Creating high-performance teams with engagement and results

When most forklift dealerships evaluate the success of their aftermarket departments and functions, they focus on the usual Key Performance

When most forklift dealerships evaluate the success of their aftermarket departments and functions, they focus on the usual Key Performance

Back in March of this year, after attending and exhibiting at this year’s record-breaking ProMat Show in Chicago, one thing

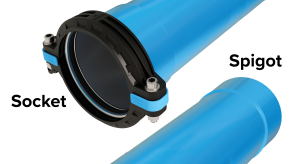

An easy-to-install, cost-effective solution delivering the renowned robust pressure and resistance of Unipipe systems Unipipe Solutions, a provider in the industrial

As we enter the second quarter of 2025, the material handling industry continues to see the trend toward electrification and

As we enter the second quarter of 2025, the material handling industry continues to see the trend toward electrification and

The Women In Trucking Association (WIT) has announced Alyssa Briggs as its January 2025 Member of the Month. At only

Another January is upon us, and with it comes the opportunity to reflect on the year behind us and set

Intella Parts Company has launched its innovative mechanic network, designed to connect forklift owners with experienced independent technicians across the

In one of my past editions, I shared that dealers sometimes struggle to differentiate the role of an equipment sales

During my recent travels and meetings with industry colleagues, dealers, and OEMs, many discussions took place exploring the dynamics and

In April’s edition, I wrote about the topic of data-driven decision-making. In one instance, I discussed how most dealerships I

I recently attended MODEX 2024, and this year’s show was highly anticipated by professionals across our industry. Automation, robotics, software

As we are well into the first quarter of 2024, the subject of labor shortages continues to be a trend

Motion Industries, Inc., a distributor of maintenance, repair and operation replacement parts, and a premier provider of industrial technology solutions,

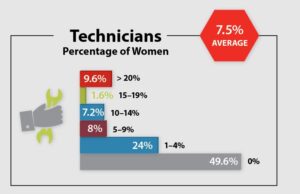

According to new data from the 2023 WIT Index, which was released recently by the Women In Trucking Association (WIT),

Concentric, LLC announced the acquisition of Retech. An established market leader across the US, with headquarters on the west coast,

I recently met with a customer discussing their service technician opportunities and while we were talking about this, we also

I am sitting at my computer on May 14 wondering if my T Bills will be worth anything two weeks

I recently attended the MHEDA’s Annual Convention and Exhibitor Showcase and as always, came home with some great takeaways and

With this month’s issue we are putting the spotlight on safety, it is a good time to discuss some products,