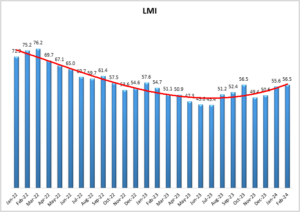

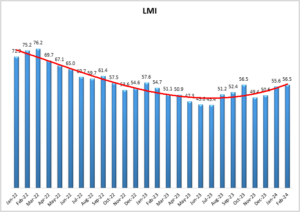

February 2024 Logistics Manager’s Index Report® LMI® at 56.5

Growth is INCREASING AT AN INCREASING RATE for Inventory Levels, Warehousing Utilization, Transportation Capacity, Transportation Utilization, and Transportation Prices Growth

Growth is INCREASING AT AN INCREASING RATE for Inventory Levels, Warehousing Utilization, Transportation Capacity, Transportation Utilization, and Transportation Prices Growth

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending March 2, 2024, as well

Facilities provide port-wide protection as part of a $109 million safety program Officials today dedicated two new Port of Long

WorkHound, an employee feedback management for frontline workforce industries, unveiled its eagerly anticipated Annual Trends Report focused on top feedback

Join CVG at MODEX 2024 for an insightful seminar on “Contract Manufacturing Benefits to Your Process.” Hosted by Terry Shaw

Trew, LLC has introduced its Technology and Education Center (TEC). Located in the company’s Fairfield facility, the TEC serves as

Mid America Paper Recycling, an independent brokers, processors, and exporters of recovered paper in the Central United Sates, will exhibit

We ask questions all the time. At work, at home, amongst friends. Often, we ask questions that we already know the

In this episode of The New Warehouse Podcast, Dennis Hoang, COO and Co-Founder of Patturn, delves into the innovative world

Next year, The ARA Show™ will head back to Las Vegas and the Las Vegas Convention Center. A full day

The February 2024 BLS jobs report showed a surge of 353,000 jobs added in January, more than double than what

December 2023 U.S. cutting tool consumption totaled $187.9 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT –

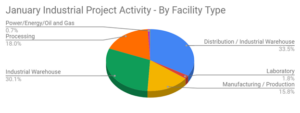

Research by SalesLeads’ experienced industrial market research team, shows 369 new planned industrial projects tracked during the month of January.

SalesLeads has announced the January 2024 results for the new planned capital project spending report for the Food and Beverage

Connections. Innovations. Solutions. As the speed of the manufacturing and supply chain world continues to accelerate, building a more agile,

Sometimes salespeople get a bad rap. Sometimes they create it. Sales require self-confidence but there’s a fine line between self-confidence

Trelleborg Tires will showcase its full premium portfolio for material handling and logistics at LogiMAT 2024, the international trade fair

In an upside surprise, December 2023 orders of manufacturing technology totaled $491 million, up nearly 22% from November 2023, and

SalesLeads has announced the January 2024 results for the new planned capital project spending report for the Distribution and Supply

SalesLeads has announced the January 2024 results for the new planned capital project spending report for the Industrial Manufacturing industry.