Securing funding for your small business

Busting the three biggest myths about the Small Business Administration Given that politics are always a hot topic, you’ve likely heard plenty from both political parties about how government at all levels simply doesn’t work. That’s not a new complaint, and just about everyone can share a story about some government nightmare they’ve endured. But there’s a federal agency that bucks the trend: The Small Business Administration. The SBA enjoys broad support from all corners of the political spectrum—and deservedly so. That’s because the SBA, which dates to 1953, fulfills its mandate of helping small businesses. Don’t believe me? Google it. Sure, you’ll find scattered complaints, but the SBA generally gets strong reviews. That said, the SBA doesn’t always get the credit it deserves and there’s a lot of misinformation going around as well, especially among entrepreneurs who are missing out on strong financing possibilities. Let’s talk about three of the biggest myths surrounding the SBA. The SBA lends money Although the SBA can directly lend money in cases of disaster, that’s not its main role when it comes to lending. Instead, it serves as a government guarantee program for banks and nonbanks. That means it essentially serves as a backup to lenders who might otherwise not be interested in making loans to smaller and/or unproven businesses—it offers guarantees up to 85% for loans up to $150,000 and 75% for loans bigger than that. Because lenders are less likely to endure the full brunt of defaults, they’re more likely to make loans to unproven businesses. The SBA does set requirements and application process details. Applications will require personal background information, a business plan, personal and business credit reports, income tax returns, bank statements, and a resume, among other things. It’s also possible personal or business collateral is required. One benefit for you, the borrower, is that the loan terms tend to be longer (up to 10 years) and require smaller monthly repayments because of good interest rates. The SBA is only for mom-and-pop shops Mom-and-pop shops are definitely among the kinds of businesses the SBA is looking to help, but they can also work with much larger businesses. Through its flagship 7(a) program, SBA-backed loans can be as large as $5 million for needs such as working capital. And through its lesser-known 504(b) program, as much as $12.8 million can be obtained for businesses seeking to buy real estate or major equipment. A $5 million loan, not to mention a $12.8 million loan, is way above what a mom-and-shop needs. While there’s no one-size-fits-all template for a typical SBA loan customer, most are businesses that are going to have anywhere between $50,000 and $5 million in annual revenues and up to 40 employees. Those businesses are likely to be cash flow positive and are profitable. Of course, if mom and pop need a loan, small amounts are available, too. There are no minimum guaranty amounts for an SBA loan program. My banker didn’t tell me about SBA-backed loans or said I’m not qualified, so I’m out Not to fear: You’re most likely not “out.” There are about 2,200 banks and nonbank lenders through the United States who write SBA-backed loans. Each one uses the program differently and requires varying qualifications. Thus, even if one lender rejects you, it doesn’t mean that all will. It’s always worth trying another lender (or two or three) if you get rejected—advice that applies when seeking non-SBA loans as well. If you go to a doctor and don’t like what he/she says, you may try another physician, so why not do the same here? In addition, there may be other reasons why your initial lenders may not tell you about SBA loans. Perhaps they’re ignorant about the program. Or maybe their employer doesn’t give them incentives that make them want to push SBA loans; remember, your banker is trying to make a living, too, and might push you toward more profitable options for his/her own pockets. It might even be something as simple as your banker is lazy: Lining up an SBA loan usually does require more documentation than a regular loan. And large banks often aren’t interested in making small loans, which can be less profitable and riskier than larger loans. So, if you get rejected for an SBA loan by a large bank, try a smaller bank, which may well specialize in the program and have lenders well-versed in the process. Hopefully, I’ve cleared up misconceptions about the SBA and its lending programs. These programs work, as many business owners will attest, and there’s little to no downside in at least considering an SBA loan the next time you need funding. Its website, sba.gov, is helpful as well, providing further information in an easy-to-use format. About the Author: Ami Kassar is the founder and chief executive officer of Multifunding LLC, speaker, and author of The Growth Dilemma. Heavily involved in business finance for two decades, Ami has advised the White House, The Treasury Department and The Federal Reserve Bank on the state of the financing markets. A nationally-recognized expert on business capital, Ami Kassar has helped over 1,000 entrepreneurs raise over $400 million of debt for their businesses. For more information on Ami Kassar, please visit www.AmiKassar.com.

The next round of planning

Time to figure out how to plan for and deal with 2020. A tough assignment for just about any professional manager. Let’s see …………. Could be bad Not so bad Same as last year Better than last year Extremely better than last year Must be one of these choices. But the “real’ results will depend on both internal and external factors that could sway the results one way or the other. So best to have a plan or two that cover where the “factors” lead you. External Factors ECONOMY Nobody knows where it is headed but some can provide reasonable analysis that can get you through the next 12 months. I read a lot of financial publications with a central theme that the amount of debt accumulating simply cannot be repaid following standard accounting rules and economic history, which will in time create a credit crisis which in turn will trigger a massive recession similar to 2008. The question, however, is when. So, the question is “Do we have to worry about a major recession in 2020?” Probably not since our economy is working quite well now with earnings able to provide debt service coverage and thus avoiding a credit crisis, we fear will cause a major recession. On a scale of 1 to 10 with 1 being a disaster and 10 a home run I come out between 6-7 for 2020. That being the case, I would plan for at least a repeat of 2019 with a good chance to do even better. INTEREST RATES Interest is a major expense on your income statement that eats up a significant portion of cash flow. On the other hand, rates are low and right now there is not much reason to expect them to change in 2020. And even if they increased by 20-30 basis points, the impact would hardly be noticed. If anything, and I have mentioned this before, I would be reviewing all note obligations to see if refinancing is possible. I recently looked over a note only two years old and discovered I could refinance for 1% less, which lowered interest expense by $200,000. Free money. INFLATION This is another factor that was expected to increase. But so far under control, expect for tariffs which many of you may be experiencing. Tariffs will increase inventory cost which could put you in a poor competitive position. If you can, reduce buying new and buy used until the situation clears itself. You can do the same regarding rental units. Irrespective of tariffs, the old demand and supply still impacts costs as well as revenues. And those of you in a union environment know full well you will get an annual bump. I have been refurbing units internally as well as buying refurb units from manufacturers. Costs are down along with an increase in customer interest in refurb units. EMPLOYMENT This is our fly in the ointment. It seems everybody is looking for talent with none to be found. If you can’t find people then consider outsourcing what needs to get done. Adopting a new system can also result in becoming more efficient and thus needing less people. In any event, getting more efficient by getting more out of the staff you have is a must. You must know what the techs are producing, and what truck drivers are doing. I just attended a demo for a new system and was astounded how much better it is compared to the one purchased 15 years ago. All departments can be managed by C level folks off on one screen. You get more efficiency, better customer service, it makes you easier to do business with, speeds up the collection process, and every person on your payroll knows what is going on through their phone or tablet. How can I not convert to the new player in town? Time to repeat one more suggestion I have made previously. Hire several recent graduates. You will become more efficient whether you like it or not, and your transition to a new system will be much faster. Internal Factors PLANNING Planning for profits and cash flow from operations is a must, also keeping in mind the tax aspects of your business. I also suggest getting familiar with tax planning tips you can pass off on your customers. I attended the AED convention last week and in talking to one member asked how business was going and what aspects seemed to be growing. The answer was “FLEET MAINTENANCE”; the fastest growing section of his business. REVENUE Based on what we covered so far you can expect a repeat of last year. But keep in mind that those folks with the new system using the latest technology may have a “better mousetrap” for your customer. Best to figure out what you are up against, because this issue will not go away. And remember, rental continues to become more popular as the popularity of fleet maintenance supports. LABOR Here MONEY AND SUPPORT “talks. Pay referral fees to employees. Kick in more money to retirement plans. Provide a bonus program when departments hit goals. Provide training for higher paying jobs. Follow a team approach to keep them interested in your company. Acknowledge hard work and achievement. OVERHEAD Insurance markets are very tight. Expect major increases especially in umbrella coverage. Run a tight, safe ship to avoid problems with insurance. I know of one insurance agent who had to approach 40 companies for an umbrella policy. And still a “no go”. Technology is getting pushed down to smaller and smaller companies. Best tell some of those new young hires to search out what competitors are doing and what you can do to attract new business. You will be surprised at what they bring you. I work with one young lad who worked a deal and a re-deal on his phone in amount five minutes. Collected the data and sent pictures of invoices and machines. All I could think was, “why can’t

Has the TCJA lowered your taxes?

