Women In Trucking Association announced continued partnership with Ryder System, Inc.

The Women In Trucking Association (WIT) has announced that Ryder System, Inc. has renewed its Gold Level Partnership. This partnership

The Women In Trucking Association (WIT) has announced that Ryder System, Inc. has renewed its Gold Level Partnership. This partnership

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending July 19, 2025. For this

Provides port of origin to rail destination data from 41 shipping lines, 6,000 ports, and 600+ North American railroads TransmetriQ

Don Kwok to lead efforts maintaining fiscal strength, asset security The Port of Long Beach has appointed Don Kwok as

The Women In Trucking Association (WIT) announced today that Hyundai Translead has renewed its Silver Level Partnership. This continued partnership

Tariff pause may drive trade in July as retailers stock up for peak season Cargo moving through the Port of Long

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending July 12, 2025. For this

Port of Long Beach documents advances, sets ambitious new environmental targets As part of a yearlong celebration of “20 Years

MTI welcomes four national transportation leaders to the Board of Trustees & promotes two to emeritus status MTI welcomes Dina

International Transportation Service will increase efficiency by adding 19 acres International Transportation Service on Friday “broke ground” on a terminal

The Women In Trucking Association (WIT) has announced that Michelin North America, Inc. has renewed its Gold Level Partnership. This

This memo provides background and key context for reporters covering the debate over AAR’s waiver petition. With this request, railroads

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending July 05, 2025. For this

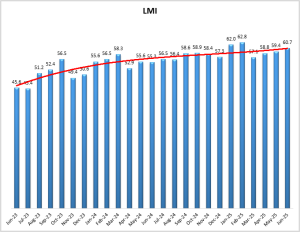

Growth is INCREASING AT AN INCREASING RATE for: Inventory Levels, Inventory Costs, and Transportation Utilization. Growth is INCREASING AT A

GEODIS has announced the appointment of Laura Ritchey as President & CEO of the Americas region. Ritchey will also serve

The Summer 2025 edition of the Maersk Global Market Update examined how businesses are adapting to the uncertainty caused by

The Association of American Railroads (AAR) has reported U.S. rail traffic for the week ending June 28, 2025. For this

The Women In Trucking Association (WIT) has announced that Bridgestone Americas has renewed its Gold Level Partnership. The continuation of

Felling Trailers, Inc. has announced Ivy’s Legacy Foundation as the beneficiary of the 13th annual 2025 Trailer for a Cause

Kevin chats with Ben Emmrich, Founder and CEO of Tusk Logistics, in this episode of The New Warehouse Podcast. With