Pricing and Profits

Ahhhh, the age-old dilemma that has become part of every type of business, especially dealers. Never goes away and becomes part of every sales meeting whether it is on the agenda or not. And that topic would be PRICING. What got my attention about pricing recently is an article written by April Maguire titled “Name Your Price” which covers every type of pricing scenario available and then some. It also contains some thought on “Setting the Right Price” considering Cost, Customer types, Competition and Tiered Pricing. It appeared in www.procontractorrentals.com. Although the article is not directly geared towards dealers the concepts discussed fit each and every business out there that needs to negotiate pricing, and I can’t think of many that don’t Digging a little deeper into price negotiations a business owner must consider how much aggressive pricing is hurting the bottom line. Or is it? Do you really know what impact your pricing strategy is having on profits and cash flow? Aggressive pricing is normally used to increase market penetration or attract more from current customers to increase the top line. Initially, aggressive pricing may be financially unsound if you have substantial fixed costs to hurdle over. You know how it goes, you must cover fixed costs and then variable costs to generate a profit, and normally a successful pricing program will accelerate growth and fixed cost coverage and generate higher profits. You have probably experienced this scenario many times in your life with Amazon being a prime example of how this strategy works. On the other hand, competitive or aggressive pricing which is thought to reduce margins, may not reduce margins at all. Maybe the pricing strategy currently being used produces above average margins because the other component of the transaction is being properly managed and planned for, with the other part of the transaction being COST, which in this environment is decreasing because of technology and other methods of efficiency. Let’s see if we reduce revenue by reducing pricing and costs have been reduced more than the price reduction….you wind up with more margin dollars, especially if overall sales dollars increase from the current level. Applying new technology and efficiency is a must for every business. For certain companies it may be a simple and cost-effective change. For more technical and large projects, it could be considerably more expensive requiring expert implementation of new systems and procedures. The former providing a short payback cycle, the latter a longer payback period requiring constant supervision to meet goals. So here I am writing this when a perfect example of the variables and how they work together to produce above average profit jumps out right in front of me. I was in the market for new gutters and leaf guards for a house in Wisconsin, and went through the process of interviewing various vendors to discuss products and pricing. Before these meetings took place, I spent some time searching the web to get current pricing for the materials and labor for this type of project. After taking to four different companies I selected one that met the “web” pricing along with a nice product line. The “winner” sent out an experienced estimator who provided pricing in about 15 minutes. We were instructed to contact dispatch to set a date and time for the work. So far all very efficient. I signed the bid on August 9th and the work was completed on August 20th. And I can tell you this would not have been the case with the other vendors. I couldn’t help myself and had to think how my chosen vendor could make a dollar with the pricing they gave me …. especially when compared to the other vendors. Well let me tell you how. Dispatch called and said they would be there at 9am and this was 8 am when they called. At exactly 9am a white school bus with an extension on it (this was a BIG bus) with the name Pinnow Sheet Metal, Inc. from Oshkosh Wisconsin pulls up. Once parked five people came charging out the front door and are on the roof within 60 seconds confirming the gutter measurement and tearing the down the old gutter system. Person on roof measures and yells to supervisor or conveys the measurement to person in the bus who pushed a button to produce a seamless gutter for the exact size needed, along with the downspouts to compete the job. Here is the best part. THERE WERE BACK ON THE BUS AND LEAVING 40 MINUTES LATER! I kid you not. Both the house and garage had new gutters and guards on them. A chat with the supervisor explained that they have their system down with each crew member knowing what they need to do, they work with the same crews and have been providing this service for many years. And believe me the work was excellent with my house looking a lot better. So, I believe they made a nice margin on the work they do using the pricing that they consider reasonable. No doubt their pricing gets them more work without scarifying profit. And to top it off the supervisor did not stop to converse with us to go over the invoice etc. Nope…. hop on the bus and corporate will send you the invoice for payment saving another 15 minutes in terms of non-billable labor waiting on the bus. This is a perfect example of the simple fix with immediate feedback. Have a system. Continuously update the system. Find ways to get more efficient. Be on time. Have your crew under control. Have equipment you need up and running. In short, the bus contained the crew and the equipment to produce the gutter and downspout to complete the work schedule for that day. I kept looking around and asked my wife “Where did they go”. I also said “Boy, that was a nice ROI for 40 minutes or work “ I guess the bottom line

The One-Day Dealer Conference offers over a week of training in a day

Want a crash course on dealership aftermarket offerings, dealer field-based technician autonomy, tax updates, learn the new lease standards, best practices for credit reports and trade payment services, exit strategies, ESOP benefits and tax savings, understanding fiduciary responsibilities just to name a few of the sessions? Industry publications Material Handling Wholesaler and Material Handling Network are presenting a One-Day Dealer Conference on Thursday, September 19th at the Wintrust Financial Corporation building in Rosemont, Ill. “We tailored this conference for dealerships in the forklift, agriculture and construction equipment industry to take one-day off and learn how their business can be more profitable on the operational and financial management level.” says Material Handling Wholesaler Publisher and General Manager Dean Millius. “When you look at the session line-up you would expect to cover this information in a week long conference.” added Millius. Millius had found through their internal research that many dealers can’t invest a lot of time out of the office and have limited budgets to attend these types of learning and networking conferences. With a one-day conference that is centrally located in the Chicagoland area many dealers in the upper Midwest can attend the conference and drive home in the same day. The registration for the One-Day Conference is $499 and they recently announced a special discount on adding co-worker registrations for additional $99 until sold out. To view the full brochure, click here. To register you can go to www.dealer-conference.com for the September 19th One-Day Dealer Conference. To take advantage of the special co-worker price you can register them by clicking here. Each registration receives a full-day of learning, networking and food throughout the day. A brochure detailing the full day of sessions can be seen by clicking here.

