Nucor announces Plate Mill Group reorganization

Nucor Corporation announced today that it will reorganize the Company’s plate group, including ceasing production at Nucor Steel Longview, LLC.

Nucor Corporation announced today that it will reorganize the Company’s plate group, including ceasing production at Nucor Steel Longview, LLC.

Net earnings attributable to Nucor stockholders of $1.14 billion, or $4.45 per diluted share Net sales of $8.71 billion Net earnings before noncontrolling interests of $1.23 billion;

One of the largest U.S. manufacturers of industrial steel work platforms (mezzanines), material lifts, safety guarding, and access products has

TAB Wrapper Tornado allows Penn sheet metal to wrap long pallet loads fast Metal fabrication company Penn Sheet Metal, Allentown,

Nucor reports the safest and most profitable year in Company history, eclipsing prior records set in 2021 Fourth quarter and

The new machine improves product quality and increases production capacity Bison Gear & Engineering Corp., a provider in the power

TerraSource Global, a manufacturer of high-quality material sizing equipment based on the Gundlach, Jeffrey Rader, and Pennsylvania Crusher brands, and

The U.S. plastics industry continued to grow in 2022 against the backdrop of weaker domestic and global economic growth. Data

Nucor Corporation announced that California Steel Industries, Inc. (CSI) will build a continuous galvanizing line at its mill in Fontana,

October 2022 U.S. cutting tool consumption totaled $200.6 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT –

Nucor Corporation announced today that Noah Hanners will be promoted to Executive Vice President effective January 1, 2023. Mr. Hanners began his

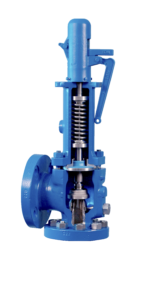

New Crosby Balanced Diaphragm and Bellows leak detection pressure relief valve solutions improve performance, safety, and reliability while reducing emissions

New orders of manufacturing technology totaled $457.7 million in October 2022, according to the latest U.S. Manufacturing Technology Orders Report

Nucor Corporation has announced that it has made an equity investment in Electra, a Colorado-based start-up developing a process to

The acquisition is Millwood’s second Waverly, OH location Millwood, Inc. acquired its second location in Southern Ohio and 35th location

Say hello to ChIP, Custom Industrial Product’s newest addition to its family! ChIP acts as the brand ambassador for Custom

Diversified Plastics, Inc., an international rotational molder based out of Latta, South Carolina, announces that their Business Development Manager, John

The shipments of primary plastics machinery (injection molding and extrusion) in North America slowed in the third quarter according to

Developing homegrown leaders is one of the most important things companies can do to pave the way for continued success.

Orbital wrapping machine manufacturer TAB Industries, LLC, Reading, Pa.has increased the amount of component parts that are “Made in USA”