in building new markets, forging strategic partnerships, and driving sales growth while prioritizing customer satisfaction. “I am thrilled to join GRI, a company deeply committed to sustainability and offering an exceptional product line for today’s market,” said Junkins. “I look forward to leveraging my experience to contribute to the teams success and propel GRI to new heights in North America.” Jeff Cole, with 28 years of industry experience, joins GRI from Yokohama-TWS where he led the US and Canada Aftermarket Sales Teams for Material Handling and Construction Tires. His career encompasses a diverse range of roles across tire manufacturing, wholesale distribution, retail service centers, and the military sector. Cole has a history of cultivating strategic partnerships and implementing programs that enhance sales, efficiency, and customer experience. “I am excited to be part of GRI, a company at the forefront of sustainability in the tire industry,” said Cole. “I am eager to apply my expertise to drive GRI’s future success in North America.” “We are delighted to welcome Cara and Jeff to the GRI family,” said Ydo Doornbos, Director North America. “Their expertise and passion for the industry align perfectly with our vision to become a global leader in tire manufacturing. Their leadership will be crucial in accelerating our growth in the US and enhancing customer satisfaction.”

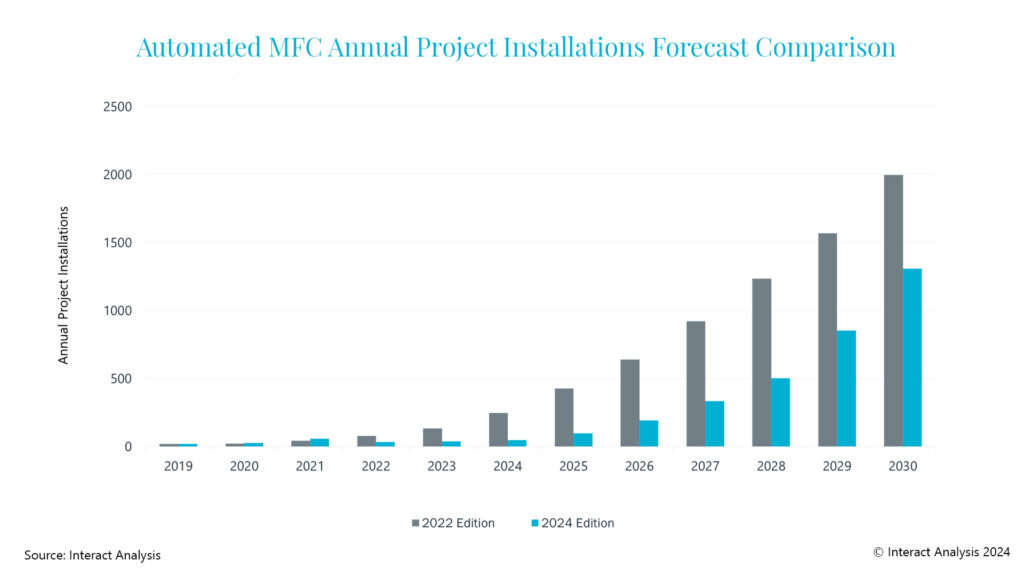

Automated Micro-Fulfillment Centers (MFCs) market needs to overcome challenges to reach forecast $3.5bn by 2030

