Glorified parts runners

Last month, we spoke about the differences between equipment salespeople (ES), and customer service representatives (CSR’s). I explained that your equipment sales staff is akin to a group of hunters, that seek singular targets and specific results. CSR’s in contrast, look to establish and cultivate ongoing, long-term relationships with end-users. The customer’s connection to the dealership may have been initiated by the ES, but their most frequent touchpoint on an ongoing basis should be with the CSR (and your field service personnel). Done successfully, the CSR’s will establish themselves as an integral part of the dealership’s value proposition to the customer. Once established, and properly cared for, it will be difficult for your competitors to infiltrate these customers when it comes time for renewal. We hire CSR salespeople to represent our aftermarket department. I like to call them “customer care” representatives because their key role is the ongoing development of these high-value relationships. The CSR should be the center point of our customer experience, and they should be the initial responder when customer interaction is needed. Many dealerships however fail to define the role of the CSR role or manage its activity and processes properly. What is the job of a CSR? What should a CSR spend their day doing? What does the dealership expect from a CSR? How does the CSR measure his own success? CSR highest and best purpose It’s harder to define the role and expectations for a CSR than it is for an ES. The ES is engaged in selling products that can be easily quantified. Customer service is much more fluid and dynamic. Because of this hard sales targets may be surrendered for the more nebulous goal of “keeping the customer happy”. When this happens, the activity of the CSR can devolve into a range of tasks that are neither productive nor profitable. In these dealerships, the CSR’s spends the majority of their day engaged in one of three tasks. Delivering parts to customers that service their own fleet of equipment Delivery (and possible review) of service invoices as well as mediating service department invoice disputes. Preparing and delivering quotes for suggested service found on PM’s These tasks may be necessary based on your policies, practices, and routines. They are not however the highest and best purpose for a CSR. This is what I feel should be the mission statement of every CSR: “To establish and maintain valuable partnerships with customers that manage expectations, and result in prudent and value-added management of their equipment fleet”. If the activity of the CSR is not supporting this mission statement, then we need to rethink their role. Their call planning, daily tasks, and customer interactions should all be supporting this value-centric partnership. Parts Delivery So, are your CSR’s doing that, or are they simply glorified parts delivery people? No doubt you have some customers that promise to buy parts from you because the CSR is willing to deliver them personally. Before we offer this service to the customer however, let’s do a little math. How much parts business are these customers actually giving you? What is the actual cost of making these deliveries? Are you getting ANY service billing in addition to the parts? If you take the time to drill down, many times you will find that these visits are not worth the investment of time, energy, and dollars. If all we are doing is showing up to delivery parts (which are routinely discounted) and the customer visit is not designed to actively pursue additional business, we may be wasting our most precious resource…. time. Let’s say a capable CSR is paid an average salary and commission $60,000. He visits a parts customer 40 miles away, twice a month, and delivers parts. It takes him 30 minutes to confirm the order, print and organize the paperwork, and box up parts from the parts department. He loads his truck and invests 40 minutes to drive to the customer location. He delivers those parts and spends 20 minutes in conversation with the customer. These conversations may be about service or technical items, but mostly it’s just idle chatter. Rarely are any other proposals offered. Accessories and allied products are normally not discussed. The CSR delivers the parts and makes some friends. End of story. The CSR invests 3 hours a month for this one customer doing a task that in every measure can only be described as “goodwill”. At a rate of $250 per day for the CSR, this is the cost to the dealership: 3 hours at $31.25 = $93.75 80 miles at 0.55 = $ 44.00 Net Cost = $137.75 At this rate, this CSR has to deliver $400 in parts every month just to break even. You could hire a private courier service for less money, and at least make a profit! At a minimum, hire a parts runner at minimum wage. The point I am trying to make here is that the “face time” a CSR has available in the field is valuable, and we routinely waste it doing valueless things. I don’t mind the occasional parts delivery, but ONLY if the trip to the customer site was to propose other products, programs, or value-driven services. Delivery of parts should be an adjunct function, not a primary task. Invoice Review Many customers, especially the ones with large fleets, want the CSR to print, collate, deliver, and review service invoices on a periodic basis. This can be a valuable visit. At least the face time dedicated to these visits is with a decision-maker. The problem with these visits is that many times the CSR is simply there to “explain the price”. The customer sifts through the invoices, and questions the CSR on the validity of the labor allowances and parts markups, and the CSR posts a defense of why these charges are appropriate. In these situations, the goal of the CSR is survival. The focus is to get out of there

