Sunbelt Rentals acquires Wagner Rental & Supply locations

Sunbelt Rentals has acquired Wagner Rental & Supply, which has locations in Chillicothe, New Boston, Jackson, Ohio, and Ashland, Kentucky.

Sunbelt Rentals has acquired Wagner Rental & Supply, which has locations in Chillicothe, New Boston, Jackson, Ohio, and Ashland, Kentucky.

October New Business Volume Up 6 Percent Year-over-year, 11 Percent Month-to-month and Nearly 6 Percent Year-to-date The Equipment Leasing and Finance Association’s (ELFA) Monthly

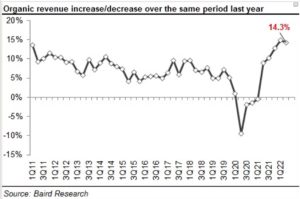

After two years of rapid post-pandemic revenue growth in 2021 and 2022, the equipment rental industry is expected to see

United Rentals, Inc. has announced that the company has entered into a definitive agreement to acquire the assets of family-owned

Despite early indicators of a modest rebound in equipment and software investment growth in Q3, demand may soften in several

Third Quarter Highlights Equipment rental revenue increased 35.9% to a record $706.2 million Total revenues increased 35.4% to $745.1 million

LiuGong North America has added another Florida-based dealer to its lineup, in the form of Hollywood, Fla.-based Durante Equipment. Durante

August New Business Volume Up 4 Percent Year-over-year, Down 13 Percent Month-to-month, Up 5 Percent Year-to-date The Equipment Leasing and Finance

Surrey, BC/Territories of the Coast Salish (Kwantlen, Katzie, Semiahmoo, Tsawwassen first nation) Territory – Westland Insurance Group (Westland) and the

Effective September 21, 2022, H&E Equipment Services Inc. (H&E) announces the opening of its Hollywood rental branch, its 10th in

LogiMove adds extensive mobile workflow capabilities to the Texada rental management platform enabling powerful applications including automated equipment inspection Texada

July New Business Volume Up 2 Percent Year-over-year, down 2 percent Month-to-month, up 5 percent Year-to-date The Equipment Leasing and Finance

This should be fun! Here I sit putting my thoughts together on July 27 waiting on Mr. Powell to announce

Today’s economic indicators are mixed and uncertain, but all continue to point toward significant growth for equipment rental revenue in

The American Rental Association (ARA) announces Erika Singleton as the association’s new Workforce Development Manager. With a background in human

Second Quarter Highlights Equipment rental revenue increased 35.1% to a record $605.4 million Total revenues increased 30.5% to $640.4 million

Bomag Americas announced the passing of Bert DeJong, a company leader and industry veteran for more than 30 years. DeJong

Sixty-one percent of respondents said second-quarter revenue exceeded expectations, while 34 percent reported revenue in line with their initial expectations.

Rental Equipment Investment Corp. (REIC), a portfolio company of Kinderhook Industries LLC, announced the acquisition of Cahill Services. Cahill represents

The Equipment Leasing & Finance Foundation (the Foundation) releases the May 2022 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index