Market challenges post-Covid – including rising living costs, project delays and bottlenecks – will need to be overcome in order for the sector to flourish. Opportunities for the automated Micro-Fulfillment Center (MFC) market are growing substantially over time due to the rising demand for shorter delivery times. Providing vendors address the barriers to adoption, the MFC market is projected to grow at a CAGR of 65% from 2023 to 2030, reaching over $3.5 billion annually by 2030. According to the latest report from Interact Analysis, the market for automated micro-fulfillment centers (MFCs) has witnessed a series of challenges to adoption. However, the market opportunity remains high. To reach widespread adoption, several barriers need to be overcome. Assuming these barriers are overcome, Interact Analysis expects the market could grow to an annual revenue of $3.5 billion by 2030. Nascent stages of growth Despite initially high expectations, deploying automated MFCs has faced several challenges that fit into two categories: productivity inhibitors and hidden costs. Productivity inhibitors include integrating manually picked items, with those selected by automation proving inefficient, reducing overall system throughput. Advancements in manual in-store fulfillment software have also narrowed the ROI gap, diminishing the appeal of automated solutions. Additionally, macroeconomic factors, such as rising living costs, have also encouraged consumers to favor in-store shopping over delivery services, further dampening demand. Furthermore, hidden costs like construction delays and process refinements – along with productivity inhibitors like bottlenecks in the consolidation of manually picked items and MFC replenishment – have also negatively impacted ROI, making the adoption of automated MFCs less attractive. These barriers to adoption must first be addressed. If they aren’t, the number of MFC deployments will be lower than expected. Addressing the barriers to adoption As part of the research process, Interact Analysis identified several key strategies MFC vendors should adopt to address the previously mentioned barriers to adoption. These include sophisticated fulfillment software, flexible and scalable automation solutions, effective pricing models, and many others. To address the barriers to adoption discussed above, vendors must be able to provide expansive fulfillment software. Online grocery fulfillment is complex and involves the processing of orders, quickly. Automated MFC’s offer the capability to integrate hardware, software, and human labor to solve these logistical challenges efficiently. Flexibility and scalability are also key. Automation solution providers must be able to provide solutions that cater to different facility sizes while ensuring that they enhance the ROI for retailers. The level of complexity of the solutions must also be considered. Retailers want to be able to install the solution without the need to spend time and money training workers. Many automation providers have successfully done this by having user-friendly interfaces installed on the technology. What does the future hold for MFCs? Overall, the market for Automated Micro-Fulfillment Centers (MFCs) is projected to experience significant growth, with a forecast compound annual growth rate (CAGR) of 65% from 2023 to 2030, reaching a market size exceeding $3.5 billion annually by 2030. In 2024 alone, Interact Analysis predicts that grocers will spend $18.5 billion on store labor for online order picking. By comparison, the total warehousing sector will spend ~$180 billion on labor, meaning that grocery in-store fulfillment labor cost equates to 10% of the total warehouse labor costs. The market is witnessing a bifurcation, with smaller sites for convenience orders and larger sites for weekly shop orders. As a result, technologies such as mobile AS/RS, shuttle AS/RS, and ultra-high-density storage systems are expected to play a significant role in fulfilling weekly shop orders, while nanofulfillment solutions are primarily going to be used in the fulfillment of convenience orders. Labor is generally still being used for manual in-store picking but the total addressable market for MFCs through localized fulfillment is increasing. Overall, the e-commerce market value for localized fulfillment is expected to increase from $1.9bn in 2023 to $4.4bn in 2030. This is mainly driven by the grocery segment but also other verticals such as healthcare and general merchandise due to the demand for shorter delivery times. Rowan Stott, Research Analyst at Interact Analysis, comments: “The market is in its early stages of growth, with several barriers to adoption in the MFC industry that haven’t been addressed yet by vendors. We believe that addressing these will be the most important factor in determining future growth. “Overall, the automated MFC market is poised for substantial growth, driven by the increasing demand for localized fulfillment and advancements in automation technologies. As major retailers continue to invest in these solutions, the market is set to rapidly expand, offering significant opportunities for vendors and stakeholders in the industry.” About the report Over the years, we’ve developed and refined our view of what micro-fulfillment is and how to define it. We’ve come to the conclusion that micro-fulfillment is less about the size of the facility, but rather more about the radius of delivery. As such, the scope of this report is constrained by delivery radius, rather than facility size. In addition to providing a wealth of granular market data, this report will also explore what the biggest barriers limiting the uptake of micro-fulfillment centers, along with the key attributes that retailers are looking for when selecting an automation partner.