Status report, please

Well, how is it going out there? You where you think you were going to be? Are customers still buying at your best guess rate considering COVID-19? Even though customers are still buying, how much longer can that go on considering shortages of parts and materials. Are you going to survive the PPP forgiveness test? Did you include the “forgiveness” in your income tax estimate for the current year? Remember you have one last chance to use the Bonus in 2020. And if you decide to purchase equipment towards that end, will it show up by December 31, 2020 to allow the deduction? How is your cash balance holding up? How about where you stand versus your ’20 budget? Are you closely monitoring AR and the approval process for new customers? The latest news is the Fed will hold interest rates low until there is a clear indication of a 2% average increase in inflation which could take two years to get here. Does the bank still love you? Same question regarding your OEM’s and related finance companies. Time to review your bank loan and OEM agreements. On the positive side are you seeing any “opportunities “in terms of new lines, small undercapitalized service providers, poorly operated competitors, or add-on products or services to sell to customers? Are you pursuing technology to make you more efficient, easier to do business with, and at the same time inform customers of “deals” as well as required equipment repairs? Are you in touch with dealers within your network to share ideas and information to help survive this pandemic? If not, you should. Those Currie dealer groups work! And they will put you on a path to improve profits and company value. No matter how you answered any of the questions above every dealer or service provider needs to be cautious when it comes to keeping the company solvent, profitable, and valuable. Personally, I have been updating the budgets every 60 days or so and making department managers explain any pluses and minuses relative to the existing budget in place as well as their support for the adjusted budget going forward. At the same time, I am projecting out a cash balance for the end of each quarter using historical collection results and also taking into account all debt service currently on the books as well as any contemplated for the current quarter. I then extend this review to the end of the year or six months out whichever is longer. Obviously, the key to any budget or cash flow analysis is revenue projection. Needless to say, all departments need to provide reasonable budgets and have a plan to hit the quarterly results projected. Any indication that cash flow is slipping or actual results continuously below budget indicates that certain direct and overhead expenses need to be trimmed to align with revenues. And the longer you wait to make these adjustments the more likely you will not survive the recession. Calculate what it takes to replace $1 of cash flow because I assure you once you do you will never again hesitate to adjust costs in a timely fashion again. As far as I can tell prices are feeling the impact of COVID-19. THEY ARE ALL HIGHER! How will this impact your operating results or sales opportunities? Those fixed maintenance contracts will take a hit should parts and supplies increase in cost by 10% or so. Does it make sense to increase expenses for budget purposes? You can always try to pass on these cost increases at the risk of encouraging customers to shop the market. There is no doubt that dealers with a meaningful “systems” department have an advantage. There seems to be a new warehouse going up on every block where I travel. These systems need to be designed, a budget prepared for approval, financing obtained, employees trained and a maintenance contract agreed to. Since these systems are the bread and butter of efficient warehouse operation the dealers who control these systems have a stronger bond with the warehouse user. Much easier to sell additional products and services. The Bottom Line here is your operation needs constant management with a goal of maintaining positive cash flow. Attain this goal and the rest is downhill. Garry Bartecki is a CPA MBA with GB Financial Services LLC. E-mail editorial@mhwmag.com to contact Garry

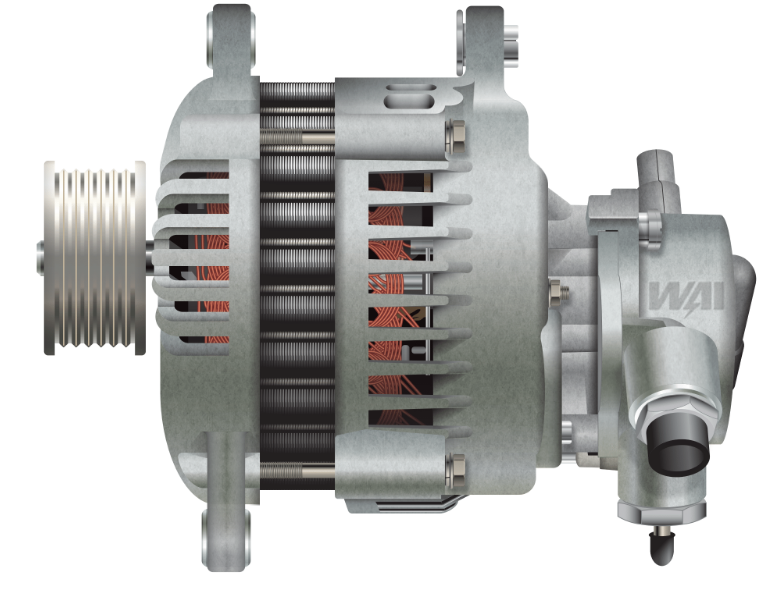

WAI Global features Starters and Alternators for Forklift

WAI Global, a global parts manufacturer for the heavy-duty, agricultural, automotive, industrial, and power sports aftermarket, features its complete line of starters ideal for forklift. WAI has worked relentlessly to meet the ever-changing needs of its customers in the forklift market. This includes an unwavering commitment to be “first-to-market” with the latest and most superior model products available. WAI Global’s starters and alternators boast proven superior quality and are tested to OEM specifications and include premium Transpo electronics and WBD grade bearings manufactured by WAI. Alternators boast top performance with thorough testing at idle and full load RPMs. Starters are tested for RPM, torque, voltage, and solenoid performance. Additionally, validation testing for all products includes endurance, humidity, power thermal cycling, vibration, salt spray, and thermal shock. Every starter and alternator comes with extensive coverage and a warranty rate reduction through the extended field life of new units. Test sheets are included in every box.

