EP 304: Schneider Electric

No matter where your organization finds itself in its sustainability journey, you won’t want to miss this week’s episode of

No matter where your organization finds itself in its sustainability journey, you won’t want to miss this week’s episode of

Redefining the Road magazine, the official magazine of the Women In Trucking Association (WIT), announced today the recipients of the 2022

The answer to this question may seem obvious, depending on what side of the proverbial fence you sit on. Traditionalists

The Power Transmission Distributors Association (PTDA), an association for the industrial power transmission/motion control (PT/MC) distribution channel, welcomes a new

The Women In Trucking Association (WIT) and Daimler Truck North America (DTNA) are seeking nominations for the 2022 Influential Woman

H.R. 5376 raises taxes on the American middle class by $16.7 billion in 2023 The National Association of Wholesaler-Distributors (NAW),

Staffing employment increased 4.9% in the week of July 11–17, returning to a rounded value of 106 after a drop

Internal, External, and other solutions to staffing shortages It’s no secret that the staffing shortages facing most businesses today are

In this week’s episode, we discuss the state of the warehousing labor market with Daniel Altman, Chief Economist at Instawork.

The Women In Trucking Association (WIT) has announced that it is seeking nominations for its inaugural Technology Innovation award for

The Women In Trucking Association (WIT) has announced Maria Rodriguez as its August 2022 Member of the Month. Maria is

For years, major corporations, service providers, and government agencies have surrendered to the temptation to cloak their cost-saving efforts in

After ten years of activity, Flight Systems Industrial Products (FSIP) has redesigned and relaunched its Material Handling Technical Forum. The new look makes navigating,

David Suarez joins me this week from the booth at MODEX 2022. David Suarez is the VP of Business Development

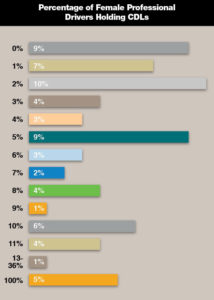

Newly released data by Women In Trucking’s WIT Index shows a significant increase in recent years The percentage of professional

A widely known term, at least in academia, is “the tragedy of the commons.” The term “commons” describes a resource that

Motor City is home to LTL carrier’s newest tuition-free professional truck Driving Academy Yellow Corporation has announced the opening of

Employed Baby Boomers were much less likely to search for a new job, and also cited age as a potential

In a slump? Not making enough (or any) sales. Feel like you’re unable to get out of the rut? Maybe

The summer of 2022 is not really looking better than the Spring. the business climate is still tenuous as labor