Kito Crosby enters into agreement to acquire eepos GmbH

Innovative light, flexible, and ergonomic crane systems for safer and more productive workplaces, further expanding and enhancing Kito Crosby’s installed lifting solutions offering Kito Crosby has announced that it has agreed to acquire eepos GmbH (“eepos”) and its subsidiaries, renowned for their aluminum light crane systems. The acquisition is expected to be finalized in the third quarter of 2024. Founded in 2006 in Wiehl, Germany, eepos has introduced flexible lifting solutions to workplaces worldwide. Focusing on the development of modular, smooth-running cranes made from lightweight aluminum, eepos has become a ubiquitous brand in ergonomic lifting solutions, with a significant global presence including subsidiaries in the US, Mexico, Brazil, Hungary, Turkey, France, South Africa, China, and India. eepos will join Kito Crosby’s expansive portfolio of installed lifting solutions, including the Kito, Harrington, and Erikkila brands. This extensive portfolio provides turnkey lifting solutions across a wide range of applications and industries. Additionally, the acquisition furthers Kito Crosby’s presence in the attractive manufacturing sector as well its leadership in ergonomic solutions enabling safer working practices for workers globally. Robert Desel, CEO of Kito Crosby, stated, “As an innovative leader in modular crane systems, eepos perfectly complements and expands our installed lifting solutions portfolio. The eepos team shares our core values and we are thrilled to welcome them to Kito Crosby and extend our employee ownership program to all eepos employees.” Bastian Schoenfeld, CEO of eepos, remarked, “We are proud to embark on our next journey with Kito Crosby. Both companies share a passion and commitment to manufacturing excellence and customer satisfaction and we look forward to this next chapter together.” Volkhardt Mücher, Chief Sales Officer of eepos and Michael Hindenberg, Chief Technical Officer of eepos, added, “By leveraging Kito Crosby’s global footprint, commercial, and technical teams, we will be able to accelerate our mission and commitment to safe and ergonomic lifting solutions for workers worldwide.”

ASSP recruiting presenters for Safety 2025 in Orlando

The American Society of Safety Professionals (ASSP) is seeking a diverse group of occupational safety and health professionals to present at the Safety 2025 Professional Development Conference and Exposition in Orlando. The submission deadline is Sept. 11. Safety 2025 – scheduled for July 22-24 at the Orange County Convention Center – will be attended by more than 6,000 occupational safety and health professionals looking for solutions to today’s workplace safety challenges. Industry experts share best practices that can help protect workers and enhance business operations in every industry worldwide. ASSP’s call for presenters involves one-hour concurrent sessions that focus on business and leadership skills, fall protection, risk assessment and management, prevention through design, standards, emergency action plans and many other topics. Prospective speakers must identify emerging issues, develop strategies for overcoming safety challenges and aim to expand attendee knowledge and professional skills. “It’s a terrific opportunity for safety and health experts to contribute to the development of their colleagues while advancing our industry,” said ASSP President Pam Walaski, CSP, FASSP, who has been a conference speaker every year since 2005. “Being a safety presenter is truly a rewarding experience.” ASSP members serving on the Society’s Conference Planning Committee will evaluate all speaker proposals against the following criteria: Degree to which the session meets ASSP’s education objectives. Interest and need for the topic within the occupational safety and health profession. Speaker’s presentation skills and experience. Interested presenters must submit a separate application for each session, with a maximum of two proposals. Please direct questions to ASSP’s professional development team at PDCspeaker@assp.org. Session proposals for Safety 2025 must be submitted online by Sept. 11. ASSP will notify successful applicants through email by the end of February.

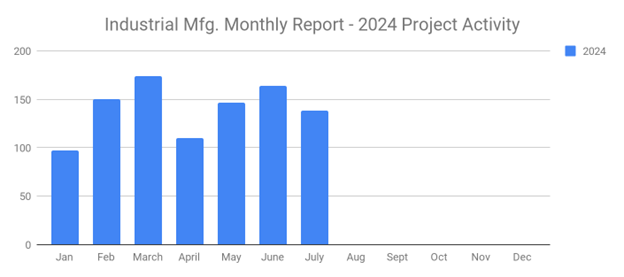

Summer slowdown hits in July 2024 with 138 new Industrial Manufacturing Planned Industrial Projects

