I found a sales answer I’ve been looking at for YEARS

“Hi. How are you today?” I hate that line. When salespeople call up and say, How are you today? it’s a warning sign

“Hi. How are you today?” I hate that line. When salespeople call up and say, How are you today? it’s a warning sign

Over the last six years, I have spoken with many people in our industry about their company’s digital strategy, more

The Women In Trucking Association (WIT) has announced Pilot Company as its fuel sponsor for the 2022 Driver Ambassador Program. The

The U.S. Equal Employment Opportunity Commission (EEOC) released the ‘Know Your Rights’ poster, which updates and replaces the previous “EEO

MassRobotics, an innovation hub and startup cluster focused on the needs of the robotics community, today announced it is collaborating

The Plastics Industry Association (PLASTICS) has announced that Mónica Mancilla Cooke has been named Senior Director, Human Resources, effective immediately. “We’re

The Plastics Industry Association (PLASTICS) just announced that Charlotte Dreizen has been named Director, Sustainability and Environment, effective immediately. As a

It seems like the question on most business owners’ minds at the moment is, “are we headed for a recession?”

The U.S. labor market remains tight, in spite of recent changes. The Bureau of Labor Statistics reported approximately 4.2 million

Live from the booth at MODEX 2022, Amit Levy, Executive Vice President of Customer Solutions and Strategy at Made4Net, joins

In-person event to feature keynotes from AWESOME, José Andrés, and Ron Howard When the premier manufacturing and supply chain trade

The American Staffing Association has made a statement in regard to the latest job report that came out this morning.

The Power Transmission Distributors Association (PTDA), the association for the industrial power transmission/motion control (PT/MC) distribution channel, welcomes two new

While some educational programs require time for participants to use what they have learned on the job, SafetyFOCUS from the American

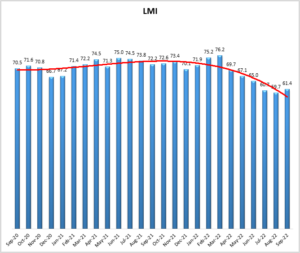

LMI® at 61.4, Growth is INCREASING AT AN INCREASING RATE for Inventory Levels, Inventory Costs, Warehousing Utilization, Warehousing Prices, Transportation

Workplace cultures that are strong in diversity, inclusion, and belonging have been linked to increased productivity, according to the 2022

Employer disclosed Employee’s Confidential Medical Information, Harassed Her, Retaliated against Her, and fired Her for Complaining, Federal Agency Charges Hattiesburg,

7.6% growth Year-Over-Year in September Staffing employment grew in the week of Sept. 12–18, rising 1.4% to a rounded value

New Data by Women In Trucking’s WIT Index Shows Predominance of Women in human resources and talent management roles The

The American Society of Safety Professionals (ASSP) Foundation has received a second Susan Harwood education and training grant for $159,967