We now have two years of the Tax Cuts and Jobs Act (TCJA) changes under our belts: 2018 and 2019. Are your taxes lower than before the law went into effect? Not surprisingly, the answer depends on your specific situation. Perception vs. Reality After most people filed their 2018 tax returns, only 40% believed that they had received a tax cut under the TCJA, according to an online survey conducted for The New York Times in April 2019. Only 20% were certain they had received a tax cut. In contrast, a study conducted by the independent Tax Policy Center concluded that 65% of households actually got a tax cut in 2018, while only 6% actually paid more. The rest saw little or no change in their tax bills. Here’s a table comparing the results of the Times survey and the Tax Policy Center study based on household income levels: Household Income “Think They Got Tax Cut,” according to the Times survey “Got tax cut,” according to the Tax Policy Center study Under $30,000 30.0% 32.1% $30,000 – $50,000 36.1% 69.1% $50,000 – $75,000 41.5% 81.7% $75,000 – $100,000 47.9% 86.6% Over $100,000 46.4% 89.5% As you can see, perceptions overrode reality, especially at higher income levels. Since the TCJA changes were fully phased in for the 2018 tax year, we would expect the “got tax cut” percentages for 2019 to be about the same as for 2018. It remains to be seen whether perceptions will change after 2019 returns are filed this year. Why the Big Disconnect? There are several reasons for the gap between tax cut perceptions and reality for the 2018 tax year. The first was the way the TCJA was portrayed by some members of the media and some politicians — essentially as tax cuts exclusively for businesses and wealthy people. The second reason has to do with the federal income tax withholding tables. The tables weren’t properly updated in 2018 to account for changes made by the TCJA, causing many people to have their taxes under-withheld. Though most people paid lower taxes overall for the year, many received lower refunds compared to previous years. For those who depend on tax refunds for an annual “spring bonus,” a lower-than-expected refund felt like a tax increase. Employer tax withholding tables were adjusted for 2019. So, tax refunds collected during this year’s filing season may be more in line with expectations. Winners and Losers Regardless of public perception, the TCJA changes clearly resulted in some winners and losers. As stated, outcomes depend on specific circumstances. Here are five key takeaways from last tax season: In general, when it comes to individual taxpayers, higher-income taxpayers received the biggest tax savings from the TCJA, because tax rates were significantly reduced. Simple math dictates that people who pay heavy taxes are benefiting the most from that change. If you live in a high-tax state and have significant home mortgage debt, the TCJA provisions that limit your itemized deductions for state and local taxes and home mortgage interest expense may have increased your tax bill for 2018 compared to previous years. If you were hit with the alternative minimum tax (AMT) before the TCJA, you’re probably now AMT exempt. If you still owe the AMT, you probably owe much less than before. Most young lower-income and middle-income families with kids under age 17 probably came out ahead under the TCJA — even though personal and dependent exemption deductions were eliminated. These taxpayers benefited from 1) lower individual tax rates, 2) increases in standard deductions, and 3) increases in the child tax credit. Many self-employed individuals benefit from the new deduction for up to 20% of qualified business income from so-called “pass-through” entities (sole proprietorships, LLCs, partnerships and S corporations). Self-employed individuals also benefit from increased first-year depreciation write-offs for business vehicles and equipment. Strong Economy The U.S. stock market has soared over the two years that the TCJA has been in effect. The following table shows the growth in two leading stock market indices from December 2017 to December 2019. Stock Market Values 2017 vs. 2019 Market Index December 2017 December 2019 Growth Dow Jones Industrial Average $24,719.22 $28,538.44 15.5% Standard & Poor’s 500 $2,673.61 $3,230.78 20.8% Together with other macroeconomic factors, the TCJA has contributed to economic growth by lowering the maximum corporate federal income tax rate from 35% to 21% and expanding first-year depreciation write-offs for business equipment additions. Tax cuts can stimulate the economy by providing an influx of cash that businesses can use for a variety of purposes, including buying equipment, hiring workers, paying off debt and buying back stock. Roughly seven million jobs have been created since January 2017, and the unemployment rate hit a 50-year low in 2019, according to the U.S. Department of Treasury. Wages also have risen significantly for blue collar workers over the last two years. As a result, the Council of Economic Advisers (CEA) estimates that real disposable personal income per household has increased by $6,000 since the TCJA became law. You can’t give the TCJA all the credit for these positive economic results, but it has played a part in recent economic growth. Stay Tuned Economists generally agree on two things related to the TCJA. First, it’s hard to isolate the effects of the TCJA from other economic factors. Second, not enough time has passed to evaluate the full effects of the TCJA on the U.S. economy. Most individual and business taxpayers have benefited from the TCJA in some way. However, some people will pay more tax under the TCJA than under prior tax law. To evaluate exactly how the TCJA changes have affected you or your business, contact your tax professional.

OneCharge and ECOTEC listed as approved vendors for Charge Ready Transport Program

OneCharge Lithium Ion Batteries and ECOTEC chargers listed as approved vendors for “Charge Ready Transport” program, which provides financing for fleet electrification infrastructure OneCharge Inc., a provider of lithium motive batteries for the material handling industry, and Ecotec, a provider of world-class, energy-efficient battery charging solutions, has announced that their Southern California customers are eligible for Southern California Edison’s “Charge Ready Transport” program. This SCE program covers most or all of the customers’ costs for electric infrastructure needed up to the charging station. The five-year program has authorized up to $30 Million for forklifts specifically. These are the main criteria for program eligibility, applicants must: be within the SCE service territory; purchase or lease two or more electric forklifts within 18 months of signing the agreement; procure, own, install, and operate the charging stations for 10 years; easement will be required. These are the zero-emission voucher incentive benchmarks for clean off-road equipment projects: Forklift lbs. Lift Cap Funding 8,001 – 12,000 $15,000 12,001 – 20,000 $20,000 20,001 – 33,000 $50,000 >33,000 $150,000 Electric Forklifts have lower operating costs Electric forklifts cost less to own over their lifetime than comparable internal combustion engine (ICE) forklifts. A typical ICE forklift is about 3-5 times more expensive to operate than its electric counterpart. And with fewer tune-ups, a reduction in engine parts and no tank refills, electric forklifts are also more productive than legacy forklifts. Lower operating costs, reduced maintenance and improved safety make electric forklifts a better investment. Electric Forklifts are just as powerful Modern electric forklifts perform side- by-side with their ICE counterparts, while being safer and less expensive to operate under most circumstances. Electric Forklifts reduce pollution With virtually no fuel expenditure, electric forklifts fit modern “earth-friendly” initiatives. With manufacturing trending green, electric forklifts are a smart, cost-efficient option. Plus, workers are not exposed to harmful tailpipe emissions with electric forklifts. The bottom line: less carbon footprint, more healthy work environment. Electric Fleets don’t require space-wasting battery changing rooms Fast chargers eliminate the need for battery-changing rooms. Batteries are charged during scheduled breaks and shift changes without ever leaving the vehicle. Fast charging won’t harm batteries With unique algorithms, battery monitoring and heat management technology can actually extend the life of your batteries by almost 40% and reduce your battery inventory by 50%. Energy security Energy efficiency and security is perhaps the most underrated of all the advantages of electric forklift trucks. The U.S. still imports millions of gallons of oil on a daily basis. Slowly and surely, electric forklifts (along with electric cars) are helping reduce the need for the U.S. to rely so much on foreign imports. Electric forklifts are helping to fill the void with reliable, safe, and efficient transportation – all with a better overall economic benefit. Additional application requirements apply. Visit: https://www.sce.com/crt

How do we stack up?

