Internal audit

Back in the good old days I used to spend a lot of my professional life auditing equipment dealers and

Back in the good old days I used to spend a lot of my professional life auditing equipment dealers and

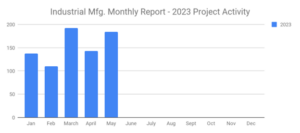

IMI SalesLeads has announced the May 2023 results for the new planned capital project spending report for the Industrial Manufacturing

I am sitting at my computer on May 14 wondering if my T Bills will be worth anything two weeks

There is no doubt that Balance Sheet Management needs to be a top priority for Dealer Management. Dealers have a

It is a generally accepted principle that moderate inflation is good for business. Moderate inflation has been a fact of

Hey, let’s talk MTM, otherwise, known as Mark to Market. You will soon become very familiar with this phrase. Especially

AtomBeam Technologies Inc., whose game-changing product has the potential to revolutionize how data is sent and stored, announces today that

Keep your planning process short. From what I see this is a must regarding 2023 and maybe even 2024. The

The Equipment Leasing and Finance Association, which represents the $1 trillion equipment finance sector, today revealed its Top 10 Equipment

New orders of manufacturing technology totaled $436.5 million in November 2022, according to the latest U.S. Manufacturing Technology Orders Report

Selling your business? What if I told you that you could exclude up to $10 Million from the sale of

November new business volume up 9 percent year-over-year, down 24 percent month-to-month, up 6 percent year-to-date The Equipment Leasing and Finance

IMI SalesLeads announced the November 2022 results for the newly planned capital project spending report for the Industrial Manufacturing industry.

Our topic this month deals with tax planning and an organized approach to minimizing your tax bite as part of

First Financial Equipment Leasing (FFEL), a provider of equipment financing solutions and a member company of JA Mitsui Leasing Ltd

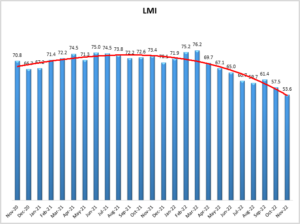

LMI® at 53.6 Growth is INCREASING AT AN INCREASING RATE for: NOTHING Growth is INCREASING AT A DECREASING RATE for:

October New Business Volume Up 6 Percent Year-over-year, 11 Percent Month-to-month and Nearly 6 Percent Year-to-date The Equipment Leasing and Finance Association’s (ELFA) Monthly

The Equipment Leasing & Finance Foundation (the Foundation) releases the November 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). The index

Santa will hopefully be good to you and provide you with an unexpected taxable income along with a few tax

New orders of manufacturing technology totaled $519.3 million in September 2022, according to the latest U.S. Manufacturing Technology Orders Report