JLG to Partner with CWB National Leasing for funding in Canada

JLG Industries Inc., a global manufacturer of mobile elevating work platforms and telehandlers, is partnering with Canadian-based CWB National Leasing,

JLG Industries Inc., a global manufacturer of mobile elevating work platforms and telehandlers, is partnering with Canadian-based CWB National Leasing,

Another year goes by and I hope 2019 operating results met your expectations and beat the budgeted profit as well.

The 2020 Equipment Leasing and Finance U.S. Economic has been released. This comprehensive report analyzes global and domestic trends impacting

Seeq’s advanced analytics solution now available as SaaS application in the AWS Marketplace Seeq Corporation, advanced analytics applications for process

Toyota Commercial Finance (TCF) recently named Mark Taggart as the company’s new president and Chief Executive Officer (CEO). Dave Crandall, TCF’s

As 2019 comes to a close many forklift dealers are reminding their customers of end of the year tax savings

The Equipment Leasing & Finance Foundation (the Foundation) released the November 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI).

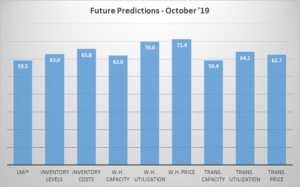

LMI® at 54.4%, Growth is INCREASING AT AN INCREASING RATE for: Warehousing Capacity, Warehousing Utilization, Transportation Utilization, and Transportation Capacity.

Before we get started, I would like to have you get hold of the October 31, 2019 issue of Forbes

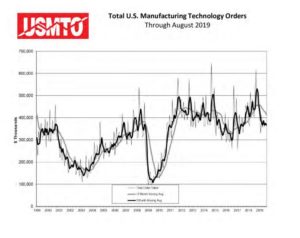

U.S. manufacturing technology orders fell 1 percent from the previous month to a total of $361.5 million in September 2019

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross

U.S. manufacturing technology orders fell 3.2 percent from the previous month to a total of $365.6 million in August 2019,

The Equipment Leasing & Finance Foundation (the Foundation) releases the September 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to

Women are making significant gains in median earnings and their poverty rates are decreasing. Yet, the wage gap between men

Ahhhh, the age-old dilemma that has become part of every type of business, especially dealers. Never goes away and becomes

Want a crash course on dealership aftermarket offerings, dealer field-based technician autonomy, tax updates, learn the new lease standards, best

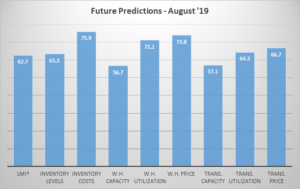

LMI® at 56.6%, Growth is INCREASING AT AN INCREASING RATE for: Warehousing Prices, Transportation Capacity and Transportation Utilization. Growth is

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross

If you have been putting off registering for the One-Day Dealer Dealer Conference in Rosemont, IL on Thursday, September 19th