As you know, I have been involved for many years in the material handling industry, the construction equipment industry and the equipment rental industry. It has been a very interesting and educational ride leading me to totally respect all the players in these industries. What I find so interesting about the material handling business is how many dealers respond to competitive and economic headwinds and still survive to fight another day. There is no doubt in my mind that a material handling dealer is working a business in a tough industry. One of the toughest to manage, and to manage successfully. I say that because you compete in a competitive market with excessive OEM options available, at least five profit silos to manage, managing capital intensive products and services, and to top it off, finding yourself in a very competitive situation for personnel to operate the business. With a lack of qualified techs and most sales candidates coming in with a non-compete agreement they signed, being able to attract and keep quality people must be one of the major stumbling blocks you face. All in all, a tough business to work in and still produce above average profits and cash flow. Consequently, I often wonder how a business such as yours, in such a very competitive industry with major capital and personnel needs, stacks up against other industries in terms of investment potential. So, when I came across an article outlining how to measure potential investments, I could not resist the temptation to see how the material handling business measures up against the expected “results” of the four test categories noted in the article. These four calculations are used to evaluate the quality and value of almost any business or industry. Doing the calculations and reviewing the results will help quantify exactly what makes a given business great, average or poor. #1 High Profit Margins The question is how much cash you generated from operations, which is different than total changes in cash balances. The goal is to produce cash flow from operations against total sales of at least 20%. You can get “Cash Flow from Ops” right off your year-end financial report. Then run the calculation CASH FLOW FROM OPS/ TOTAL SALES = %. A 20% result puts you in World Class Business status #2 Capital Efficiency This could be a tough one. Let’s see. Capital efficiency is defined as how much capital the business needs to maintain its facilities and growth of its revenues. A capital efficiency company generates excess cash for distribution to owners or to support growth. What is expected is more excess cash available for owners and growth compared to Cap-X requirements. In other words, cap X of less than 50% of Cash Flow from Operations. In your case Cap-X covers rental assets, facilities and other long-term assets such as delivery equipment, shop machinery and technology. It does not include inventory as Cap-X. Using this definition makes it easier to attain. And remember, transferring inventory to rental assets should be considered Cap -X at that point. #2 Goal is to keep at least 50% of Cash Flow from Ops net of Cap-X for the year. #3 Return on Invested Capital This one is easy to calculate. Again, I would use the year-end report. It is a metric to determine the value and power to shelter your business from profit-eliminating competition. Calculate as follow: Equity plus LT Debt / net income. Goal is to shoot for 20% I suggest that any calculation using net income be normalized to eliminate “personal” expense as well as one-off transactions. The same type of adjustments you would make valuing the company for sale. I know some dealers use unclassified balances sheets, especially if they have large rental fleets, because the short-term amount of the fleet debt creates negative a working capital which must be explained to banks and other financial institutions. If you have an unclassified Balance Sheet, you may want to run this calculation both ways. #4 Return on Net Tangible Assets This is not as complicated as it sounds unless you have a material “goodwill” amount on the balance sheet. This calculation gives you the best overall measure of the quality of any business. It is known as ROE. The calculation is as follows: Total Assets – (Total Liabilities, Goodwill, Trademarks, other non-tangible assets) / normalized net income = Return on net Tangible Assets. Goal is to shoot for 20%. In other words, it is a return on equity net of intangible assets or ROE. I have mentioned in the past about the need to properly depreciate the rental fleet. My goal is to produce a net book value of the fleet at OLV (orderly liquidation value). If you write it down to zero book value, you have overstated expense as well as undervalues your fleet asset. For this calculation I would make the adjustments to adjust fleet value to no less than OLV. ROE combines brand impact, capital efficiency and quality of earnings and considers the results from the prior 3 tests. It also rewards companies that can borrow most of the capital they need. For a dealer, that is important. To summarize: Cash Operating Profit should be 20% or more No more than 50% of Cash Operating Profit used for Cap-X Return on Invested Capital should be at least 20% Return on Net Tangible Assets should be at least 20% Hit most of these goals and you have an above average company when compared to other industries. You can also use your normalized EBITDA number to compare to other industries as well. So, how do you think your industry fared in terms of these financial metrics? Great? Average? Or Poor? To get an answer to the question I reviewed the latest MHEDA DiSC report and find that the TOP 25% QUARTILE can meet or get close to the minimum percentages required for each metric. Surprised? I was to some extent. On the other hand, seeing

Quarter One: Here we come.

I am composing this month’s column after opening the presents Santa left for me. All I can say is he must have enjoyed the shot glass filled with 30-year-old Scotch I left under the tree. Also been wondering how you reacted to last month’s column which did not express much hope for 2021. Adding another six weeks of data to the thought process has not changed my mind much, and in fact, I came up with another risk or two that need attention. After listening daily to numerous financial gurus I am intrigued by the consistent theme that “Your business will not be the same when we come out of this Pandemic period”. But upon pondering this question for a couple of weeks I am starting to put together a picture of what may change, why it will change, and how it will impact companies selling equipment, parts, and service. So, what are the new threats I uncovered in the last six weeks? It has to do with an event that will prove negative no matter how your customer base performed for you in 2020. It has to do with the Stock Market, and the bubble the market finds itself in the middle of a major RECESSION. How does that work? And I think we all know what is on the horizon. Think back to the late 1990’s or 2008-09 period. Looking at some of the S&P Valuation Factors (and believing we are in a major recession) the factors are a little hard to believe. Median EV to Sales 4.0 US Total Market Cap to GDP 170% Median Price to Sales 2.8 Median Price to Book 3.9 Median EV to EBITDA 15 Average Price to Earnings 25 Think you could sell your company based on these factors and being able to fund the purchase debt. NO WAY! The buyer could not get the financing to finance the deal because post-purchase cash flow would not support it. Another source covers 1945 to 2025 and calculates that the average PE ratio over this period is 17. But we are at 31 which is higher than all past bull market peaks during this period. The risk here is we know what is coming in terms of a market correction. It is only a matter of time. The point is that even if you had a banner year because your customer base represented the right distribution streams or non-exempt companies, a major market correction (similar to the big ones in the past) will put all companies in a pinch. In other words, no matter how well you did in 2020 with the expectation to repeat in 2021, I would consider this market risk (very seriously) and avoid new major fixed commitments. So even if you were a high-flyer in 2020 you are not exempt from running different risk profiles to see how you would have to adjust if revenues fell by 50%. Dig out my prior column for additional risk analysis. Now let us spend a few minutes considering how your company will emerge on the other side of the Pandemic. Think about it. Have your management team think about it. Because no matter how big or small your company is, or how profitable it was in 2020, there are changes coming you have no control of, and changes required to remain competitive meeting customer needs (which will also change) 18-24 months from now. After considering the options available regarding the industry I see two trends resulting from this Pandemic period, caused by the new paradigm shift in the ways you did “Business” and the patterns developing in the industry forcing changes in the way dealers to operate post Pandemic. One is Technology and all the changes available therefrom The other is changes in customer needs and the ability of current dealers to meet those needs As a result of these shifts, two types of dealers will be created. The first looking like the status quo, who if they remain with the status quote will find revenues falling, margins decreasing and company value shrinking. At the other end of the spectrum will be the TOP 25% dealers who will grow during this period, pick away at competitor’s customers, have much higher sales per employee numbers, higher margins from current revenue silos as well, and new revenue silos. And they will do this with manageable fixed costs, with the ability to shift the business model to meet customer needs and solutions to more than they are providing currently. This latter group will embrace technology in all its forms, and as a result employ fewer people in most departments, except maybe in the service department depending on what services are being offered. Every transaction will be digitized where the system does the work with management reviewing the results in real-time. We will get into this further next month. TAX NOTE Round 2 or PPP2 is on the horizon and after reviewing the first drafts of the program, it appears the amount available from the PPP2 would be similar to the PPP1 amount. There is a major difference, however. With Round 1 recipients filled in the application and received a loan. This time you need to prove you need it. What the publications state is if you have one quarter in 2020 that was 25% less than the same quarter in 2019, you qualify. This is tougher than it sounds. There is also an SBA benefit available. If you are funding a business mortgage via the SBA you can receive a pass for three months (last I heard). Not sure how they will handle it, but you would get the break when you need it. PPP2 forgiveness will be tax-free (this is what they said last time). And there is the noise that PPP1 will be tax-free, eventually. See you next month. Garry Bartecki is a CPA MBA with GB Financial Services LLC. E-mail editorial@mhwmag.com to contact Garry