August 2019 Logistics Manager’s Index Report®

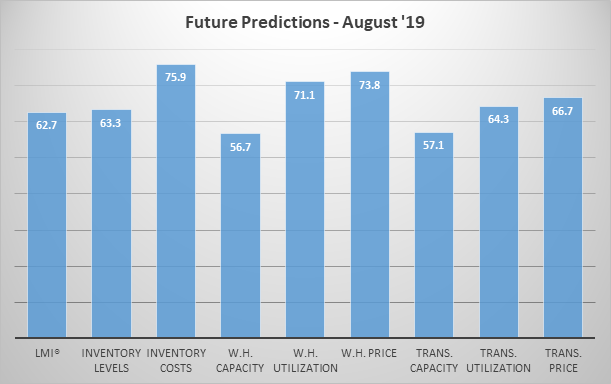

LMI® at 56.6%, Growth is INCREASING AT AN INCREASING RATE for: Warehousing Prices, Transportation Capacity and Transportation Utilization. Growth is INCREASING AT A DECREASING RATE for: Inventory Levels Inventory Costs, Warehousing Capacity and Warehousing Utilization. Warehousing Capacity is STEADY. Transportation Prices are DECREASING. According to a sample of North American logistics executives, growth continued (although at a decreasing rate) across the logistics sector in August 2019. Six of the eight metrics are increasing, although only two of those are at an increasing rate. Warehouse Capacity is holding steady, and Transportation Prices, which have been the LMI metric most predictive of the economy, is DECREASING for the third time in four readings. The overall LMI is down (-0.32), reaching a score of 56.6, which is the second lowest score in the history of the index. This is also down significantly from this time a year ago, when it registered at 70.8. With that being said, August’s score of 56.6 is still above 50.0, which indicates (slowing) growth in the logistics industry. Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, and in conjunction with the Council of Supply Chain Management Professionals (CSCMP) issued this report today. Results Overview The LMI score is a combination eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50 percent indicates that logistics is expanding; a reading below 50 percent is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in August 2019. Seven of the eight metrics read in below their historical average. Only Transportation Capacity reads in above average. Transportation metrics have been the most dynamic over the history of the LMI®. Transportation Prices are detracting for the third time in four months, down slightly (-0.32) to 48.9, which suggests a marginal decrease in freight price. This is a vast difference from a year ago. In August 2018 Transportation Prices were growing at a rate of 92.7, making for a 43.8 point drop over the course of the year. The change index used by the LMI® ranges from 0-100, so to go from growing at close to the fastest rate possible to contracting in the span of 12 months suggests a significant shift in the market. This lack of growth, with the continued growth of Transportation Capacity (64.8, up 26.4 points from 38.4 at this time a year ago). These findings corroborate recent reports of cratering freight markets, with trucking companies closing at a significantly increasing rate[1]. Warehouse Prices are up once again (+3.6), likely due to the stagnation (-1.5) in Warehouse Capacity which has held at a steady state of 50.0. Although Warehouse Prices are up month-over-month, they are still down sharply from a year ago when they were at 80.4. Finally, Inventory Levels are down significantly (-7.6) from the last reading to 59.6. While firms are still adding inventory, it is at a slower pace than last month as well as the historical average. LOGISTICS AT A GLANCE Index August 2019 Index July 2019 Index Month-Over-Month Change Projected Direction Rate of Change LMI® 56.6 57.2 -0.60 Growing Decreasing Inventory Levels 59.6 67.2 -7.61 Growing Decreasing Inventory Costs 70.3 71.2 -0.86 Growing Decreasing Warehousing Capacity 50.0 51.5 -1.49 Steady From Increasing Warehousing Utilization 64.0 64.9 -0.88 Growing Decreasing Warehousing Prices 69.8 66.2 +3.61 Growing Increasing Transportation Capacity 64.8 62.7 +2.14 Growing Increasing Transportation Utilization 55.1 53.2 +1.94 Growing Increasing Transportation Prices 48.9 49.2 -0.32 Contracting Decreasing The index scores for each of the eight components of the Logistics Managers’ Index, as well as the overall index score, are presented in the table below. All seven of eight metrics are up, but many are moving at low or considerably decreased rates. The overall LMI® index score is down to its lowest point in the history of the index, but still indicates growth in the logistics industry. Historic Logistics Managers’ Index Scores This period’s along with all prior readings of the LMI are presented table below. The values have been updated to reflect the method for calculating the overall LMI: Month LMI Average for previous readings – 63.8 High – 75.71 Low – 56.0 Std. Dev – 5.57 August ‘19 56.6 July ‘19 57.2 June ‘19 56.0 May’19 56.7 April ‘19 57.9 March ‘19 60.41 February ‘19 61.95 January ‘19 63.33 December ‘18 63.54 November ‘18 66.98 October ‘18 71.20 September ‘18 70.80 July/August ‘18 70.80 May/June ‘18 72.55 March/April ‘18 75.71 January/February‘18 68.89 September-December ‘17 70.09 July/August ‘17 63.64 May/June ‘17 62.02 Mar/April ‘17 60.76 Jan/Feb ‘17 61.69 Nov/Dec ‘16 61.79 Oct ‘16 60.36 Sep ‘16 60.70 LMI® The overall LMI index is 56.6 in the August 2019 reading, which is down very slightly from July’s index score of 57.2, and the second-lowest score in the history of the index. Before April of this year, the overall LMI had never dipped below 60.0, it has been below 60.0 in every reading since. The variance in the LMI index has been minimal over the last five readings, with a total range of 1.9. This may indicate that the logistics industry has settled into a state of low, but steady growth. Interestingly, respondents expect the LMI will be up significantly in the next 12 months, estimating it at 62.7. This indicates that our panel is optimistic that the logistics industry will be on firmer footing and growing at a faster rate a year into the future. Inventory Levels The Inventory Level index is 59.6, 6.6 points down from last month’s reading, indicating that that inventory levels are rising but at a decreasing rate. This value is approximately 8 points below the value both one and two years ago at this time. This is the second time in a year that the value has dropped below

