Steady Hands in Shifting Sands: Maintaining Your Dealership’s Edge

In the September issue, we typically cover the latest developments in finance, rental, and leasing, providing input that dealers can

In the September issue, we typically cover the latest developments in finance, rental, and leasing, providing input that dealers can

The Federal Reserve held the federal funds rate steady at a target range of 4.25% to 4.5% for the fifth

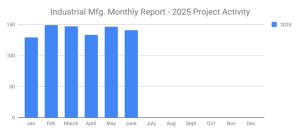

Industrial SalesLeads has announced the June 2025 results for its new planned capital project spending report, highlighting the continued strong

Last month, I opened a discussion changing the way a dealer accounts for daily, monthly, and annual financial activity, switching

Business inventories across the U.S. were unchanged in May, according to the Commerce Department’s latest report, marking a second month

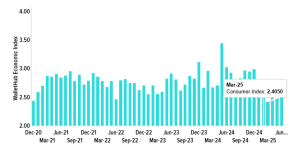

The WalletHub Economic Index decreased by 13% between June 2024 and June 2025. This means consumers are less confident about

I know I am as guilty as anyone of stating that CASH IS KING. Must have included that statement at

The Equipment Leasing & Finance Foundation (the Foundation) releases the June 2025 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall,

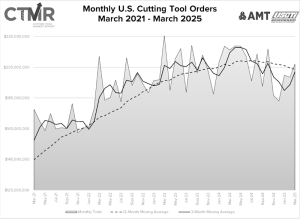

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association

The recent wave of tariffs and other trade controls has created radical uncertainty for businesses. Here’s how decision-makers can best

I talked with Jim Margner (my state and local tax expert), who prepared notes for the Illinois Equipment Dealers Association

New name reflects broadened financial offerings and corporate development OnPoint Capital has announced that it has completed its company name

Our financial world seems out of whack and will probably continue to be for the rest of the year. This

Last month, we covered performance gaps and how to avoid them because if you cannot prevent them, there is a

Last month, we covered performance gaps and how to avoid them because if you cannot prevent them, there is a

As you know, I love to review business and industry data daily. I probably read 100 emails daily and receive

Profit-sharing plans (PSPs) have been around for decades. Employers may use them to attract and retain workers and incentivize employee

Today, the Federal Reserve announced that it would hold benchmark rates at a target range of 4.25% to 4.50% in

I hope you had a splendid holiday week! There certainly were plenty of football games to watch. Besides a wicked

The Equipment Leasing & Finance Foundation (the Foundation) releases today’s December 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Overall, confidence in