SalesLeads has released the July 2024 results for the new planned capital project spending report for the Industrial Manufacturing industry. The Firm tracks North American planned industrial capital project activity, including facility expansions, new plant construction, and significant equipment modernization projects. Research confirms 138 new projects, compared to 164 in June. The following are selected highlights of the new Industrial Manufacturing industry construction news. Industrial Manufacturing – By Project Type Manufacturing/Production Facilities – 121 New Projects Distribution and Industrial Warehouse – 73 New Projects Industrial Manufacturing – By Project Scope/Activity New Construction – 54 New Projects Expansion – 36 New Projects Renovations/Equipment Upgrades – 54 New Projects Plant Closings – 12 New Projects Industrial Manufacturing – By Project Location (Top 10 States) Texas – 11 Ohio – 9 Indiana – 8 Illinois – 7 Michigan – 7 Pennsylvania – 7 California – 6 Georgia – 6 Massachusetts – 6 Ontario – 6 Largest Planned Project During the month of July, our research team identified 27 new Industrial Manufacturing facility construction projects with an estimated value of $100 million or more. The largest project is owned by Substrate, Inc., which plans to invest $108 billion in constructing a three million-square-foot manufacturing complex in BRYAN, TX. Substrate is currently seeking approval for the project. Top 10 Tracked Industrial Manufacturing Projects MISSOURI: A federal agency plans to invest $3 billion to expand its nuclear weapon component manufacturing complex in KANSAS CITY, MO, by 2.5 million SF. Construction will occur in multiple phases, with the completion of the 1st phase slated for Summer 2026. TEXAS: A federal agency plans to invest $1.4 billion in constructing a semiconductor manufacturing and office campus at the University of Texas in AUSTIN, TX. They are currently seeking approval for the project, which will occur in two phases. VIRGINIA: Industrial wire and cable MFR. plans to invest $681 million in constructing a 750,000 SF manufacturing and warehouse facility at 1213 Victory Blvd. in CHESAPEAKE, VA. Construction is expected to start in early 2025 and complete in early 2028. OKLAHOMA: Solar panel component MFR. plans to invest $620 million in constructing a manufacturing facility at Tulsa International Airport in TULSA, OK. They are currently seeking approval for the project. Construction is expected to start in late 2024, with completion slated for 2026. CALIFORNIA: A steel fabrication company plans to invest $540 million to construct a 551,000-square-foot manufacturing and warehouse complex on Sopp Rd. in MOJAVE, CA. They are currently seeking approval for the project. GEORGIA: Tire Manufacturing Company is considering investing $500 million to construct a manufacturing facility and is seeking a site in Georgia. Watch SalesLeads for updates. MICHIGAN: Automotive MFR. plans to invest $500 million for the renovation and equipment upgrades on their manufacturing facility at 920 Townsend St. in LANSING, MI. They are currently seeking approval for the project. KENTUCKY: Automotive MFR. is planning to invest $400 million in constructing a manufacturing facility in SHELBYVILLE, KY, and is seeking approval for the project. NORTH CAROLINA: Medical device MFR. plans to invest $400 million in constructing a 550,000 SF manufacturing, warehouse, office, and training campus at 1911 Old Creek Road in GREENVILLE, NC. Construction is expected to start in Fall 2024 and be completed in late 2026. ILLINOIS: Automotive mfr. plans to invest $334 million in renovation and equipment upgrades at its manufacturing facility in BELVIDERE, IL. It is currently seeking approval for the project. About Industrial SalesLeads, Inc. Since 1959, Industrial SalesLeads, based in Jacksonville, FL, is a leader in delivering industrial capital project intelligence and prospecting services for sales and marketing teams to ensure a predictable and scalable pipeline. Our Industrial Market Intelligence, IMI, identifies timely insights on companies planning significant capital investments such as new construction, expansion, relocation, equipment modernization, and plant closings in industrial facilities. The Outsourced Prospecting Services, an extension to your sales team, is designed to drive growth with qualified meetings and appointments for your internal sales team. Visit us at salesleadsinc.com.

