Seeking Nominations: 25th Salute To Women in Material Handling Cover Story

Do you know an exceptional woman making an impact in the material handling industry? Material Handling Wholesaler is now accepting

Do you know an exceptional woman making an impact in the material handling industry? Material Handling Wholesaler is now accepting

In response to demands for more effective tools for accelerating supply chain relationships, the Power Transmission Distributors Association (PTDA) will

Let’s start with the argument every aspiring leader loves to have—even if they don’t say it out loud:

From Munich to Miami: transport logistic Continues to Build Global Bridges 2,722 exhibitors from 73 countries, over 77,000 visitors from

The National Association of Wholesaler-Distributors (NAW) welcomes President Trump’s newly released AI Action Plan, a forward-looking roadmap for federal artificial

The American Society of Safety Professionals (ASSP) and the Scaffold and Access Industry Association (SAIA) signed a memorandum of understanding

Email is not just killing productivity—it’s killing people’s time, focus, and sanity. Studies show that 50-70% of people check email

Press one if you’d like to leave a message. I’ll be glad to return your call as soon as I can.

When most forklift dealerships evaluate the success of their aftermarket departments and functions, they focus on the usual Key Performance

“This would be a great business if it weren’t for the competition!” Unfortunately, the existence of the competition impacts every

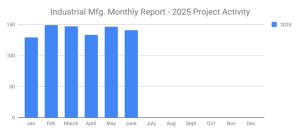

Industrial SalesLeads has announced the June 2025 results for its new planned capital project spending report, highlighting the continued strong

Last month, I opened a discussion changing the way a dealer accounts for daily, monthly, and annual financial activity, switching

Business inventories across the U.S. were unchanged in May, according to the Commerce Department’s latest report, marking a second month

Recent statistics indicate that over 29 million people participate in some form of fantasy football league. ESPN reports more than

Bruce Lyon, a longtime member of the American Society of Safety Professionals (ASSP), is the recipient of the 2025 Prevention

New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For

Have you ever run a marathon? Most people haven’t. But many salespeople run them every day – the long sales

The American Society of Safety Professionals has announced the ASSP Foundation received a landmark $325,000 gift from the Board of

The American Logistics Aid Network, or ALAN, released an announcement regarding last week’s flooding in Texas. “A few weeks ago,

HAVER & BOECKER is celebrating 100 years of the Machinery Division. It kicked off the year-long festivities in May by