Plibrico’s Manufacturing flexibility helps customers make strong business re-openings

Plibrico’s customer-centric core value assist in making safe return-to-work strategies successful As thermal processing plants re-open across America, they face challenges and uncertainties never witnessed before, from reestablishing supplier channels for critical materials to servicing new orders resulting from pent-up demand. All while at the same time ensuring the health and well-being of their employees. One company that is helping make plant re-openings successful is the Plibrico Company. A major supplier of refractory solutions for the aluminum, steel, mineral, and petrochemical processing industries, with special expertise in ensuring the safe, productive operation of high-temperature furnaces, boilers, and incinerators. Plibrico is playing a major role in the safe return-to-work strategies of its industrial customers by instituting a robust COVID-19 Response Plan that includes swift action to client dynamic needs. Many thermal processing plants that were running on a reduced schedule or idled, are now returning to work and starting to reopen. As production starts to ramp up, organizations find themselves in critical need of refractories for unplanned repairs or maintenance. Refractories that are vital for them to ensure a reliable and safe return to operation. “I am extremely proud of the Plibrico employees that have helped our customers make a strong comeback during this turbulent time,” notes Brad Taylor, President and CEO of the Plibrico Company. “Today’s demand for refractories has presented both a challenge and an important opportunity for us to demonstrate our flexibility and commitment to customer success.” Taylor points to Plibrico’s Oak Hill, Ohio manufacturing site as an example of the company’s strengthened resolve. The majority of Plibrico’s refractory materials are manufactured at this centrally-located production facility. An extensive inventory of raw materials is stored and processed here, resulting in the plant being known industry-wide for its fast turn-around of quality refractory products. “Even during April and May when customers were grappling with the volatility of the marketplace, Plibrico increased its commitment to its customers thru increased inventory and staffing. The increases allowed added flexibility to ensure on-time delivery at a time when our customers needed us the most,” said Taylor. “Plibrico customers have come to rely on the flexibility and strength of our manufacturing facility to be able to help them meet their challenging schedules, and that’s what we deliver. These are the situations where Plibrico has always excelled.” One example was a customer that had an unexpected schedule change and required a large expedited order of multiple refractories. The catch? All refractories needed to be produced and delivered to Nebraska in only two days. The purchase order was received on a Tuesday morning that had the plant spring into action. Remarkably, the Plibrico team manufactured the entire order by Wednesday. Next up was Plibrico’s logistics team which put in extra hours processing the paperwork, loading the truck, and getting the shipment delivered to Nebraska to satisfy the customer’s short timeline. Another case of an exemplary customer experience came in the form of an aluminum processing plant. In the midst of a scheduled repair, the aluminum plant’s manager realized he needed two more pallets of special refractories to finish the project. Plibrico received the order on a Monday morning, and once again quickly responded, re-organizing its schedule to manufacture the special material the customer needed. Despite it being a holiday week, the Plibrico team secured a truck and shipped the load overnight so that the customer had it first thing in the morning when the work crew came in, avoiding additional costly downtime. As the economy starts moving forward, thermal processing plants are beginning to increase their production schedules and shuttered plants are starting to re-open. Successful safe return-to-work strategies include re-engagement of supplier channels for critical materials like refractories. Pivoting plant schedules and changing demands, makes supplier flexibility and superior customer service key to achieving success. Plibrico’s customer-centric core values, safe robust response plan, and willingness to go the extra mile are helping its customers achieve their return-to-work goals. Plibrico customers are emerging stronger and better prepared to meet their production and competitive market demands.