JLG to Partner with CWB National Leasing for funding in Canada

JLG Industries Inc., a global manufacturer of mobile elevating work platforms and telehandlers, is partnering with Canadian-based CWB National Leasing, making the company the financial provider of choice in Canada for JLG Financials retail financing program. Expanding upon the success of the JLG Financial launch in November of 2018, this increases the program’s retail presence in the Canadian market for the first time. With approximately 700 rental outlets carrying JLG equipment in Canada, this partnership is designed to simplify and expedite financing for business owners based there. The program supports up to 100 percent financing for the purchase of new or used equipment – any make or model – and it allows customers to choose from a variety of flexible financing options to meet any need. Most approvals are same-day and only require simple documentation. “This partnership offers JLG rental businesses an extraordinary level of service with special rates, point-of-purchase sales assistance and personal financing advice, giving them more options for their customers and easing the process when they are selling equipment,” said Matthew Coldsmith, JLG director of customer financial solutions. “CWB National Leasing has a proven success in this industry, and they have strong relationships with many of our customers already.” A portion of JLG Canadian resellers currently use CWB National Leasing for financing, and the company is the largest longest-standing equipment financing company in Canada. “CWB National Leasing is proud to be chosen as JLG’s financing partner in Canada,” said Miles Macdonell, senior vice-president of sales. “Established relationships at a large number of JLG Canadian resellers and a technology platform that makes financing fast and easy for customers has positioned us to support JLG’s continued growth in the Canadian market.”

Tax planning: Keeping it or giving it to Uncle Sam

Another year goes by and I hope 2019 operating results met your expectations and beat the budgeted profit as well. If that is the case pat yourself on the back because we all know the effort required to hit the numbers, especially after maneuvering the monthly ups and downs associated with the various departments throughout the year. I have always marveled at how equipment dealers balance all the balls they have in the air and still make the numbers work. That is one of reasons I LOVE this business, and the people in it. If your operating the business properly your Balance Sheet and Income Statements should be 90% cleaned up by the end of the year, awaiting a few final adjustments before the financial package is presented to your auditors with a March 15 deadline for their report. The same goes for the tax returns which should also meet the March 15 and April 15 deadlines so that all the tax issues are behind you and you can concentrate on 2020. The point here is that management needs to plan for 2020 starting in October or November of 2019. Waiting for the year end close to find out you did six months after the year end just does not cut it any longer. Department heads need to concentrate on what is working and fix what it not, with this process beginning on Day 1 of the new year. Some of the issues facing management on January 1 of every year are as follows: THE CASH BALANCE Is it adequate for what you have planned? Can we generate cash faster? Are invoices processed as quickly as possible? Are you using digital billing and collection methods to reduce the cash cycle? Are the credit and collection policies current for your business today? Is the cash flow from operations in the upper 25% quartile? INVENTORY We are talking new, used and parts inventories. How to the turns and GP% compare to the MHEDA Disc Report? Do you have a list of what to get rid of? Do you have an annual valuation of what the used units are worth in terms of OLV? Is there phantom value when the OLV is compared to the used book values, or perhaps a loss if units are overvalued. Knowing what to expect in profit from new, used and parts inventories is a must on Jan 1 of each year. The sales department need meaningful budgets that generate cash flow for the reporting period. RENTAL FLEETS Both long-term and short-term fleets. Are you ready for the new lease accounting GAAP rules that will have rental customers asking about their leases and how much of the lease payments are for the unit and how much for maintenance? Better be ready. The OLV comparison applies here as well regarding short-term rental units. Bankers need to know if OLV values exceed book value. ACCOUNTS PAYABLE AND ACCRUED EXPENSES Are we shopping our purchases as often as we can? Technology is making purchases cheaper. Interest rates are down. Have we discussed rates with our lenders? I have encountered new ways to purchase company insurance. New ways to make money from Rental Equipment Insurance purchases that benefit both dealer and customer. Ways to offer value via certificate tracking programs that benefit both dealer and customer. Question every purchase. Find the hidden value in AP and ACCRUED EXPENSES. DATA DIVING Check your performance against competitors in your territory. Join a 20 Group and actively participate. Rouse Analytics has a program to compare competitors in a territory by getting access to member data files and working up averages for various profit and cash flow drivers so that they can compare each member of the group against the group data. This is an amazing tool. You can zero in on every line item in sales, costs and gross profits. 20 groups provide a similar comparison only with non-competitive locations. There is a lot that can be done to make money in the material handling business if you can operate in the upper profit quartile. Trying to catch up to dealers in that level is something else again. But, I have found a very competitive marketing and advertising program on the market that will (1) build your company a website and update it as need be; (2) help build your data base and flag it for certain type of prospects and products; and (3) get you up to speed on all media avenues required by your type of business. All for $350 a month! The dealer must supply what they want included in the website, email blasts and the social media account, but they will show you how to do that. This could be a great tool when trying to try out a new marketing program for a special profit or service. If you follow up on some of these ideas, you will find yourself making more money which brings us to the TAX PLANNING portion of this column. Make more money and pay more taxes. How about make more money and keep more money? I like the latter thought better and I am sure you do as well. At our One-Day Dealer Conference in September we had some of the brightest tax folks available with expertise regarding equipment dealers and rental companies. One portion of the presentation, which I mentioned last month has to do with the Wayfair decision requiring sales tax collections on goods shipped into a state even though the seller has no presence in the state. Needless to say, this gets a bit crazy, but the exposure is real even down to what is called the RESPONSIBLE PERSON RULES whereby personal liabilities may apply for any officer, director or employee who knows of and has responsibility to comply with individual state tax laws. As far as Wayfair is concerned, every company should get a report from their accounting firm (from a person with expertise in this area) to explain where

