Carolina Handling approved as DOD SkillBridge partner

Carolina Handling has been approved by the U.S. Department of Defense as a DOD SkillBridge Authorized Organization to provide job

Carolina Handling has been approved by the U.S. Department of Defense as a DOD SkillBridge Authorized Organization to provide job

Five steps to turn negative thoughts into positive actions Do you have a Negative Nancy (NN) or Toxic Tim (TT)

The Transportation Intermediaries Association (TIA), the only organization exclusively representing transportation intermediaries of all disciplines doing business in domestic and international

The Power Transmission Distributors Association (PTDA) will host a new talent development event, the PTDA 2024 Industry Immersion Conference in

The soft landing the U.S. economy generally experienced through 2023 did not affect all sectors of the economy evenly. Even

The National Association of Wholesaler-Distributors (NAW), representing the 8.2 trillion-dollar wholesale distribution industry and 6 million American workers, strongly opposes

‘The Collegiate Automation Program’ helps prepare students for careers in machine design and manufacturing. Norwalt, a specialist in custom-built automation

The American Logistics Aid Network (ALAN) has announced that it has named Robert O. Martichenko chairman of the board. Martichenko

Material Handling Wholesaler is now accepting applications for a rare sales position opening. Click here for details and to apply.

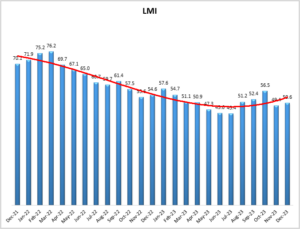

Growth is INCREASING AT AN INCREASING RATE for: Warehousing Utilization, Warehousing Prices, Transportation Capacity, and Transportation Utilization Growth is INCREASING

“The red sea situation is acute, but not chronic for shipping” says Christian Roeloffs, cofounder and CEO of Container xChange Shipping

Everyone likes a good rivalry story. They inspire, build emotional connections, and create a deep level of authenticity with the characters

Assessing the plastics industry landscape in 2023 reveals a year marked with nuanced shifts across various sectors. From the fluctuations

Jeannette Walker is the new chief executive officer of the Material Handling Equipment Distributors Association (MHEDA). She served as interim

Staffing employment dipped in the week of Dec. 11-17, with the ASA Staffing Index decreasing by 0.9% to a rounded value of

Industrial SalesLeads announced the November 2023 results for the new planned capital project spending report for the Distribution and Supply

Research by Industrial SalesLeads’ experienced industrial market research team, shows 423 new planned industrial projects tracked during the month of

Industrial SalesLeads announced the November 2023 results for the new planned capital project spending report for the Food and Beverage

Staffing jobs dropped 1.7% from second quarter The number of temporary and contract workers employed by U.S. staffing companies eased

Industrial SalesLeads has announced the November 2023 results for the new planned capital project spending report for the Industrial Manufacturing