TRUMP mandate. How will it affect your dealership?

Many of you probably had your 2025 plan in place before the election. If I had to guess, there is

Many of you probably had your 2025 plan in place before the election. If I had to guess, there is

Today, the Internal Revenue Service announced that the optional standard mileage rate for automobiles driven for business will increase by 3

The Federal Reserve continued to cut the benchmark interest rate. At today’s Federal Open Market Committee (FOMC) meeting, the 25-basis-point

Last month, I suggested that dealers compare their 24 results against their peers’ accounting and cash flow budgets. I also

Are you ready for 2025? Here is a 60-question assessment of how well your business has adopted those fundamental Best

It is time once again to figure out how you did compared to last year, against budget, against cash flow

The Internal Revenue Service today announced relief for individuals and businesses in 51 counties in Florida due to Hurricane Milton.

Much is going on that impacts OEMs, Equipment Dealers, Financing Sources, and Customers. Inflation, supply chain disruptions, and geopolitical tension

According to a PwC Pulse Survey ….40% of Executives plan to implement significant reorganization, including layoffs. That is up from

Tracking the markets as I do, the April results left me wondering what the heck is going on, especially when

Record first quarter total revenues of $804 million, an increase of 9% Net income decreased 3% to $65 million, or

And that is the problem. Inflation or no inflation. GDP growth or inadequate GDP growth. Job claims that help and

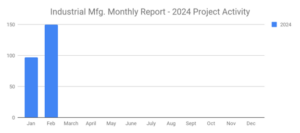

Industrial SalesLeads has announced the February 2024 results for the new planned capital project spending report for the Industrial Manufacturing

Simplifies acquisition process, provides added flexibility Mitsubishi Logisnext Americas (Logisnext), a manufacturer and provider of material handling, automation, and fleet

There are still plenty of questions and discussions taking place about what to expect in 2024. Management is really under

First Citizens Bank has announced that its Equipment Finance business has named Joy Shanks as senior vice president and head

Is there never a “TAX TIME” in the U.S.? Don’t think so. And I believe “TAX TIME” is going to

OEM’s and Lift Truck dealers have always been paying close attention to what is happening in the auto industry, thinking

I am preparing an intro for this month’s topic, and then we will jump into material prepared by Nathan Hawkins

At this time in our economic lives this topic has a lot of pros and cons to consider before deciding