2020 Equipment Leasing and Finance U.S. economic outlook

The 2020 Equipment Leasing and Finance U.S. Economic has been released. This comprehensive report analyzes global and domestic trends impacting capital spending and economic growth in the coming year. It identifies key signposts specific to the equipment finance industry and features Momentum Monitors that identify turning points for 12 verticals in their respective investment cycles. Each economic outlook is updated quarterly. Equipment and software investment growth decelerated for the second consecutive quarter in Q2 but remained positive, primarily due to moderate annualized growth in software (equipment investment was essentially flat). Although a recession in the next six months appears unlikely, business conditions for the equipment finance industry are also unlikely to improve materially over the rest of the year, particularly for equipment verticals that serve the manufacturing sector. Over the next three to six months: Agricultural Machinery investment growth should improve; Construction Machinery investment growth should increase modestly; Materials Handling Equipment investment growth may improve; All Other Industrial Equipment investment growth is likely to remain moderate; Medical Equipment investment growth should strengthen; Mining & Oilfield Machinery investment growth should improve modestly, but is likely to remain weak overall; Aircraft investment growth is likely to remain in negative territory; Ships & Boats investment growth should remain weak; Railroad Equipment investment growth should soften; Trucks investment will likely weaken; Computers investment is likely to remain weak; and Software investment growth growth should remain strong. U.S. Capital Investment & Credit Markets: Capital investment contracted for two consecutive quarters in 2019 and is expected to remain muted in early 2020, in large part due to the ongoing trade war with China and other slowing economies around the world. Despite weak or negative investment growth and faltering business confidence, credit market conditions remain broadly healthy. Financial stress, while up slightly, remains subdued by historical standards and credit supply, while slightly tighter, is still not cause for concern. However, demand for credit — especially by businesses — has weakened notably, which may portend a further slowdown in business investment in 2020. Overview of the U.S. Economy: The U.S. economy saw uneven growth over the course of 2019 and ultimately decelerated from its 2018 pace. Consumers were the economy’s driving force throughout the year, buoyed by the strongest labor market in a generation and faster wage growth. However, political uncertainty, tariffs, and reduced economic activity among several key trading partners have weighed on U.S. exports and business investment. These headwinds show few signs of abating, which should lead to slower growth in 2020.

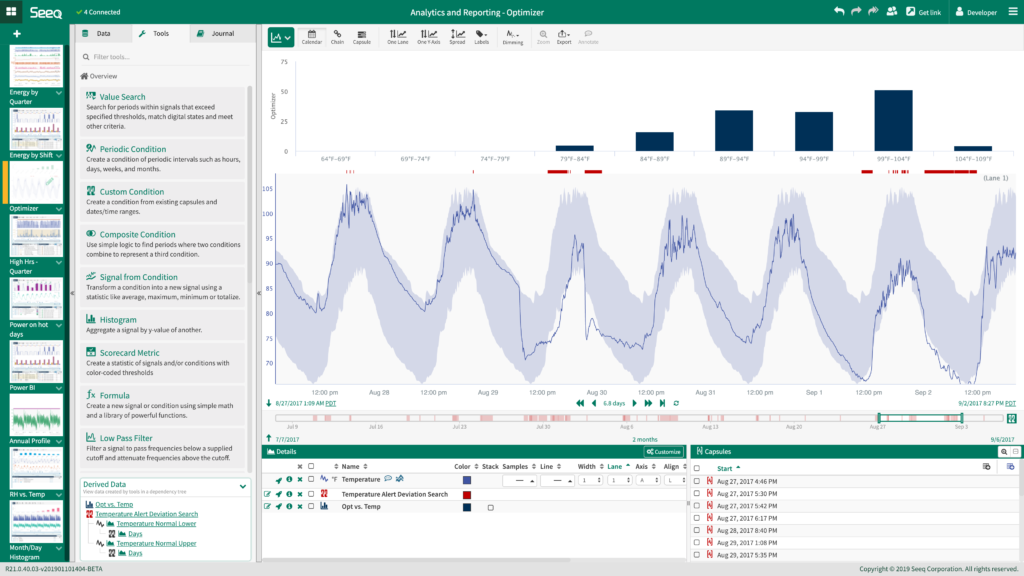

Seeq Corporation announces AWS Industrial Software Competency achievement

Seeq’s advanced analytics solution now available as SaaS application in the AWS Marketplace Seeq Corporation, advanced analytics applications for process manufacturing data, announced it has achieved Amazon Web Services (AWS) Industrial Software Competency status. This designation recognizes that Seeq has demonstrated technical steps proficiency and proven customer success building solutions targeting one or more of the primary steps in discrete manufacturing or process industries in Product Design, Production Design, Production/Operations. These specialized software solutions enable companies in process and discrete manufacturing industries to increase the pace of product innovation while decreasing production and operational costs in their value chain. Achieving the AWS Industrial Software Competency differentiates Seeq as an AWS Partner Network (APN) member that has delivered proven customer success providing specialized solutions aligning with AWS architectural best practices to support the Production and Operations category in the AWS Industrial Software Competency. “Seeq is proud to be one of the APN Partners to achieve AWS Industrial Software Competency status,” says Steve Sliwa, CEO of Seeq. “By leveraging the agility of AWS, Seeq enables process engineers, managers, teams, and data scientists to derive more value from data already collected by accelerating analytics, publishing, and decision making.” AWS is enabling scalable, flexible, and cost-effective solutions from startups to global enterprises. To support the seamless integration and deployment of these solutions, AWS established the AWS Partner Competency Program to help customers identify Consulting and Technology APN Partners with deep industry experience and expertise. To receive the AWS Industrial Software Competency designation, APN Partners undergo rigorous AWS technical validation related to industry specific technology as well as an assessment of the security, performance, and reliability of their solute Seeq’s advanced analytics solution is also now available in the AWS Marketplace, enabling customers to rapidly investigate and share insights from process manufacturing data stored either on premise on in the AWS cloud. This announcement caps an impressive year for Seeq. The company recently ranked #369 on the Inc. 5000 list of fastest-growing private companies and #43 on this year’s Entrepreneur 360 list. In October Automation World included Seeq in its list of top technology startups to watch. “Leveraging both the expertise of the engineers and machine learning innovations, leading-edge solutions like Seeq enable organizations to gain intelligence from operations and obtain business value very quickly,” observes Janice Abel, Principal Analyst at ARC Advisory Group. “Seeq is designed for ease of use by a variety of plant employees, making it simple and quick for them to find and share insights in their data.”

Toyota Commercial Finance names new president and CEO

Toyota Commercial Finance (TCF) recently named Mark Taggart as the company’s new president and Chief Executive Officer (CEO). Dave Crandall, TCF’s former President and CEO, is retiring after 33 years with Toyota. “Mark is committed to doing whatever it takes to help deliver a world-class ownership experience to Toyota Forklift customers, supported by world-class financial services,” Crandall said. Taggart spent the last 16 years with Toyota Financial Services (TFS), most recently serving as president and CEO of Toyota Financial Savings Bank. In that role, Taggart was responsible for overseeing all of Toyota’s U.S. banking operations, which provide a wide range of services to Toyota and Lexus dealers and consumers. Taggart has served in numerous roles since joining TFS in 2003, including multiple general manager positions for TFS International in Japan. “It is such an honor to be part of the TCF team,” Taggart said. “We will focus on developing talent for the future by training our teams with a comprehensive view of the business, and leverage the best of each of our teams to make the whole group better. I look forward to finding ways to create synergies and reduce costs to make our company even more competitive in a world that’s changing faster than ever.”