Business in a Post COVID-19 world

As I write this article in early May, I am hoping that by the time it hits your inbox, COVID-19 will be solidly in the rear-view mirror, and you will be experiencing some sense of normalcy and return to business as usual. All of that remains to be seen. Businesses are already fretting over how to hit the restart button, and what kind of regulatory hurdles they will encounter to demonstrate safe operation and due diligence. Company manuals will likely have to now include social distancing guidelines and explain measures to ensure the safety of both employees and customers alike. Our industry is one that has limited “over the counter” operations, as most dealership activity takes place over the phone, or while visiting the customer’s place of business. This actually COMPLICATES the issues at hand. How can you prepare for the myriad of new rules and distancing requirements that will undoubtedly be an obstacle to gaining entry to new and old customers alike? Understanding PPE requirements From gloves to face coverings to full disposable coveralls, there will undoubtedly be requirements where your field service technicians will need to “suit up” in PPE equipment that will be confining and uncomfortable. It will be best to prepare them now by stocking the van with appropriate PPE, and metering these requirements into your daily work routine so that these items can be normalized over time. The earlier you start, the better it will be for your staff and your customers. Not every customer site will have the same requirements. For this reason, it’s important to contact customers immediately after they restart operations to ascertain what is and is not required. Having this compliance data keyed into a customer file window that is visible during the dispatch or PM scheduling processes is vital to show up “ready”. The work orders issued to the technician should also visibly display this data so that they are aware of what the requirements are. Sanitary services Many of you have already anticipated the needs, and have expanded your service offerings to include disinfecting equipment for customers. I expect that this will be an ongoing need in a post-COVID-19 world. It goes without saying that you will need to ensure that equipment decontamination is an integral part of all current service and repair processes. The customer, however, may require you to offer “stand-alone” decontamination on a weekly, daily, or pre-shift basis. The sanitizing services I have seen in the marketplace already include the following: Disinfectant applied (with a 10-minute rest) to all high touch areas (as per CDC guidelines): Overhead guard and grips or door handles Steering wheel, hydraulic and steering column control levers Dashboard, including key switch and emergency brake lever Dipstick pulls, covers and caps Hood, latches, seat, arm-rests, hip restraints LP tank brackets and couplers and hoses Battery connectors, vent caps, and cables (for electric units). Health certifications Although it is not yet a requirement in the USA, any spike in virus infections or (God forbid) the rise of another virus, may eventually require that your field personnel have some sort of health certification stating that they have tested positive for antibodies, or that they have been vaccinated against a particular virus. This is being seriously considered in countries like Chile, Turkey, and the UK, especially in connection to the travel and hospitality industry. Although these measures are not required here (at this time), I would expect that eventual countermeasures may include this provision especially in companies that are a part of the food processing and distribution supply chain. Although certification may possibly include some form of a certificate from a health testing organization, broader health safety measures don’t necessarily have to start there. This process could initially roll out with a company health and wellness statement that assures customers of the preventative measures taken for all field personnel. This could include a list of requirements enforced by the dealer prior to entering a customer facility. PPE, consistent with the customer’s needs Pre-shift or multiple hour body temperature logs Handwashing requirements Document handling (touchless delivery) Equipment decontamination (post-repair). It would be smart to be ready to investigate and implement ways to be compliant with any certification requirement should it arise. If the virus fades, it may not be necessary. That said, COVID-19 will not be the last virus we will ever see. Having a contingency plan in place to offer this level of assurance to your customers will give you a decided advantage over your competitors. Field service readiness Yes, I am going to beat this drum again! Are your technicians READY to perform multiple service functions on a single visit, with the resources they currently have on the service van? Unless you equip your technicians will the tools to quote, close, and complete routine repairs ONSITE, return visits to the customer location will continue to hamper your effectiveness. Most dealers do not supply their technicians with these tools to use independently. Life has changed. It’s hard enough to collect the proper PPE and jump through all of the hoops to get into the customer’s facility the first time. Coming back two or three times because the service department had to issue a quote for the repair, or the technician had to fetch parts he didn’t have in the van will only irritate your customer AND your technician. Your customer hates paying for return travel time anyway. Imagine when you add the time for multiple entry requirements. The bottom line is that you must be READY. Being ready requires an investment in a meticulous analysis of the equipment population assigned to every field technician. It requires stocking parts on the van that are CONSISTENT with this analysis. It requires drafting pre-engineered menus of common repair items that are applicable to each make and model of equipment being serviced. This menu must detail the parts needed to complete the repair (including fluids, grease, and hardware). It must also include reasoned labor allowances, disposal costs, fees, and

Good, cheap pneumatics

Good, Cheap Pneumatics For the past three issues of MHW, we have been writing a series of articles based on the information and ideas presented at the 2019 MHEDA Rental and Used Equipment Conference. This conference was held in October of 2019, and during the conference, I shared ideas and strategies with the attendees regarding best rental and used equipment practices, and strategies. Although the information provided by the speakers was relevant and useful, some of the most exciting ideas were shared across the table at the breakout sessions. The best and most applicable ideas in sessions like this, are usually shared “dealer to dealer”. This month I want to leave the rental department behind and focus on some of the ideas shared in regard to used equipment. Used Equipment Strategies: Sources The one recurring theme I hear from used equipment managers is that they just can’t find good used equipment. One reason for this is that in a dealership setting, the bar is set relatively high in terms of what is acceptable, and saleable, and what is not. We (and our customers) tend to want USED equipment, not OLD equipment. Telling the difference can be a moving target, as year of manufacture sometimes doesn’t indicate a unit’s true age and condition. Equipment shows its age first in hours, then in years. Can you trust the hour meter? It depends on where the unit came from. In our business there a few popular sources of used equipment: Rental Fleets – YOU are always your best and first source for used equipment. I find that dealers that have built and cared for their rental fleets properly, seldom have to look outside their own resources to find pre-owned inventory for sale. Leasing Companies – Lease returns are another valid source for sourcing used equipment, especially if you are looking to purchase a “package” of multiple units. It’s common for finance vendors to partner with dealer organizations, so if you are looking for a particular brand, this is the place where you are likely to find an ample list to choose from. The down-side is that you have to share your profitability with the finance company. Acceptable residual values on original leases have also increased over the years. Add the seller’s markup, and prices can get pretty steep. This can squeeze your budget for refurbishment, and affect your overall profitability. We also need to be careful. Many long-term leases have been pushed from 60 to 72 or even 84 months. The original lessee most likely had a duty cycle of more than 1 shift. Combine these two factors and you may need to check the hour meters to see if the deal is worth making! Wholesalers – I love these guys, and they are necessary to our business. For the dealer wholesalers exist to DISPOSE of equipment that is not suitable for the retail market. There are times however when you can partner with a wholesaler and participate in a purchase of your brand of equipment. Dealing with wholesalers is a “caveat emptor” situation. These guys are also direct sellers in your marketplace. Make sure you insulate yourself properly, and inspect machinery carefully. Warranties from wholesalers usually end at their driveway. Trade-ins – Most of the equipment the dealer takes on trade is being traded in because it is PAST its useful economic life. An old used equipment guy once told me “don’t water dead plants”. This applies to most of the equipment traded in today. Use your network of wholesalers and move these units off the lot. Even if you have to take a small loss, it’s better than pitching a tent over it in the shop, and then trying to sell an overvalued boat anchor. Brands Many dealers have taken to the practice of only selling used equipment that is manufactured by the OEM they represent. All other brands are sold on the wholesale market. This policy provides some advantages. Parts are available and priced right. Not having to buy your refurbishment parts from the dealer preserves your profitability. Technical expertise. Your service crew knows these units. This makes labor allowances easier to manage. Limiting available used trucks to only your OEM drives your brand and unifies your messaging. If all of the equipment on the lot is the same color, the customer will correctly assume that you can answer all the questions, and undoubtedly provide the after-sale service. All of this said, I usually see this “OEM brand only” policy in dealerships that have either have adequate rental fleet to feed their used equipment inventory, or they have a close relationship with the leasing agents that routinely market their brand. Grades and quality Let me just start by saying the words “good, cheap and pneumatic” don’t belong in the same sentence. By far, ITA class 5 forklifts are preferred in the used equipment marketplace. The reason is simple. Pneumatic tire forklifts can perform a wider range of tasks, and operate both on improved and unimproved surfaces. As the hot commodity, you will rarely want to discount a good pneumatic unit, as they hold their value well. But, if I had a dollar for every time a customer was looking for a good, cheap pneumatic I’d be a rich man. So, what does “good used equipment” mean in our business? In my experience, most well run dealerships will limit retail used equipment offerings to units that are able to pass the following test: Under 10 years old Under 15,000 hours No visible engine smoke No visible engine oil leaks Transmission does not slip Starter bendix and flywheel in good condition Ignition provides clean start within 5 seconds No hydraulic leaking or seeping from any cylinder No hydraulic valve cavitation At least 50% tire life remaining If it passes these tests…. it’s a machine that most likely will provide a customer with a useful life in a light to moderate use environment. Warranty It’s also a machine that the dealership

