Risk Assessment

As you well know there are quite a few issues facing dealers for the balance of 2022 and into 2023.

As you well know there are quite a few issues facing dealers for the balance of 2022 and into 2023.

The new guide builds upon the 2013 Temporary Worker Initiative The American Staffing Association, in partnership with the National Institute

Vouchers for Tractors, Forklifts, Construction Equipment, and more to help reduce emissions and improve air quality The California Air Resources

Every year MHI powers the MHI Young Professional Network Awards to recognize an outstanding job by MHI member company employees. There are

The Power Transmission Distributors Association (PTDA) will convene for the PTDA 2022 Industry Summit in Nashville, Tenn. on October 27-29,

Each segment of the transportation industry carries its own challenges in electrification, and some are easier to overcome than others.

The Propane Education & Research Council has introduced new training for cylinder delivery drivers which is now available in The

Safe + Sound Week registration is open! Join thousands of businesses who are recognizing their commitment to workplace safety and

Hy-Tek Material Handling and Advanced Handling Systems (AHS), a Hy-Tek Material handling company, full-service integrators of automated fulfillment and distribution

The Plastics Industry Association (PLASTICS) has announced that Ashley Hood-Morley has returned to fulfill the role of Vice President, Industry

The Warehousing Education & Research Council (WERC) recently announced the availability of the 2022 DC Measures report. DC Measures captures

Orders of manufacturing technology dipped slightly in May 2022 to $441.2 million, according to the latest U.S. Manufacturing Technology Orders

Why propane forklifts are cleaner and more productive Many challenges are facing material handling operations today—labor, rising energy costs, supply,

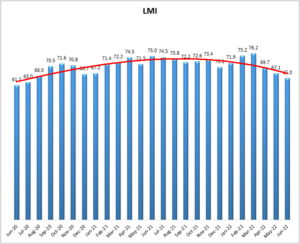

LMI® at 65.0 Growth is INCREASING AT AN INCREASING RATE for Inventory Levels Growth is INCREASING AT A DECREASING RATE

Cost the economy half a billion dollars a day and destroy 41,000 U.S. jobs As negotiations between the Pacific Maritime

The Women In Trucking Association (WIT) has announced Nona Larson as its July 2022 Member of the Month. Nona is

Carolina Handling, the exclusive Raymond Solutions and Support Center for Georgia, North Carolina, South Carolina, Alabama, and Florida’s central time

Throughout the month of July, a national nonprofit Wreaths Across America (WAA) will be celebrating its annual Giving in July campaign.

Yellow Corporation is continuing its commitment to train the next generation of safe, professional semi-truck drivers as it expands its

The multi-million-dollar project will enable the conversion of the Réunion Island power station to biomass, reducing emissions by 84% Global