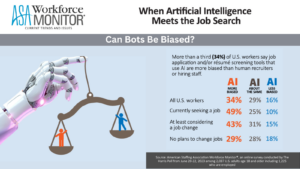

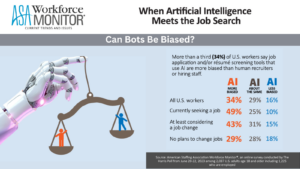

Distrust in recruiting: 49% of employed job seekers say AI recruiting tools are more biased than humans

However, 39% of Gen Z, Millennials report using AI tools in job hunt Nearly half of employed U.S. job seekers

However, 39% of Gen Z, Millennials report using AI tools in job hunt Nearly half of employed U.S. job seekers

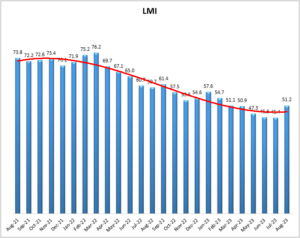

Growth is INCREASING AT AN INCREASING RATE for: Inventory Costs, Warehousing Utilization, and Warehousing Prices Growth is INCREASING AT AN

The Women In Trucking Association (WIT) has announced Laura Duryea as its September 2023 Member of the Month. Duryea is

Kito Crosby, a manufacturer of lifting and securement solutions, has announced its Lifting for the Troops campaign for 2023, supporting the Children

Budgeting season is coming soon for many companies, and this usually includes the review of major initiatives, costs, resources, and

Today, the NLRB issued two full-Board decisions, Wendt Corporation and Tecnocap, LLC, (both decided on August 26, 2023), addressing the statutory duty of employers

Dematic FIRST® Scholarships support students pursuing STEM (science, technology, engineering, and math) educations Dematic announces the 2023 recipients of its Dematic FIRST® Scholarship program,

In an era marked by immense volatility and complexity, characterized by technological advancements, business consolidations, fierce competition, and economic fluctuations,

The American Society of Safety Professionals (ASSP) is seeking a diverse group of occupational safety and health professionals to join

The Power Transmission Distributors Association (PTDA), the leading association for the industrial power transmission/motion control (PT/MC) distribution channel, is welcoming

As Hurricane Idalia approaches landfall, ALAN (American Logisitics Aid Network) is busy preparing, and they are encouraging the logistics community to do

Award ceremony to take place September 12 at 3 pm PST at PACK EXPO Las Vegas in the RPA Pavilion

In this episode of The New Warehouse Podcast, Ann Sung Ruckstuhl, Senior Vice President and Chief Marketing Officer of Manhattan

Over four-in-ten staffing firms report gains in new assignments Staffing employment edged up in the week of Aug. 7-13, with

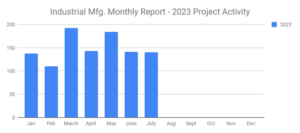

SalesLeads announced today the July 2023 results for the new planned capital project spending report for the Industrial Manufacturing industry.

Are you seeking more influence with your customers? With your boss? With your prospects? With your connections? With your associates

Global trade prospects are significantly influenced by the global economic outlook. The state of the global economy plays a crucial

New orders of manufacturing technology totaled $411.3 million in June 2023, according to the latest U.S. Manufacturing Technology Orders Report

The Council of Supply Chain Management Professionals (CSCMP) and LinkedIn have partnered in introducing an innovative Professional Certificate available exclusively on LinkedIn

In this episode of the New Warehouse podcast, Kevin is joined by Emilee Martichenko, the Communications Coordinator at the American