Forklift dealers remind customers of 2019 year-end tax savings opportunities

As 2019 comes to a close many forklift dealers are reminding their customers of end of the year tax savings from the Tax Cuts and Jobs act signed on December 22, 2017. The maximum deduction limit for the Section 179 has increased to $1 million and equipment purchases to $2.5 million. The tax law also extended first-year bonus depreciations to include new and used equipment and in service after September 27, 2017. Both Section 179 and bonus depreciation now allow 100 percent write-off on used equipment in the first year and require that the equipment be put into use in the deduction year. All machines purchased and in service before December 31, 2019 may qualify for 2019 year-end tax savings. What is the Section 179 Deduction? Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. Several years ago, Section 179 was often referred to as the “SUV Tax Loophole” or the “Hummer Deduction” because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV’s and Hummers). But that particular benefit of Section 179 has been severely reduced in recent years (see ‘Vehicles & Section 179‘ for current limits on business vehicles.) However, despite the SUV deduction lessened, Section 179 is more beneficial to small businesses than ever. Today, Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits. Here’s How Section 179 works: In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example). Now, while it’s true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it. And that’s exactly what Section 179 does – it allows your business to write off the entire purchase price of qualifying equipment for the current tax year. This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2019 tax return (up to $1,000,000). Limits of Section 179 Section 179 does come with limits – there are caps to the total amount written off ($1,000,000 for 2019), and limits to the total amount of the equipment purchased ($2,500,000 in 2019). The deduction begins to phase out on a dollar-for-dollar basis after $2,500,000 is spent by a given business (thus, the entire deduction goes away once $3,500,000 in purchases is reached), so this makes it a true small and medium-sized business deduction. Who Qualifies for Section 179? All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2019 should qualify for the Section 179 Deduction (assuming they spend less than $3,500,000). Most tangible goods used by American businesses, including “off-the-shelf” software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction. For basic guidelines on what property is covered under the Section 179 tax code, please refer to this list of qualifying equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2019 and December 31, 2019. What’s the difference between Section 179 and Bonus Depreciation? Bonus depreciation is offered some years, and some years it isn’t. Right now in 2019, it’s being offered at 100%. The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation has only covered new equipment only until the most recent tax law passed. In a switch from recent years, the bonus depreciation now includes used equipment. Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,500,000) on new capital equipment. Also, businesses with a net loss are still qualified to deduct some of the cost of new equipment and carry-forward the loss. When applying these provisions, Section 179 is generally taken first, followed by Bonus Depreciation – unless the business had no taxable profit, because the unprofitable business is allowed to carry the loss forward to future years. Section 179’s “More Than 50 Percent Business-Use” Requirement The equipment, vehicle(s), and/or software must be used for business purposes more than 50% of the time to qualify for the Section 179 Deduction. Simply multiply the cost of the equipment, vehicle(s), and/or software by the percentage of business-use to arrive at the monetary amount eligible for Section 179. Past Section 179 Limits We’ve compiled a handy guide to Section 179 for previous tax years. Click the links below to be taken to the year of your choice. Section 179 for 2018 Section 179 for 2017 Section 179 for 2016 Section 179 for 2015 Section 179 for 2014 Section 179 for 2013 and 2012 Section 179 for 2011 Section 179 for 2010 Section 179 for 2009 Section 179 for 2008

Equipment finance industry confidence up in November

The Equipment Leasing & Finance Foundation (the Foundation) released the November 2019 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market is 54.9, an increase from the October index of 51.4. When asked about the outlook for the future, MCI-EFI survey respondent Quentin Cote, CLFP, President, Mintaka Financial, LLC, said, “It appears we have absorbed the headwind of the trade wars. Consumers still seem to be pulling the economy forward.” November 2019 Survey Results The overall MCI-EFI is 54.9, an increase from 51.4 in October: When asked to assess their business conditions over the next four months, 13.3% of executives responding said they believe business conditions will improve over the next four months, up from 9.7% in October. 73.3% of respondents believe business conditions will remain the same over the next four months, an increase from 71% the previous month. 13.3% believe business conditions will worsen, down from 19.4% in October. 13.3% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, unchanged from October. 63.3% believe demand will “remain the same” during the same four-month time period, a decrease from 73.3% the previous month. 23.3% believe demand will decline, down from 13.3% in October. 20% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, up from 16.7% in October. 80% of executives indicate they expect the “same” access to capital to fund business, unchanged from last month. None expect “less” access to capital, a decrease from 3.3% in October. When asked, 26.7% of the executives report they expect to hire more employees over the next four months, an increase from 16.1% in October. 73.3% expect no change in headcount over the next four months, an increase from 71% last month. None expect to hire fewer employees, down from 12.9% the previous month. 16.7% of the leadership evaluate the current U.S. economy as “excellent,” down from 19.4% the previous month. 83.3% of the leadership evaluate the current U.S. economy as “fair,” up from 80.7% in October. None evaluate it as “poor,” unchanged from last month. 10% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 3.2% in October. 76.7% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 58.1% the previous month. 13.3% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 38.7% in October. In November, 30% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 25.8% last month. 63.3% believe there will be “no change” in business development spending, a decrease from 71% in October. 6.7% believe there will be a decrease in spending, an increase from 3.2% last month.

