Vidir Solutions has announced the pan carousel automated storage system

Optimized vertical carousel for enhanced inventory accessibility and ergonomic performance Vidir Solutions has announced the Pan Carousel, a vertical carousel expertly

Optimized vertical carousel for enhanced inventory accessibility and ergonomic performance Vidir Solutions has announced the Pan Carousel, a vertical carousel expertly

Comprehensive solution engineered for efficient and cost-effective rack maintenance SpaceGuard Products has announced its Centurion™ Pallet Rack Repair Kits. The Centurion™ line

Mike Baily, an Industry Specialist at REB, has passed away. A tribute was published on LinkedIn, expressing heartfelt messages about

Bradford Systems has announced a strategic partnership with Rainbow Dynamics. This collaboration aims to revolutionize storage and retrieval systems across

Visit booth #S1956 to see how versatile VRCs improve efficiency and worker safety PFlow Industries will showcase its vertical material

Mallard Manufacturing, a leader in gravity flow racking systems and solutions, will exhibit at PROMAT 2025 in Chicago, IL, from

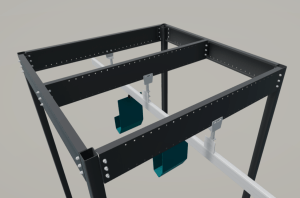

New framing solution provides versatility, cost savings, and seamless integration with Steele Solutions’ platform systems. Steele Solutions Inc., a manufacturer

This growth will further Wize Solutions’ plans for the Phoenix Metro Area Wize Solutions has announced that it has acquired

Fourth quarter and full year 2024 diluted EPS of $1.22 and $8.46, respectively. Fourth quarter and full year 2024 net

Versatile portable racks provide a wide range of flexible storage solutions for warehouse professionals Selective pallet racking is a versatile,

KPI Solutions (KPI), a supply chain consulting, software, systems integration, and automation supplier, announced that Gartner has recognized the company

stow announced the successful completion of the largest mobile racking installation in Northern Europe, at Frigoscandia’s state-of-the-art logistics facility in

Consolidated net earnings attributable to Nucor stockholders of $249.9 million, or $1.05 per diluted share Adjusted net earnings attributable to

For businesses seeking optimal warehouse logistics management, Steel King Industries, an OEM with extensive expertise in designing and manufacturing high-quality

MAHLE Aftermarket turned to Kardex for an automated storage and retrieval solution following a shift in orders from large pallets

Nucor Corporation announced consolidated net earnings attributable to Nucor stockholders of $645.2 million, or $2.68 per diluted share, for the

Fairchild Systems, a division of Fairchild Equipment, has been named one of the top 8 dealers, receiving the prestigious 2023

Vertical reciprocating conveyors (VRCs) act as the pivotal link between two major trends in warehouse operations that are dramatically increasing

Net earnings attributable to Nucor stockholders of $844.8 million, or $3.46 per diluted share Net sales of $8.14 billion Net

Nucor Corporation just announced that it has acquired Southwest Data Products, Inc. (SWDP), a manufacturer and installer of data center