Time is short to beat rate increase for Safety 2025 in Orland

Workplace safety and health professionals have just one week to beat a rate increase for the Safety 2025 Professional Development

Workplace safety and health professionals have just one week to beat a rate increase for the Safety 2025 Professional Development

Workplace safety and health professionals have just one week to beat a rate increase for the Safety 2025 Professional Development

The American Society of Safety Professionals (ASSP) has named Georgi Popov the recipient of the 2025 Thomas F. Bresnahan Standards Medal for

In high-volume yard operations, safety isn’t just a priority. It’s a critical responsibility. The yard is a dynamic environment where

Launches Safety Ambassador program for companies to promote training achievements Another National Ladder Safety Month has ended with millions reminded,

The American Logistics Aid Network (ALAN) today announced the following additions to its board of directors: Marc Blubaugh, Partner and

Industry leaders to discuss how enterprise shippers are transforming yard operations into a competitive advantage YMX Logistics has announced an educational

Annual awards honor extraordinary supply chain relief efforts The American Logistics Aid Network (ALAN) has opened nominations for its ninth

With more than $200,000 raised to date toward its $325,000 goal, the PTDA Foundation is making strong strides in its

The Material Handling Equipment Distributors Association (MHEDA) successfully concluded its 2025 Annual Convention & Exhibitor Showcase, held April 26–30 in

This week saw a landmark celebration at Combilift’s global headquarters in Monaghan, marking the 10th anniversary of the highly successful

Ibukun Awolusi, Ph.D., a widely respected educator in the environmental health and safety field and member of the American Society

Order intake increases to € 2.706 billion (Q1 2024: € 2.439 billion) Revenue slightly down to € 2.788 billion (Q1

First Quarter 2025 Highlights Record equipment rental revenue of $739 million, an increase of 3% Record total revenues of $861

Many businesses and workers share a global cautiousness about automation. Yet the reality of robotics and autonomous solutions, such as

The time for systems of selling has passed. The time for sales manipulation has passed. The time for “finding the

Our financial world seems out of whack and will probably continue to be for the rest of the year. This

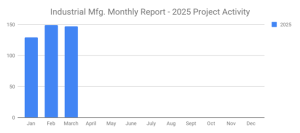

Industrial SalesLeads announced the March 2025 results for the new planned capital project spending report for the Industrial Manufacturing industry.

How PepsiCo uses AI and optimization to evolve warehouse decision-making AI and Orchestration Drive More Efficient Warehouse Execution AutoScheduler.AI has

The American Welding Society (AWS) has announced the highly anticipated Welding Summit 2025, to be held August 6-8, 2025, at