The Warehouse Automation Journey: Moving from understanding to action

When writing our book The Warehouse Revolution – Automate or Terminate, we were committed to creating a comprehensive overview of the warehouse automation space. We knew a rapidly growing number of companies were soon to embark on a challenging journey, yet they had no way to get up to speed quickly. Since its publication, and after multiple conversations with readers and corporate leaders, they most commonly ask: “Ok, now I understand the context and the technologies, but how do I turn it all into action?” For the last ten years, Logistics, Warehousing, and Supply Chain operations have been severely strained and continue to be today. Some of this strain can be attributed to episodic events like the pandemic, geopolitical conflicts, or recent disturbances in significant trading routes. The main cause, however, has been a permanent transformation of the role that supply chain operations play in the global economy and, more directly, in company business performance. On the distribution side of logistics, e-commerce has changed the business metrics by which logistics centers and professionals are measured. Order fulfillment lead time and order accuracy measurements replace shipping volume and cost per shipment metrics. We have gone from order lead times of weeks or even months to hours. On the supply side, just-in-time manufacturing has reduced in-transit inventory quantities, which, combined with globally stretched supply chains, result in very fragile supply lines. To compound the problem, qualified labor has become scarcer, more expensive, and less attainable where it is needed most, near large urban areas that drive the need for shorter shipment and distribution times. Despite the increased use of air freight, the speed at which we can transport goods economically has not improved enough. In the case of distribution, improvements in physical speed have been negligible. The nodes in the supply chain (ports, distribution, and fulfillment centers) bear the brunt of the needed changes. Industry leaders are applying a blend of automated equipment and advanced information systems to tackle these challenges. It used to be the case that executives could tolerate suboptimal performance of their supply chains without putting their company’s survival in danger. This is no longer the case. If shipping times or order accuracy are uncompetitive, customers will go elsewhere. Even minor hiccups in supply chains may result in production disruptions that break commitments or impair product availability. In The Warehouse Revolution, we discuss the case for automation in detail and describe the many processes and technical options that should be focus areas for companies of all types and sizes. The risk and complexity of automation may be daunting for many small- and medium-sized businesses. Breaking down the components of risk is critical. To achieve this and ultimately address the risks, it is crucial for companies to execute multiple non-trivial, internal sub-projects: 1. Operational Process Assessment: Once the operation crosses a threshold of volume and complexity, logistics and material handling systems show behaviors that are difficult to understand and predict without the help of sophisticated analytics and optimization tools. Identifying bottlenecks, the impact of order mix in volume, determining multi-product and multi-echelon inventory policies, order release, batching, etc., requires specialized knowledge and non-trivial effort. 2. Technology Assessment: By their very nature, material handling projects deal with the intersection of the physical world with the information world. They require expertise in building construction, including fire and other regulations, mechanical equipment and layout, electrical power, electronics and communications, real-time and enterprise software, human factors, and ergonomics. Technology in all these disciplines evolves rapidly and needs to be selected, applied, and integrated together. 3. Project Execution Assessment: No individual or small team can master all required technologies, and very few organizations can either. Professionalized project and program management becomes a critical element in the success of these projects. In many cases, this capability is provided by the project’s primary systems integrator. Only very large companies implement a sufficient number of projects over time to justify the development of this capability in-house. 4. Organizational Change Assessment: Even projects with stellar design and execution will fail if the organization that needs to implement them is not ready or is unwilling to embrace them. In extreme cases, some even suffer from active sabotage. Organizational communication, training, and change management cannot be ignored or relegated to an HR topic. They need to be an integral part of the project. While these challenges are very real, they are not insurmountable if appropriately addressed, but the investment required will be significant, and the executive team must understand the associated ROI clearly. The ROI may be realized by reducing the overall operating costs or enhancing revenues. Cost reduction is by no means a certain outcome of an automation project. The real effect of automation projects is a change in the operation’s cost structure. There will be a shift from variable costs associated with direct hourly labor to indirect costs based on a combination of financial investments, equipment maintenance, operational expenses, and salaried labor. This means that the per-unit costs before and after the project depend heavily on the volume at which the system will perform. Lower volumes favor an operation with a more variable cost structure, while higher volumes can more easily justify a larger investment. It is essential to consider how costs change if the volume begins to exceed an operation’s capacity. The change may be incremental in less automated operations and addressed with overtime or extra labor. For automated operations, the limits to the system may be much more strict and require upgrades or significant reconfiguration of the system. Executives and project leaders must determine the performance profile of the operation (order and item variability, volume, etc.) and decide on its design capacity. As shown in the figure taken from the book, the capacity may differ significantly from the simple average of expected volumes. On the revenue front, apart from the apparent effect of capacity increases to support more business, automation can improve customer satisfaction by increasing order accuracy, reducing order lead time, and making order fulfillment

Isn’t it time to differentiate equipment and parts sales?

