Staffing employment edges down in October

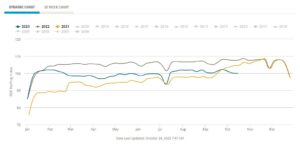

Staffing employment edged down in the week of Oct. 9-15, with the ASA Staffing Index decreasing by 0.1% to a

Staffing employment edged down in the week of Oct. 9-15, with the ASA Staffing Index decreasing by 0.1% to a

The Women In Trucking Association (WIT) just announced the three finalists for the 2023 Influential Woman in Trucking award sponsored

When it comes to supply chain and logistics, efficiency takes center stage. Central to this pursuit is the practice of

I am preparing an intro for this month’s topic, and then we will jump into material prepared by Nathan Hawkins

You do something wrong. The customer gets mad. You apologize and try to fix the problem, make nice, and hope

Efficiency is fundamentally about using less input and getting more output.When CEOs talk about increasing “worker efficiency”, it usually means

The Women In Trucking Association (WIT) announced that Walmart has renewed its Gold Level Partnership for the fourteenth year, supporting

The American Society of Safety Professionals (ASSP) has welcomed a new chief financial officer. Steven M. Lothary, MBA, will lead

MHI recently announced the dates for ProMat 2025. ProMat 2025 will be held March 17-20, 2025 at Chicago’s McCormick Place.

Trade show and conference to feature over 1,000 exhibitors, 165 sessions and keynotes from Jeremy Renner, AI expert Gerd Leonhard,

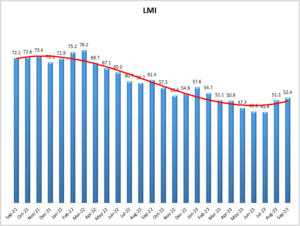

Growth is INCREASING AT AN INCREASING RATE for: Warehousing Utilization, Warehousing Prices, Transportation Capacity, and Transportation Utilization. Inventory Costs, Warehousing

The ARA Show™ returns to The Big Easy when the world’s largest equipment and event rental trade show makes its

New orders of manufacturing technology totaled $404.2 million in August 2023, according to the latest U.S. Manufacturing Technology Orders Report

ARA, Toro Company Foundation, Local volunteers step up to the Plate for Area Youth The American Rental Association (ARA) Foundation,

Workplace cultures that are strong in diversity and inclusion have been linked in increased productivity, and companies in commercial freight

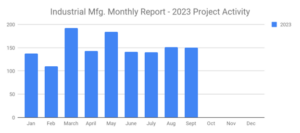

SalesLeads has announced the September 2023 results for the new planned capital project spending report for the Industrial Manufacturing industry.

The Plastics Industry Association (PLASTICS) announced Husky Technologies (Husky), as the winner of PLASTICS’ 2023 Innovation in Bioplastics Award. The announcement came as part of

The Propane Education & Research Council (PERC) is celebrating the second annual National Propane Day on October 7, 2023. National

The American Logistics Aid Network (ALAN) has announced the 2023 winners of its Humanitarian Logistics Awards. “Today we’re honored to

The Women In Trucking Association (WIT) has announced Lauren Keeney as its October 2023 Member of the Month. Keeney is