WAI Global to showcase Starters and Alternators at ConExpo-Con/Agg Show 2020

WAI Global, a global parts manufacturer for the heavy duty, agricultural, automotive, industrial, and power sports aftermarket, announces that it will showcase its starters and alternators at the ConExpo-Con/Agg Show in Las Vegas, March 10-14, 2020, booth #B93921. WAI has worked relentlessly to meet the ever-changing needs of its customers in the heavy duty, agricultural & industrial markets. This includes an unwavering commitment to be “first-to-market” with the latest model products available. WAI will showcase an extensive range of its 100% new alternators, starters and their components. WAI’s complete line of starters and alternators are ideal for class one to class eight trucks, construction, forklift, and farm equipment. WAI Global’s starters and alternators boast proven superior quality. More than two million units have been sold over the past decade which are tested to OEM specifications and include premium Transpo electronics and WBD grade bearings manufactured by WAI. Alternator output current is thoroughly tested at idle and full load RPMs. Starters are tested for RPM, torque, voltage, and solenoid performance. Validation testing for all products includes endurance, humidity, power thermal cycling, vibration, salt spray and thermal shock. Every starter and alternator comes with extensive coverage and a warranty rate reduction through extended field life of new units. Test sheets are included in every box.

Toyota Lift of MN repeats having the Best of the Best Forklift Technicians in the USA

Toyota Lift of Minnesota (TLM) has again had multiple technicians gain Toyota Material Handling’s highest certification level, their Platinum Master Technician Certification. This year six TLM technicians attained the platinum level out of a total of 36 that reached that certification level nationwide. 119 technicians tested for the certification nationally. TLM is very proud of the documented abilities in their technician pool supporting the TLM Minnesota and western Wisconsin customer base. “Customers know when purchasing our product they receive Toyota’s unquestionable leading quality, and engineering excellence. They also expect the best service support to maintain the Toyota product,” said John Scheunemann president of TLM. “Our technical staff year over year has seen multiple technicians attain Platinum Master Technician Certification. It is not the first time we have had the most technicians in the country receive the certification”. Customers are owed service of their equipment by personnel specifically trained on their valuable assets. Techs without factory designed training usually increase downtime and in many cases result in higher maintenance expenses. A true master forklift technician knows what issues to look for and where those issues are going to be. Lengthy repairs equal lengthy and expensive delays. Experienced and technically capable technicians diagnose and fix problems faster, and get equipment back into service quicker. We are proud to support our association with Toyota Material Handling by continually stressing the value of training and product knowledge with our staff in all positions. Toyota-Lift of Minnesota (TLM) has been the area’s fastest-growing forklift and material handling dealerships. Established in 1978, we are currently offering a full line of high-quality lift trucks, aerial equipment, personnel and burden carriers as well as warehouse and material handling systems sold through our Warehouse Systems division.