In one of my past editions, I shared that dealers sometimes struggle to differentiate the role of an equipment sales rep and the role of a customer service sales representative. Too often, I see these positions rolled up into one function, and I believe these roles should always be separate functions and separate salespersons. Where an equipment salesperson’s objectives are the targeting and identifying of new equipment opportunities, along with quoting and selling of new/used equipment, if they are also tasked with selling service agreements, aftermarket parts, and providing service support, that could lead to not having enough focus on one function over the other. I believe having dedicated customer service sales representatives will allow your dealership to provide focused and professional aftermarket parts support, along with dedication to targeting and obtaining service agreements and upselling service repair quotes. Success as a customer service sales representative hinges on a blend of interpersonal skills, strategic sales acumen, and knowing your product and service offerings while staying abreast of industry trends. Let’s explore some of these skills and areas of focus. Develop and Nurture Customer Relationships First and foremost, building and maintaining strong relationships with customers is the foundation of success in this role. This is accomplished most effectively through frequent on-site visits to customers’ locations. These interactions foster trust and loyalty, setting a foundation for long-term partnerships. Listening actively and responding empathetically to customer needs and complaints is essential in efficiently resolving product or service issues, ensuring your customers are satisfied and expectations are met. Whether promoting service agreements or safety programs, delivering products, or handling follow-up visits on PM services, the customer service sales rep should strive to exceed customers’ expectations by providing exceptional service and support at all of your dealership’s customer experience touchpoints. When targeting new business, the initial contact with a prospective customer should be personable and professional while demonstrating genuine interest in their company. They should follow up consistently with valuable information or assistance rather than just sales pitches or spamming them with sales and product literature in their email inbox. This approach will help establish trust and demonstrate their commitment to the success of the prospective customer’s business. CRM Systems and Communication Effective communication is another cornerstone of success in this role. The ability to effectively communicate through various channels, including phone, email, and face-to-face meetings, will help them stay connected and responsive to your customer’s needs. Your customer service sales representatives must be adept in verbal and written communication as they will be tasked with preparing and presenting proposals, quote recommendations, and presenting and promoting new products and service offerings. Additionally, these customer service sales reps should display confidence and persistence in their communications, especially when it comes to new business development in cold calling prospects. This effort is vital for promoting your dealership’s services, parts, aftermarket and allied products, and rental offerings. Ask your customer service sales representatives if they know your dealership’s value proposition and if they can articulate it clearly and persuasively to convert prospects into loyal customers. CRM systems are essential for managing itineraries, call reports, prospecting activities, and maintaining accurate customer records. Keeping detailed records of customer interactions and follow-ups ensures no opportunity is missed and each customer receives proper attention. Accurate CRM management keeps customer information current and accessible, facilitating better service and follow-up. In my opinion, the effectiveness and use of your CRM systems will determine the success of your customer service sales representatives. Furthermore, working closely with your dealership’s equipment sales representatives and other departments is essential to covering the territory effectively as a customer service sales representative. This collaboration is made possible if all departments within the dealership are on the CRM and will help you provide a seamless experience for your customers, demonstrating that your dealership is a valued partner to your customers. Product and Industry knowledge Your customer service sales representatives should know or be provided the training to understand forklift maintenance and repair. This is crucial for building credibility and trust with customers and prospects. They must be prepared to answer technical questions and provide informed advice to your customers. You should provide continuous professional development for your customer service sales representatives by having them participate in OEM product training, other personal development programs, and industry training. Keeping abreast of industry trends and advancements will ensure they remain a valuable resource to your customers. Be a ‘student of the industry!’ Understanding what your competitors offer and identifying their strengths and weaknesses allows your customer service sales representative to position your dealership more effectively. As stated earlier, clearly articulating what sets your dealership apart, whether it’s superior service, competitive pricing, or comprehensive support, is essential for your customer service sales representatives, especially regarding attracting new business. To excel at your dealership, your customer service sales representatives must take a strategic approach to customer relationships, effectively use CRM systems, and collaborate seamlessly with team members and other departments. By prioritizing customer satisfaction, staying updated with industry trends, and continuously improving through professional development, you can significantly grow sales volume and establish your dealership as an indispensable partner for your customers. About the Author: Chris Aiello is the Business Development Manager at TVH Parts Co. He has been in the equipment business for 17-plus years as a service manager, quality assurance manager, and business development manager. Chris now manages a national outside sales team that sells replacement parts and accessories in various equipment markets, such as material handling, equipment rental, and construction/earthmoving dealerships.

As the rental, financial and technology markets change, is your dealership?