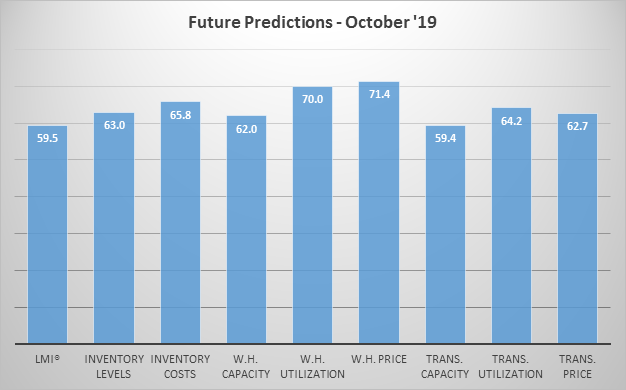

October 2019 Logistics Manager’s Index Report®

LMI® at 54.4%, Growth is INCREASING AT AN INCREASING RATE for: Warehousing Capacity, Warehousing Utilization, Transportation Utilization, and Transportation Capacity. Growth is INCREASING AT A DECREASING RATE for: Inventory Costs and Warehousing Prices. Inventory Levels are STEADY. Transportation Prices are DECREASING The LMI score is a combination eight unique components that make up the logistics industry, including: inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50 percent indicates that logistics is expanding; a reading below 50 percent is indicative of a shrinking logistics industry. The latest results of the LMI summarize the responses of supply chain professionals collected in October 2019. Seven of the eight metrics read in below their historical average. Only Transportation Capacity reads in above average. Transportation metrics continue to be the most dynamic measures in the LMI®. Transportation Prices dropped dramatically (-7.16) to 43.5. This indicates significant contraction in prices and has been more than cut in half (-44.5) from this time a year ago. Transportation Capacity is up (+5.94) (-5.34) from August, suggesting that there is slightly less slack in the transportation market than a month ago. These findings are corroborated by recent reports that volume is up, but prices are still down. The dramatic shift in Transportation Prices and Capacity can be seen in the chart below. We see very little movement in the inventory metrics this month. Inventory Levels (+0.0) maintained their slow growth at 55.1 which is consistent with September’s reading. Unsurprisingly, the subsequent change in Inventory Costs (-0.87) was very minor. Inventory Levels fell significantly (-4.42). Continuing the interesting trend from last month, inventory seems to be growing more slowly than we would normally anticipate for this time of the year as firms prepare for the holiday shopping season. Warehouse Capacity is up (+3.3) to 57.7, which is the highest rate recorded since May/June 2017. This suggests that either demand is down (which might line up with the slow growth in Inventory Levels), or that additional capacity continues to come online after the long shortage. Warehouse Prices are down very slightly (-4.0), but are still growing at a rate of 65.6. While there is still growth, it should be noted that is down 14.6 points from this time a year ago). The index scores for each of the eight components of the Logistics Managers’ Index, as well as the overall index score, are presented in the table above. All eight metrics show signs of growth, but many of them are moving at low or considerably decreased rates. The overall LMI® index score is equal to last month, tied for the second lowest point in the history of the index. Our reading indicates a continued trend of slow yet steady growth in the logistics industry. LOGISTICS AT A GLANCE Index October 2019 Index August 2019 Index Month-Over-Month Change Projected Direction Rate of Change LMI® 54.4 56.6 -2.19 Growing Decreasing Inventory Levels 55.1 55.1 0.00 No Movement Steady Inventory Costs 66.7 67.5 -0.87 Growing Decreasing Warehousing Capacity 57.7 54.4 3.26 Growing From No Movement Warehousing Utilization 67.3 65.8 1.48 Growing Increasing Warehousing Prices 65.6 69.6 -4.01 Growing Decreasing Transportation Capacity 65.4 59.5 5.94 Growing Increasing Transportation Utilization 60.4 58.1 2.24 Growing Increasing Transportation Prices 43.5 50.6 -7.16 Contracting From Increasing Respondents were asked to predict movement in the overall LMI and individual metrics 12 months from now. Their predictions for future ratings (which up to this point have been fairly accurate) are presented below. Historic Logistics Managers’ Index Scores This period’s along with all prior readings of the LMI are presented table below. The values have been updated to reflect the method for calculating the overall LMI: Month LMI Average for previous readings – 63.2 High – 75.7 Low – 54.4 Std. Dev – 5.8 Oct ‘19 54.4 Sep ‘19 56.6 August ‘19 56.6 July ‘19 57.2 June ‘19 56.0 May’19 56.7 April ‘19 57.9 March ‘19 60.41 February ‘19 61.95 January ‘19 63.33 December ‘18 63.54 November ‘18 66.98 October ‘18 71.20 September ‘18 70.80 July/August ‘18 70.80 May/June ‘18 72.55 March/April ‘18 75.71 January/February‘18 68.89 September-December ‘17 70.09 July/August ‘17 63.64 May/June ‘17 62.02 Mar/April ‘17 60.76 Jan/Feb ‘17 61.69 Nov/Dec ‘16 61.79 Oct ‘16 60.36 Sep ‘16 60.70 LMI® The overall LMI index is 54.4 in the October 2019 reading, down (-2.2) from the reading of 56.6 in September 2019. As mentioned above, this is the lowest reading for the overall index in the three-year history of the LMI. This is down significantly (-16.8) from this time a year ago, when it read in at 71.2. We have seen low scores for the LMI throughout the Summer and Fall, with the lowest seven scores in the history of the index coming in the last seven months. Respondents predict the LMI will be at 59.5 12 months in the future, down 4.2 points from September’s future prediction of 63.7. Inventory Levels The Inventory Level index is 55.1, which is exactly the same as the previous level, indicating no change in the amount of increase. This value is 7.0 points below the value one year ago and 16.1 points down from two years ago at this time. In this time of year, increasing inventory values might be expected, as companies build up inventories in preparation for the upcoming holiday shopping season. In the previous two years, this was the case. The recent lower growth numbers could indicate that inventory growth is slowing, which could indicate a lower sales expectations than previous years. When asked to predict what will conditions will be like 12 months from now, the average value is 63.0, indicating inventory levels are expected to continue to grow. This value is lower than last month’s year-ahead prediction of 66.2, and still consistent with a prediction of increasing levels next year, but another indicator of reducing growth. Inventory Costs Given the continued string of inventory growth numbers, it is

Is it time for a ‘fresh look’ at your business?

Before we get started, I would like to have you get hold of the October 31, 2019 issue of Forbes Magazine and Steve Forbes Fact and Comment on pages 21 and 22. In this column, he defends profits and wealth and how they help produce the GDP and GO numbers generated by our economy. He also goes on about the costs of living in a Scandinavia which are far above what any U.S. citizen is currently paying. In short, without wealth and profits our economy would stagnate. Well worth the read. In addition, there is a weekly commentary from John Mauldin called “Thoughts from the Frontline” which is free and very well written in “English” and understandable. I suggest you sign up for it and when you do go back over the last couple of months columns and find the discussion about MMT (Modern Monetary Theory) to get a review of what this all means. In very simple terms, MMT suggests can just print money to pay for things without impacting the overall economy. Personally, I have a problem with that theory. Mr. Mauldin tells it straight no matter if it is good news or bad news. He also invites other economists with opposing views to make their case as well. Both issues could be on your plate within the next 12-18 months requiring some thought as to how and when they may alter the course of your business. Back to a ‘fresh look’ at your business. At this time of year management is reviewing 2019 results along with the pluses and minuses encountered along the way, and at the same time creating the planning for 2020 along with a budget expected to meet debt service and adequate cash flow to fund Cap-X needs. I would assume that by the time you read this you have a folder on your desk containing both the plan and budget taking into account some sensitivity analysis reflecting how cash flow would be impacted if revenues fall short by 20% or exceed budget by 20%. Nice to have this data at your fingertips now so that you can have a plan in mind to mediate any cash flow problem. With all the craziness going on you should really have a fallback position planned out for 2020. Part of your year-end planning most likely includes a review of your current bank relationship including terms for your working capital lines, equipment lines, floor planning arrangements and potential new lease agreements and those covenants you need to deal with. Floor planning may be provided by another source but still requires a review to see if any adjustments are necessary. One adjustment I know of that needs discussion is the interest rate being charged because most likely the rate was set when interest rates were higher and expected to go even higher, when in fact they have moved lower and may wind up even lower yet. This being the case a request for a lower rate is certainly reasonable. And you know what, I think you will get it. Based on what I am hearing and seeing banks are looking for additional business and do not want to lose current customers. So, unless you are a terrible credit risk, I think you will find them to be willing to listen to any reasonable request for a rate adjustment. I recently had bankers in for one of the companies I work with and threw out how the rates have decreased and current Libor + 2% is lower than what I am paying. They didn’t walk out. They didn’t say “No”. In fact, they immediately said Ok, we will look at it and come back with a lower rate. Quite frankly, I almost fell out of my chair and was ready to ask for an interest only period but stopped myself before asking. So, get on the phone and get them in to discuss adjustments to loan terms, covenants and interest rates. You may be surprised at what you get. Now let’s get to the fresh look of your business. My question here is: ARE YOU CURRENT WITH INDUSTRY AND/ OR BUSINESS TRENDS you read about every day in the email you receive? Are you adapting to change, or will you find yourself competing with others who have lowered their costs along with providing more and better services? ARE YOU EASIER TO DO BUSINESS WITH than you were five years ago? If not, you need to take a ‘Fresh Look’ at your business and find out what others are doing, how much it cost to do it, and how they are implementing the changes and tracking result? Some of the questions you may investigate are as follows: Do you have an APP for your business? Is your accounting and CRM systems state of the art? Can you drill down into your data to search out opportunities? Are you marketing effectively and measuring related results? Are you training you sales staff using the latest lead generation methods? Are you making more money with fewer employees? If you cannot answer “Yes” to at least four or five of these questions, I suggest you bring your management team back to the table to discuss how you will remain competitive without adopting new systems and procedures that provide more sales per employee and more gross margin per employee, or said another way….using technology to replace people and reduce costs. Is it time for another meeting at your company?