Shoppa’s technicians earn recognition from Toyota

Five secure coveted Platinum Certification, one selected for national competition An unprecedented number of Shoppa’s Material Handling technicians recently passed the Toyota Material Handling Platinum Master Technician Certification, including one Shoppa’s technician selected out of nearly 120 applicants to compete for Toyota’s prestigious technician title. “Our customers demand technicians who can keep their forklifts and other equipment well-maintained and operating efficiently,” said Jim Shoppa, owner of Shoppa’s Material Handling. “With these most recent certified technicians, customers can be confident the very best in the industry are working on their equipment. I am proud of the level of excellence these Shoppa’s technicians have demonstrated.” Toyota’s unparalleled reputation as the number one forklift manufacturer in North America, with the longest lasting parts, stems from its dedication to training and developing the best technicians. Technicians are required to take classroom courses and accrue up to five years hands-on experience to earn certified, bronze, silver, gold and platinum rankings. Overall, 36 out of 119 applicants tested nationwide achieved the Platinum Certification. The five Shoppa’s technicians who earned the certification will be recognized by Toyota and Shoppa’s. Additionally, they will be recognized at Shoppa’s and at the TMHU North American Headquarters in Columbus, IN. in the Platinum Level display case, with a plaque bearing their name. Ten of the 36 were selected to visit the North American Headquarters in Columbus the week of December 9, for Toyota’s “Platinum Skills Challenge.” One Shoppa’s technician was selected to compete in this rigorous Platinum Skills Challenge, comprised of various work stations. The technicians will rotate through each station, attempting to complete each within the given timeframe. The winner of the Technician Skills Challenge will be recognized as Toyota’s Top Technician for 2020. The Shoppa’s team is honored to have a technician competing in this “best of the best” competition and will continue to develop technical expertise among the entire service team to meet growing customer and industry demand.

2020 plans – Service Department

In this issue I want to discuss ideas for both budgeting and planning service department performance. The goal here is to look at this process from a new vantage point, and use this opportunity to truly engineer initiatives and improvements. No simple formulas – no “box checking”. Once again, any meaningful planning session will include an assessment of our current (S)trengths, (W)eaknesses, (O)pportunities, and (T)hreats. Once identified, we must formulate strategies consistent with these categories to heighten our advantages and minimize our risks. Forecasts are an educated guess at a desired result. Achieving these results requires action. These actions (behaviors), must be strategic, specific, and understood by the entire team. Every process and SOP that we adopt should be tied to these specific objectives. In October, I suggested the adoption of some specific initiatives and accountability programs that would help to create desired results within the parts department. This month I will add some methods to help us achieve SERVICE our department objectives. Let’s start with the assumption that all forecasted targets are going to be consistent with three generally accepted norms: Forecasted service sales are going to INCREASE. We want to sell more labor. Forecasted service expenses are going to INCREASE. We want to mitigate this expense if we can. Forecasted profitability is going to either IMPROVE or MAINTAIN its current level. Suggestions for initiatives and behaviors that will help us meet these goals: “Pre-capturing” maintenance services Every piece of equipment that the dealerships puts into service (new or used), comes with a specific list of maintenance requirements published by the manufacturer. As an industry, many forklift dealers ROUTINELY miss opportunities that are afforded for us by the OEM. It seems that our goals and thought processes when preparing for the sale of maintenance, are fixated on PM service programs. I don’t have an issue with the sale of a PM. I do however believe that as dealers, it’s our job to EDUCATE the customer on ALL of the maintenance needs required. PM Programs are structured around the needs of the equipment at a 250- or 500-hour service interval. Replacement of the engine oil, lubrication of high wear components, as well as replacement of oil and air filters are normally the salient tasks required at these intervals. Other systems however require maintenance as well. Transmission / Torque converter Differential / Final Drive Cooling System Brake System Wheel Bearings Ignition System Fuel system These systems have much longer service intervals, and are not generally incorporated into a standard dealer PM offering. Most dealer service scheduling and quoting systems are not well formatted to alert the dealer as to when these additional services become due. In addition, we do not normally use the hour meter reading reported by the technician as a tool to “drive” the proposal of additional maintenance services to the customer. There are dealer organizations that have addressed the differing levels of PM maintenance inclusions by representing a tiered PM system. (Silver/Gold/Platinum). These systems are a good start to addressing maintenance items that are routinely missed. Many of these programs however simply offer these services at prevailing rates when they are due, and the customer is invoiced for them (or declines them) on an individual basis. Budgets being what they are, the sticker shock that can result from one PM invoicing at $130, and the next one at $950 actually deters customers from approving the “Gold or Platinum” maintenance offerings. I much prefer the idea of “pre-calendaring” a maintenance proposal to include ALL of the OEM specified maintenance over a 5-year period, and amalgamating the pricing for all these items into one static monthly rate, which is invoiced much like a Long-Term Lease with Full Maintenance and Repair (LTRFMR) program. This calendared program however addresses MAINTENANCE only. The price point should fall between a standard PM and a LTRFMR program. This serves to widen our offerings, and allows us to offer our regular PM as a “fallback” proposition. The calendar program “pre-captures” long term maintenance. These services are now always addressed, because they are “on the calendar” and INCLUDED. No more excuses, forgetting, or having the service declined because it “too expensive”. Service menus and strategic van inventory If you are a regular reader of my columns, you already understand my penchant for having the RIGHT inventory on board the service van. You will also expect me to once again harp on the need for dealers to provide the tools necessary for the technician to quote, close and complete repair items on the spot. This can’t happen without a regularly updated van inventory. The correct inventory will mirror the makes and models that the individual technicians are likely to be working on. Broad brush inventories I regularly see are cursory, inadequate, and ineffective. We have to connect the dots manually. Our technician should be a partner with us in determining the right inventory, so that they can complete same-day repairs. Leveraging telematics data Telematics functionality is already available for most makes and models of forklift and industrial equipment. These devices are game-changers. They wirelessly broadcast the status of the equipment to both the dealer and customer. This data can be used to manage the maintenance needs we talked about earlier. It also gives your CSSR reporting data that can lead to high-value customer visits, where real time needs can be evaluated. We can now truly help the customer actively manage his fleet. The question is…. ARE WE DOING THAT? New technology is great, but in order to wring the value out of the system we have to actually format the reports, and have a dialog with the customer. If we don’t have an “in the field” battle plan to leverage that data, we need to develop one. Incentives that motivate The one place that incentives can really drive additional revenue and profitability is field service. I have seen dozens of incentive programs in my travels, and to be honest…. most of them are simplistic, boring, and rote.