Much is going on that impacts OEMs, Equipment Dealers, Financing Sources, and Customers. Inflation, supply chain disruptions, and geopolitical tension lead to cautious customer behavior, thus creating new levels of management manipulation to keep the ships upright. In addition to these significant disruptive sources, you add the risk associated with technology decisions, not only for your company but also for a high percentage of your customer base familiar with emerging technologies. Here are just a few concerns dealers have on their minds: Revenue per employee Tariffs Tax opportunities Overtime Regs On-shoring Near-shoring AI and IT for manufacturers AI and IT for warehouse and distribution centers Having products and services to fit the needs of manufacturers and distributors Finding other programs and methods to increase sales. Providing consulting services to customers. Emerging Technology Electrification Hydrogen cells Inventory changes and management. Supply chain disruption Collateral value of equipment Planning for rental income to represent a higher % of sales. Resale value uncertainty Bank and Financial source education Programs to find and keep personnel Cybersecurity threats Supply chain management Need for more dealer consolidation Quarterly cash flow requirements Cap-X for AI, IT, and customer consulting And I am sure you are also trying to hire to fill talent needs throughout your organization. And how about those equipment prices? Used values are falling, leaving you with the problem of having high-priced pandemic units now dropping in price and a collateral problem with the banks. And let us not forget the new elephant in the room….AI. Making an AI decision can be high risk if you do not know what you are doing, so MHW is premiering a new column next month to help with the process. And as far as your sales silo is concerned, you will be adding new accounts to track new types of equipment, including automated guided vehicles, and different types of fuel sources being offered, such as electric trucks using lithium-ion batteries as well as hydrogen fuel cells. We can all agree that customers will look to YOU to provide insight into what type of unit best fits their needs. I have heard hydrogen is growing its market share because it is cheaper and avoids the “green costs” associated with mining and disposing of lithium. All these issues have produced some interesting discussions with bankers. CEO and shareholder anxiety must be the name of the game regarding the balance of 2024. As I have said in the past, if you are not ready or able to roll with the punches and make the investments necessary to stay in the game, it may be time to investigate transitioning out of the industry. Consolidation is taking place in all types of markets, with equipment dealers and rental companies appearing in every business publication I read. One final option before pulling the plug is to find and hire a manager prepared to deal with the issues at hand. On the FINANCING side of the business, banks and finance companies are having their own problems because many customers are experiencing cash flow challenges, resulting in payment delays to either the bank or dealer. Credit risks are also increasing because of economic uncertainty affecting dealers and customers. Having numerous financing sources available is a must for today’s markets. Financing sources are asked to finance unfamiliar new types of equipment for both the dealer and customers. Lenders must contend with the value of what is currently on their balance sheet instead of financing new equipment types with which they have zero history of working. Consequently, dealers should prepare examples of the expected values of the equipment over at least a five-year period. Dealers should prepare an annual equipment appraisal covering used equipment inventory and rental units. I also suggest you track the sales of your used equipment and compare the sales price to what appears in the valuation report. If you can show the bank that you are selling used equipment for more than what appears in the valuation report, the bank will rely more on the report when considering your credit requests. Remember that many buyers are waiting for interest rates to be reduced before purchasing new or used equipment. If so, sales will be deferred, reducing the cash flow to finance the business. I see that rental activity is increasing rather than purchasing units, eventually impacting dealer cash flow and borrowing capacity. Dealers will have little say in how all this works out. Changes in emerging technology and advancements in warehouse automation and shop floors will dictate what lift truck dealers must provide. The trick will be eliminating the old, bringing in the new, and becoming more efficient using the latest technology and AI (if it works for you). Cash flow schedules incorporating these changes should be adjusted and updated quarterly to stay ahead of the game—notice I said cash flow schedules, not budgeting worksheets. In the end, the revenue silos will produce less profits and cash flow, and dealers need to be prepared to deal with this situation. On the other hand, you may be selling more technical equipment and systems that make up for reductions in other sale categories. Change is coming faster than you think. Be prepared to produce a company ready to provide products and services and consulting to the ever-changing manufacturing and distribution world you will be living in. About the Columnist: Garry Bartecki is a CPA MBA with GB Financial Services LLC and a Wholesaler columnist since August 1993. E-mail editorial@mhwmag.com to contact Garry.