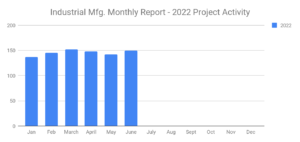

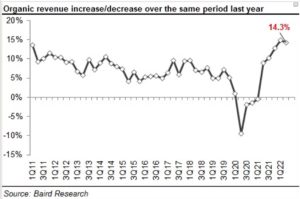

Q4 Update to the 2022 Economic Outlook forecasts 5.9% expansion in Equipment and Software investment and 1.8% GDP growth this year

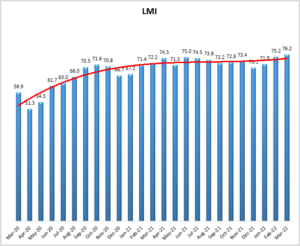

Despite early indicators of a modest rebound in equipment and software investment growth in Q3, demand may soften in several