Monthly Leasing and Finance Index: July 2019

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for July was $9.4 billion, up 15 percent year-over-year from new business volume in July 2018. Volume was down 5 percent month-to-month from $9.9 billion in June. Year to date, cumulative new business volume was up 3 percent compared to 2018. Receivables over 30 days were 2.0 percent, up from 1.70 percent the previous month and up from 1.90 percent the same period in 2018. Charge-offs were 0.37 percent, up from 0.33 percent the previous month, and up from 0.31 in the year-earlier period. Credit approvals totaled 75.7 percent, down from 77.0 percent in June. Total headcount for equipment finance companies was down 2.3 percent year-over-year. Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in August is 58.9, up from the July index of 57.9. ELFA President and CEO Ralph Petta said, “Despite early warning signs of a much-discussed economic downturn, a representative sample of companies in the equipment leasing and finance industry report strong mid-summer origination activity. While credit quality in these portfolios is something to monitor carefully, business owners continue to invest in productive assets to grow their businesses and increase operational efficiency.” David Normandin, President and CEO, Wintrust Specialty Finance, said, “MLFI data illustrates that following a slow Q1, the market appears to have stabilized with a strong Q2 and July continued that result. While there was a slight seasonal volume decrease in July from June, it was significantly less than the last two years for the same period. At the same time, the market is experiencing a slight uptick in delinquency but charge-offs remain low. Credit quality is an increasing focus of risk professionals. In spite of relentless political rhetoric, stock market volatility and trade war concerns, the U.S. economy remains solid and demand for equipment finance is strong.”

Early-bird discount for One-Day Dealer Conference nears

If you have been putting off registering for the One-Day Dealer Dealer Conference in Rosemont, IL on Thursday, September 19th you may want to circle this date on your calendar. When you register for the One-Day Dealer Conference by August 31st you will save $100 per registration. After that the registration will be $499. “At this conference designed with reader and industry leader input will touch on topics from dealer profitability in the parts and service departments to topics that will keep your company compliance with government regulations.” said Publisher and General Manager Dean Millius of Material Handling Wholesaler. “When you look at the agenda you will wonder how we are going to fit everything into one-day!” Millius added. Wholesaler monthly columnists Garry Bartecki and Dave Baiochhi are key architects of the One-Day Dealer Conference. Baiochhi will address the dealer aftermarket offerings, dealer field-based technician autonomy and customer service while Garry Bartecki will be the moderator of the conferences Rapid Fire Discussions that tackles taxes and accounting requirements, leasing recognition rules, Exit Strategies and understanding fiduciary responsibilities. “This conference is going be incredible and if you attended a conference that tackles this much learning you would be attending a week long conference costing thousands of dollars!” said Wholesaler Bottom Line columnist Garry Bartecki. “For those attending this conference they definitely will get their moneys worth.” said Bartecki. The Dealer One-Day Conference will be held at the Wintrust Financial Corporation building in Rosemont, Illinois across from O’Hare Airport in the Chicago area on Thursday, September 19th. To review the Dealer Conference agenda, please click here. If you have additional questions or want to register for the One-Day conference, go to www.dealer-conference.com. A early-bird discount of $399 per person is available until August 31st. The registration includes attendance to the conference, morning refreshments, mid-morning and afternoon snack, lunch and cocktails with appetizers.