Xeneta welcomes Jesper Kjaedegaard as Board Member

Veteran ocean freight executive to help guide freight data and analytics company Xeneta towards further growth Xeneta, an ocean and

Veteran ocean freight executive to help guide freight data and analytics company Xeneta towards further growth Xeneta, an ocean and

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending November 6, 2021. For this

Women In Trucking Association (WIT) and Freightliner Trucks presented the 11th annual Influential Woman in Trucking award today to Lily

At least 10% of Clean Truck Fund Rate set aside for truck incentives To support a goal of a zero-emissions

Ellen Voie, the president and CEO of the Women In Trucking Association (WIT), released the following statement regarding the passage

According to the US Bureau of Labor Statistics (BLS), 4.3 million Americans quit their jobs in August 2021. That’s 2.9%

The following is a formal statement from the American Association of State Highway and Transportation Officials regarding the passage of

On Friday, November 12th, the House of Representatives approved bipartisan legislation, which will make future-focused investments in the nation’s public

UPDATE: On November 6, the 5th U.S. Circuit Court of Appeals temporarily halted OSHA’s Interim Final Rule on coronavirus vaccination and

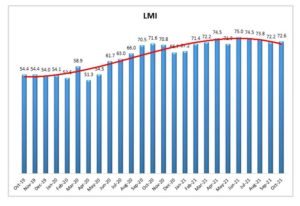

LMI® at 72.6 Growth is INCREASING AT A DECREASING RATE for Inventory Costs, Warehousing Prices, Transportation Utilization, and Transportation Prices

As a global provider in the development of workplace safety and health standards, the American Society of Safety Professionals (ASSP)

On this episode, I was joined by both Lior Tal and Ben Landen of Cyngn. Lior is the CEO and

You still have time to significantly reduce this year’s business federal income tax bill even with all the uncertainty about proposed

September New Business Volume Up 6 Percent Year-over-year, 8 Percent Month-to-month, and 10 Percent Year-to-date The Equipment Leasing and Finance Association’s (ELFA) Monthly

The Power Transmission Distributors Association (PTDA) has named Pamela Kan the 30th recipient of its Warren Pike Award for lifetime

Recently I spoke at a forum on my White Paper, “Job Shock: Moving Beyond the COVID-19 Employment Meltdown to a

DELLNER BUBENZER Group has announced the acquisition of the business of Hydratech Industries, the Danish global supplier of high-end hydraulic

Redefining the Road magazine, the official magazine of the Women In Trucking Association (WIT), has announced the recipients of the 2021

When thinking of a modern distribution center, most people will picture a conveyor and sortation system. And while they are

In this episode, I was joined by author Megan Preston Meyer. She has created the Supply Jane series of books