Why Operationalizing Strategy isn’t about Communicating Proclamations

Here’s a line in a corporate strategy document from a multi-billion-dollar client I was working with a few years ago: “We

Here’s a line in a corporate strategy document from a multi-billion-dollar client I was working with a few years ago: “We

The PTDA Foundation recognizes the urgent need for skilled professionals in the power transmission and motion control (PT/MC) industry. As

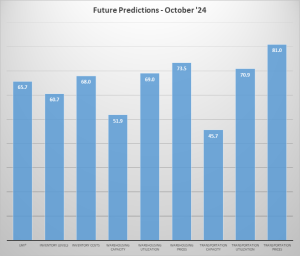

Growth is INCREASING AT AN INCREASING RATE for: Warehousing Utilization, Transportation Capacity, Transportation Utilization, and Transportation Prices. Growth is INCREASING

The Plastics Industry Association (PLASTICS) will commemorate Recycling Week from November 11-15, reaffirming the industry’s continued commitment to promoting recycling efforts across the United

Largest industry show of the year provides dynamic solutions, engaging thought leadership, and impactful connections The largest packaging and processing

Redefining the Road magazine, the official magazine of the Women In Trucking Association (WIT), announced today the recipients of the 2024

Today, the Association of American Railroads (AAR) released the “Rail Jobs Report: The Value and Opportunities in Railroading,” which provides a

Today, the American Staffing Association announced its newly elected officers for the 2025 board of directors. The board voted on the

Sales Engineering Co., a manufacturers’ representative in the New England electronics market, has announced Derek Anderson’s appointment as New England’s

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT and USCTI, totaled

You’ve heard the buzz around Generative AI-powered chatbots like ChatGPT, Claude, and Gemini. But are they worth the hype? Absolutely.

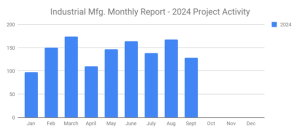

Industrial SalesLeads released its latest MiR Report for September 2024 results for the Industrial Manufacturing industry’s planned capital project spending.

It is time once again to figure out how you did compared to last year, against budget, against cash flow

I recently attended MHEDA’s Parts and Service Management Conference, and as is often the case with these industry events, I

“Going for the gold” is wrong. Being the best you can be in order to earn the gold, or get the gold

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending October 12, 2024. For this

Today, the Women In Trucking Association (WIT) announced three finalists for the 2024 Influential Woman in Trucking award, sponsored by Daimler

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders (USMTO) report published by AMT – The Association For

The Internal Revenue Service today announced relief for individuals and businesses in 51 counties in Florida due to Hurricane Milton.

American Logistics Aid Network is mobilized for Hurricane Milton. As part of our response efforts, we are committed to providing