Where will you fit in?

Reading and watching CNBC (financial channel) on a regular basis gives you a surprisingly good idea of how you are

Reading and watching CNBC (financial channel) on a regular basis gives you a surprisingly good idea of how you are

On this episode, I was joined by the Co-founder and CEO at KINETIC, Haytham Elhawary. KINETIC is focused on enhancing

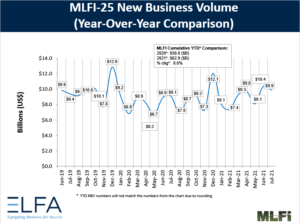

November New Business Volume Up 8 Percent Year-over-year, Down 26 Percent Month-to-month, and up 10 Percent Year-to-date The Equipment Leasing and

There is little doubt that 2022 is going to be a handful to deal with. David Baiocchi laid it all

The title of this article is NOT a typo, that’s right…up to $10 Million United States Dollars can be excluded

On this episode, I was joined by Peter C. Lewis of Wharton Equity Partners. Peter is the Chairman and President

Well, let’s start by saying that cryptocurrencies are here to stay and somewhere, somehow your company will be called upon

You still have time to significantly reduce this year’s business federal income tax bill even with all the uncertainty about proposed

I had the privilege to make a presentation with my Dealer, Rental, and Equipment team for IEDA (Independent Equipment Dealers

SalesLeads just released the September 2021 results for the newly planned capital project spending report for the Industrial Manufacturing industry.

Most people reading this probably have been, and again, the younger members of your team may not, and could probably

SalesLeads has announced the August 2021 results for the newly planned capital project spending report for the Distribution and Supply

July New Business Volume up nine percent year-over-year, Down five percent month-to-month, and Up nearly nine percent year-to-date The Equipment Leasing

This is our annual review of the Banking, Rental, and Leasing markets. Where they are and where they are going.

Hope you noticed I used a plural for the word “Forks”. Did it on purpose because every company out there

Every time I attend a Board Meeting or Management Meeting the participants always wind up asking “what is next on

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross-section

Back in the old days when OEMs, Dealers, Customers, and Banks sought to seek guidance in their crystal balls related

The Equipment Leasing and Finance Association (ELFA) has awarded Bonnie Michael, Vice President Legal and Compliance USA for Volvo Financial

In this episode, I was joined by Nathan Perkins of CSG Partners who focuses on ESOP. This is the latest