Rapid reverse engineering

Sulzer reverse-engineers compressor component with 40% cost saving Many industrial processes rely on compressors for a host of essential tasks, from powering machinery to squeezing industrial gases for storage and transportation. When one of its main compressors failed, a company in the Philippines faced high costs and the prospect of a long wait for a critical replacement part. That’s when it turned to Sulzer for help. Modern centrifugal compressors are high-performance machines. Used in the most demanding industrial applications, their job is to deliver air or other gases at high volumes and high pressures into storage, transportation pipework or to downstream machinery. The machines themselves can be very large indeed, consuming hundreds of kW of power, but the critical component at their heart is a precision-engineered high-speed impeller, which can be just a few cm in diameter. For one company in the Philippines, damage to this vital part was to be the cause of a prolonged period of expensive disruption. When a large compressor failed, investigations showed that the machine had been operating out of balance for some time. The resulting vibrations had caused such extensive damage to the machine’s 7.4-inch (188 mm) diameter impeller that the part was beyond repair. With the original manufacturer of the compressor unable to offer a timely or cost-effective replacement, the company approached rotating equipment specialists at Sulzer for a solution. Digital modelling and measurement The damaged impeller and shaft were removed from the casing and shipped to Sulzer’s facility in Indonesia. Once there, the local engineering team set about collecting all the data needed to recreate the part. Using a combination of laser scanning technology and conventional measurements, the team collected digital and dimensional inspection data to build a complete 3D representation of the impeller. The data was then used by Sulzer experts to build a 3D solid model of the replacement component. The damage to the impeller was extensive, so the Sulzer team had few complete surfaces they could use as a basis for their model. By applying engineering analysis to the geometry of the broken part however, they were able to “undo” the damage digitally and determine the precise geometry of the original component. While the experts were working on the geometry, their colleagues were continuing their own work to reverse-engineer the component. They used x-ray fluorescence (XRF) analysis to establish the exact chemical composition of the impeller. That allowed Sulzer to source the same alloy in order to manufacture the replacement. Finally, the team used zebra analysis to determine the surface continuity quality in the 3D model that would affect the surface finish required for the new part during the machining process. Machining expertise With the model, material and relevant manufacturing information now available, it was time for Sulzer’s CNC machining specialists to step in. A manufacturing team in Houston produced the replacement part, which was machined from a single block using five-axis milling techniques. After surface finishing, the part was spin tested at high speed in Houston to check for any imbalance before shipment to Indonesia. The Indonesian team assembled and balanced the new impeller on the original shaft before returning it to the customer for installation in the machine. “This project shows Sulzer’s global capabilities at their best,” says Hepy Hanipa, Head of Turbo Services South East Asia. “This was a relatively small, but highly complex component and its performance was critical to our customer’s operations. Close cooperation between Sulzer teams working on opposite sides of the world allowed us to deliver a high-quality solution on a timescale that met the customer’s needs whilst delivering a 40% cost saving.”

J W Winco offers Oil and Water Repellent Membrane

With a pore size of 1.2 µm, oleophobic and hydrophobic membranes GN 7404 provide reliable aeration and ventilation, allowing no dirt particles or droplets of oil or water to pass through the membrane In order to compensate for pressure differences in both directions, JW Winco already offers various aeration and ventilation elements with integrated filters and sieves. As a new change to its product line-up, JW Winco now also offers elements equipped with membranes alongside these standard parts. This makes it possible to prevent even smaller particles and, above all, oil and water droplets from passing through the ventilation openings. Dirt and moisture are kept away from the inside of the housing, and lubricants such as oils cannot escape. While the previous filter and sieve elements have a minimum mesh size of 100 µm, the standard membrane pores are only 1.2 µm in size. Externally, the robust membrane is additionally protected against mechanical stress by a protective sieve made of stainless steel. Ideally, the standard part GN 7404 should be installed in vertical surfaces so that no liquids can collect on the membrane, which could impair the pressure balance. At a nominal differential pressure P1 to P2 of 1 bar, the maximum air flow – depending on the diameter – is up to 34 l/min. The membrane even retains its function up to an external pressure differential of 2 bar or an internal pressure differential of up to 10 bar. The maximum operating temperature is 100 °C. The membranes themselves are made of a nylon fleece impregnated with an acrylic copolymer, and although the fibers are wetted, the porosity remains unchanged and can range between 0.2 and 10 µm if desired. Using a special process, the membrane is robustly bonded to a plastic ring socket by injection molding so that it can be firmly inserted into the stainless steel or aluminum screw fittings, sealed by an O-ring.

