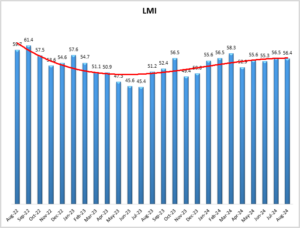

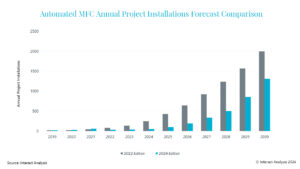

August 2024 Logistics Manager’s Index Report® LMI® at 56.4

Growth is INCREASING AT AN INCREASING RATE for Inventory Levels, Inventory Costs, Warehousing Capacity, Warehousing Prices, Transportation Capacity, and Transportation

Growth is INCREASING AT AN INCREASING RATE for Inventory Levels, Inventory Costs, Warehousing Capacity, Warehousing Prices, Transportation Capacity, and Transportation

However, there is optimism that Industrial AI will improve quality control and bring new sustainability gains Research from IFS, a technology

The Women In Trucking Association (WIT) has announced Lehua Anderson as its September 2024 Member of the Month. Anderson is

Effort to broaden opportunities to more firms exceeds goal by 15% A commitment by the Port of Long Beach to

The year-to-year gap narrows, new starts down from the previous week Staffing employment increased during the week of Aug. 12-18,

The signature event of the American Society of Safety Professionals (ASSP) attracted 6,758 workplace safety and health professionals this month

Today, Federal Reserve Chair Jerome Powell gave the most concrete signal yet that interest rate cuts are on the horizon

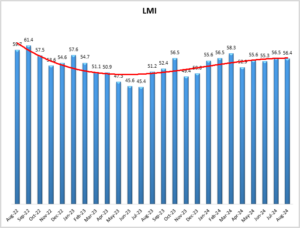

Market challenges post-Covid – including rising living costs, project delays and bottlenecks – will need to be overcome in order

The American Society of Safety Professionals (ASSP) is seeking a diverse group of occupational safety and health professionals to present

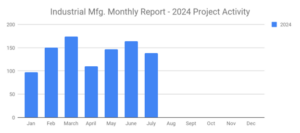

SalesLeads has released the July 2024 results for the new planned capital project spending report for the Industrial Manufacturing industry.

Much is going on that impacts OEMs, Equipment Dealers, Financing Sources, and Customers. Inflation, supply chain disruptions, and geopolitical tension

You lost a customer. You’ve probably lost lots of customers. You don’t want to think about them. It’s painful. In

Cargo surge driven by back-to-school, potential tariff increases Surging cargo volumes lifted the Port of Long Beach to its most

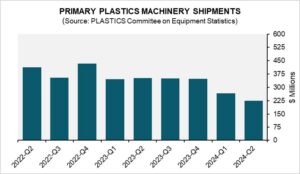

The Plastics Industry Association’s Committee on Equipment Statistics (CES) released Q2 2024 shipment data for primary plastics machinery in North

The Material Handling Equipment Distributors Association (MHEDA) is excited to announce its upcoming Parts & Service Management Conference, set for

Program advances Hyster-Yale’s commitment to veterans, enables manufacturer to recruit talent from the world’s most highly trained and motivated workforce.

The Gordon Reports are based on over 30 years of research on the causes, effects, and solutions for continuing worldwide

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing

SuperCorrExpo®, taking place September 8-12 in sunny Orlando, Florida, will feature North America’s largest display of working equipment for the

H&E Rentals has launched a Mental Health and Hope training module to shed light on the mental health crisis that