U.S. Manufacturing Technology orders decrease in September, but Automotive sector sees slight increase

U.S. manufacturing technology orders fell 1 percent from the previous month to a total of $361.5 million in September 2019 according to the latest U.S. Manufacturing Technology Orders Report published by AMT—The Association For Manufacturing Technology. Orders decreased 41 percent from September 2018, yielding a 10 percent decline in the first three quarters of 2019. Aerospace orders were flat, machine shops were down modestly, and the automotive sector saw a slight increase despite a decrease in orders in the transmission and powertrain sector. “Manufacturing technology orders were lower in September than in August, which has only happened twice since USMTO started tracking data,” said Douglas K. Woods, president of The Association For Manufacturing Technology. “The automotive and aerospace sectors were higher, however, possibly due to companies looking to buy capital equipment and complete installation by year-end to take advantage of tax incentives. It could also be an indication that there was a bump of optimism in August around the GM and labor union talks and progress on trade issues. “Contract machining, which typically represent about 30 percent of all manufacturing orders, totaled about 40 percent over the last five months. However, in September, orders fell to 35 percent. This is likely due to customers reducing their reliance on contract machining and increasing capital investments in their own plants. “Spending in the auto industry was up by about 10 percent despite a significant decline in orders by the power transmission segment of the industry. This is indicative of a supply chain that felt confident that the GM strike would be short and that NAFTA 2.0 would be resolved favorably, again, coupled with the desire to get in orders before the end of the tax year. The supply chain in the automotive sector was feeling comfortable making modest investments to gear up for 2020. In addition to USMTO data, another key data point that supports this is that the industry saw the projection for the annual sales of vehicles go back up to over 17 million units in October. There is clearly optimism that things will be better by end of year. “The aerospace industry has been a stalwart in this downturn since the beginning of 2019. Spending in September was up modestly from August, and this is significant because it was achieved by broad investment across many companies, whereas August orders were based on only a few significant orders.”

Monthly Leasing and Finance Index: September 2019–Volume up 18%

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $1 trillion equipment finance sector, showed their overall new business volume for September was $10 billion, up 18 percent year-over-year from new business volume in September 2018. Volume was up 9 percent month-to-month from $9.2 billion in August. Year to date, cumulative new business volume was up 5 percent compared to 2018. Receivables over 30 days were 1.70 percent, down from 2.0 percent the previous month and up from 1.60 percent the same period in 2018. Charge-offs were 0.40 percent, down from 0.42 percent the previous month, and unchanged from the year-earlier period. Credit approvals totaled 76.3 percent, down from 76.6 percent in August. Total headcount for equipment finance companies was down 2.1 percent year-over-year. Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in October is 51.4, down from the September index of 54.7. ELFA President and CEO Ralph Petta said, “September data reflect solid performance on the part of equipment finance companies participating in the MLFI-25 survey. Another month of relatively strong fundamentals in the U.S. economy creates a favorable environment for businesses to continue to grow and expand, driving the equipment finance industry forward. Consumer spending continues to fuel the economy, notwithstanding signs of caution and concern raised by some over the impact of trade frictions with China, a pull-back in the U.S. manufacturing sector and recent geopolitical events in Syria, Hong Kong and elsewhere.” Michael DiCecco, Executive Vice President, Huntington Asset Finance, said, “Growth of 18 percent in new business volume on a year-over-year basis for September and 5 percent year-to-date demonstrates the strength of the industry and confidence that businesses had over the last 9-12 months to invest in equipment. However, it is important to note that the Foundation’s Confidence Index is showing a downward trend over the last three months and is now at the lowest level since 2016, reflecting a more cautious outlook on the strength of the economy heading into 2020.” View the full list of participants

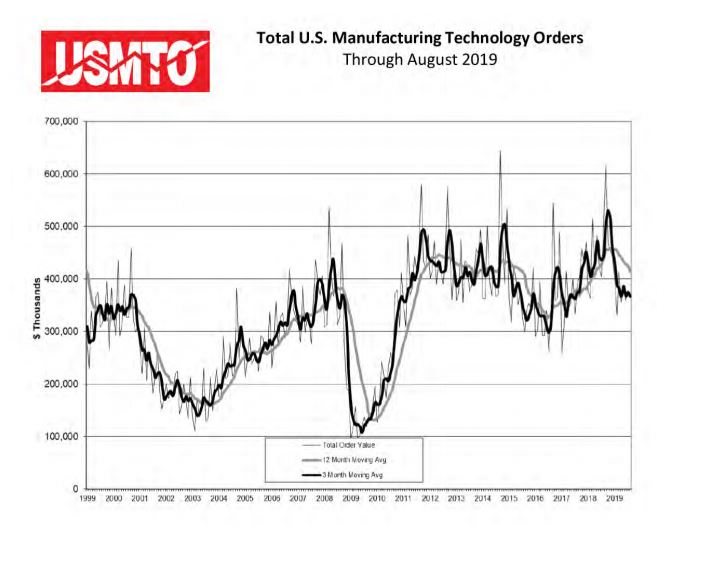

Metal Cutting Sector sees Robust Growth in S.E. and N.E., while overall U.S. Manufacturing Technology Orders decrease in August

U.S. manufacturing technology orders fell 3.2 percent from the previous month to a total of $365.6 million in August 2019, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. Orders decreased 27.6 percent from August 2018, which was the best August on record at $505 million. Orders for 2019 totaled just under $3 billion, a decline of 14.4 percent from the 2018 total to date. Despite the decline over 2018, the total value of manufacturing technology orders in 2019 are the second highest annual total through August since 2014. The Southeast region experienced robust growth driven primarily by orders in the metal cutting category. The Northeast was the only other region to have positive order growth from July to August. The North Central – East had the largest month over month decline, decreasing orders by over a quarter from July. The West and South-Central posted losses while the North-Central-West region was near-flat from over the previous month. “The consensus of analysts at MTForecast is that markets should pick up in the U.S. as early as next summer, and will pick up in Europe several months earlier, taking the pressure off the U.S.,” said Douglas K. Woods, president of The Association For Manufacturing Technology. “This was reflected at EMO Hannover where we saw a great deal of interest on the floor, particularly in the Industry 4.0/IIoT pavilion, but not a high level of capital commitment, reflecting uncertainty and challenges in the European market.” “Looking at Asia, it is likely the Free Trade Agreement with Japan will substantially reduce tariffs on U.S. machine tools imports from Japan, which will require some adjustments. Overall, it should have a positive impact on trade and improve the profitability and opportunities of U.S. agricultural, automotive and aerospace sectors, which could well offset any negative effects of tariffs falling on manufacturing technology imports.” Orders from machine shops were near-flat, yet showed a slight increase over July. Construction machinery manufacturing vastly expanded orders over July. Aerospace orders increased by nearly a third. The automotive sector decreased orders overall despite modest increases from the transmission and powertrain manufacturing sector.

Equipment Leasing and Finance Industry confidence eases in September