Know your Strengths

2022 is shaping up to be a year like none other in the recent past, as supply chain disruptions force us to reassess our priorities and reorganize our assets, our staffing, and our way of doing business. If there was ever a moment to re-invent yourself, that moment is now. As you enter the 2nd quarter of the year, demand for your products will no doubt be increasing while inventory dwindles. If you don’t have a battle plan for how you will navigate the inventory shortfall, you need to get busy. Murphy’s law stipulates that “things left to themselves go from bad to worse”. I have mentioned in previous articles the usefulness of gathering all of the middle managers and stakeholders for a yearly SWOT analysis. This year I believe this exercise to be critical. For those of you that may be unaware of this assessment tool, a SWOT analysis is designed to do a deep dive into the following: Strengths Weaknesses Opportunities Threats When market conditions change, it’s important to reassess all four of these important areas. The results may motivate you to shift resources and manpower in order to align your tools and planning to meet the realities of the current marketplace. As a consultant, I have helped mediate many of these gatherings. I always like to start with strengths and opportunities, then follow with weaknesses and threats. Strengths and Opportunities (the value proposition) Contrary to popular opinion, not every dealership is the same. There are things your organization does well. Your organization has a unique blend of experience, personnel, capitalization, and customer base. You will no doubt have advantages and points of value that your competitors don’t have. On the other hand, you also will have challenges that may be difficult to overcome based on your capabilities and resources. This blend of capabilities and deficits are the building blocks of a VALUE PROPOSITION. I define a value proposition as the PRIMARY REASON a customer does business with YOU and not the dealer down the road. It amazes me how many dealers have not codified this into a series of bullet points that every employee should have memorized by the 2nd week of their employment. For the dealership to have sustainable success it must RESONATE with customers. Why you resonate as an organization should be well defined. It’s important to KNOW what your dealership REALLY DOES WELL. Then ask WHY. By the way… the truth can be startling. When going through the process of defining strengths, there is a tendency to lean towards legacy instead of the truth. This can be emotionally challenging. Your dealership may have built its long-term reputation on a key point of value like technical excellence, robust inventory, financial flexibility, or personnel experience. These items may have been foundational attributes years ago, but do they apply to your current state of affairs? The marketplace is evolving. In order to maintain resonance, your dealership must constantly redefine the current value proposition. It has to be relevant. It has to be meaningful and it has to be TRUE. One way of assessing your strengths is to do a forensic analysis of the customers you serve. Is there an industry, or a group of industries that you tend to gravitate to? As you address unique and challenging applications in a particular industry, your reputation for solving problems adds to your value for that particular market segment. One dealer may have a substantial following from manufacturing companies, while another tends to succeed in the food and beverage industry. Many times, these followings are a natural extension of the unique blend of capabilities, policies, and offerings that resonate with a particular industry. Understanding this helps you not only to define your strengths but also allows you to plan to increase your influence inside that industry. One of the problems with a SWOT analysis is that when talking about strengths and opportunities, you will tend to cast your net a little too wide. It’s natural to want to be all things to all people. You can’t. You have limitations that will naturally limit your capabilities. Every dealer has a finite capacity to serve their customers. Keeping the list of key opportunities within the confines of that capacity can be the difference between resonance and disappointment. Weaknesses Nobody likes to talk about their weaknesses. One of the problems however may be semantic. The word “weakness” has become a pejorative because it tends to cast blame. A discussion about weakness however should simply allow you to define market realities. For instance, your competitor may have a larger field service staff than you do. They have 15 vans on the road, and you have six. Those are the numbers. The discussion shouldn’t necessarily be how to increase your staff from six to 15. The discussion should be about OPTIMIZING the operations of the six vans you have so that the customer never even considers the competitor as a viable option (despite their capabilities). A discussion of weaknesses needs to be tied to actions that limit your exposure. Optimizing resources, increasing efficiencies, customizing solutions, and increasing flexibility in your offerings are all ways you can limit your exposure in spite of deficiencies incapacity. Threats Sometimes threats can be known, sometimes they come out of the blue. Some can be external while others lurk right inside the dealership. I like to assess threats based first on their impact on customer service and second based on their impact on the bottom line. It may seem uncomfortable to think that threats can be internal, but many times we put ourselves at the highest risk when we ignore the things that can hurt us the most. These include: Lack of safety enforcement and accountability Compensation programs that negatively affect customer service (see my article on “Silos”) Customer-facing processes that take too long (service estimates, parts pricing, voice mail responses, cross-department response) Insufficient van inventory (requiring return visits) Lack of data visibility (between departments, and employees) External