A message from the 2022 Chair of the MHEDA Convention & Exhibitor Showcase

It is exciting to think that the 2022 MHEDA Convention and Exhibitor Showcase is right around the corner in sunny

It is exciting to think that the 2022 MHEDA Convention and Exhibitor Showcase is right around the corner in sunny

Peggy Arnold, a company driver for Yellow Corporation for nearly 30 years, is one of three finalists for the 2022 Driver of

When looking for growth, most leaders don’t want to leave any stone unturned. Where can we find new customers? Maybe

Three years of The New Warehouse Podcast! I can hardly believe it but I’m taking a moment to celebrate all

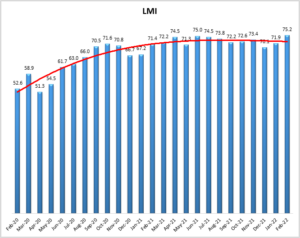

LMI® at 75.2 Growth is INCREASING AT A DECREASING RATE for: Inventory Levels, Inventory Costs, Warehousing Utilization Warehousing Prices, Transportation

Casper, Phillips & Associates Inc. (CPA) has named employees Richard Phillips and Andrew Hanek minority Associate Principals. Phillips and Hanek

The Women In Trucking Association (WIT) has announced Ginger Pitts as its March 2022 Member of the Month. Ginger is

In this episode, I share my own knowledge from experience on how to increase your warehouse education. I have been

Progress continues to be monitored at Long Beach, Los Angeles terminals The Port of Long Beach and the Port of Los

KION GROUP AG is launching a pilot project from the Business Council for Democracy for its trainees and apprentices. Over

SalesLeads has announced the January 2022 results for the newly planned capital project spending report for the Industrial Manufacturing industry.

I have been working my butt off. Closing out 2021. Planning for 2022. Working on M&A deals. Explaining how 2022

Ask. A sale takes place when a prospect trusts and has confidence in the salesperson, and the prospect perceives a

Across America, unnerving and disruptive economic and social shifts are causing confusion and anxiety. We are living in a new

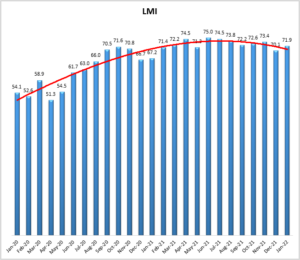

LMI® at 71.9 Growth is INCREASING AT A DECREASING RATE for: Inventory Levels, Inventory Costs, Warehousing Utilization Warehousing Prices, and

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending February 12, 2022. For this

I’ve seen hundreds of customer and competitive research documents, with pages upon pages of excellent data, qualitative feedback, facts, and

In December of 1980, I left college and got my first full-time job. We had just elected Ronald Reagan in

On this episode, I was joined by the Head of IoT at German Bionic, Norma Steller. German Bionic is focused

The Women In Trucking Association (WIT) is encouraging companies in transportation to complete a survey that collects data on gender