Cyclonaire welcomes Corey Egger as Business Development Manager – Mineral Sector

Cyclonaire has announced the addition of Corey Egger to the Business Development team, following a comprehensive search for a seasoned

Cyclonaire has announced the addition of Corey Egger to the Business Development team, following a comprehensive search for a seasoned

New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For

Arnold Magnetic Technologies Corporation (Arnold), a subsidiary of Compass Diversified and a global manufacturer of high-performance magnets and precision thin

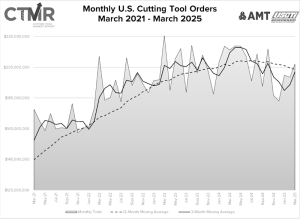

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association

New facility to accelerate growth and streamline processes in electric forklift production, solidifying the company as a leader in material

PLASTICS president and CEO Matt Seaholm issued the following statement regarding the Trump Administration’s implementation of tariffs on Canada, Mexico,

Fourth quarter and full year 2024 diluted EPS of $1.22 and $8.46, respectively. Fourth quarter and full year 2024 net

Innovative Solution for streamlined production and flexibility across industries Wauseon Machine highlights its Redeployable Automation Module, a transformative solution designed

Consolidated net earnings attributable to Nucor stockholders of $249.9 million, or $1.05 per diluted share Adjusted net earnings attributable to

The new location as an anchor of Summit Place in West Allis signifies growth and enhanced collaboration while maintaining strong

Nucor Corporation announced consolidated net earnings attributable to Nucor stockholders of $645.2 million, or $2.68 per diluted share, for the

NPE2024: The Plastics Show announced its final registration and paid exhibit space results, totaling 51,396 registrants and 1,106,767 square feet, respectively. Held from May 6-10

The RNC has sourced a local Milwaukee-area manufacturer, Wildeck, Inc., to provide structural steel platforms supporting media team members and

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing

Visit Booth #215 to connect with a Wauseon expert and find your next manufacturing solution Wauseon Machine, Inc. (WM) announced

New Age Industrial, a designer and manufacturer of aluminum storage and transport, has announced the retirement of Bob Brackle, National

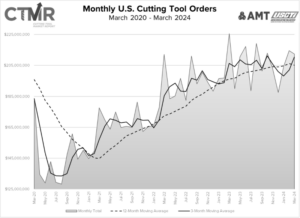

March 2024 U.S. cutting tool consumption totaled $212.4 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT –

Recognizing Exceptional Leadership in the Automation Industry Wauseon Machine announced that Chief Revenue Officer (CRO), Joe Gemma, was awarded the

Net earnings attributable to Nucor stockholders of $844.8 million, or $3.46 per diluted share Net sales of $8.14 billion Net